PBOC ends daily yuan cap for HK residents

Updated: 2014-11-13 07:00

By

OSWALD CHAN

(China Daily)

|

||||||||

|

|

|

The headquarters of the People's Bank of China in Beijing. The central bank will reportedly inject 500 billion yuan ($81 billion) into the nation's largest banks. SHI YAN/CHINA DAILY |

The People's Bank of China has abolished the daily 20,000 yuan ($3,260) conversion cap for Hong Kong residents effective Nov 17, the day that the Shanghai-Hong Kong Stock Connect program will be launched, the Hong Kong Monetary Authority said on Wednesday.

Banks will square positions arising from yuan conversions conducted by Hong Kong residents in offshore markets instead of onshore markets. As a result, restrictions for onshore conversion will no longer apply.

The change will allow Hong Kong residents to buy or sell the yuan more freely.

Chief Executive Leung Chun-ying said in Beijing that the move would help Hong Kong maintain its status as an international financial center.

Leung also thanked the HKMA and the city's banking industry for their efforts in securing the new currency exchange arrangement with the mainland.

"The removal of the conversion limits will mean more convenience for local residents to participate in Stock Connect and other yuan transactions," HKMA Chief Executive Norman Chan said during a news conference in Hong Kong.

"The new arrangement will also facilitate the introduction of yuan-denominated investment products by financial institutions in Hong Kong and enhance the city's position as an offshore yuan business center," Chan said.

He said that he believed Hong Kong's yuan liquidity pool, at 1.1 trillion yuan, is large enough to meet projected demand for investing under the Stock Connect program.

The PBOC and HKMA signed the revised clearing agreement on yuan business in July 2010, removing the restrictions on yuan deposit holders transferring cash to buy wealth management products to boost the city's status as an offshore yuan financial hub.

The 20,000 yuan daily conversion limit was not removed at that time.

"This new arrangement is instrumental to the further growth of the Hong Kong offshore yuan center," said Yang Ruhai, head of yuan business at Bank of China (Hong Kong) Ltd, which is a clearing bank for yuan transactions in Hong Kong.

The removal of the cap "will allow customers greater flexibility in meeting their requirements", said Anita Fung, HSBC Holdings Plc's chief executive officer for Hong Kong.

Nixon Chan, executive director and head of retail banking and wealth management at Hang Seng Bank Ltd, a wholly owned unit of HSBC, said: "We plan to launch more yuan investment services and structured products in the near future to meet the wealth management needs of customers."

The Hong Kong Association of Banks, in a statement on Wednesday, called the arrangement "a significant step forward in promoting the internationalization of the yuan".

|

|

| PBOC acts to shore up liquidity | PBOC injects $81b into banks |

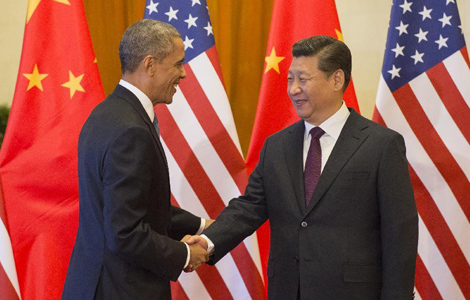

Xi, Obama agree on major-country ties

Xi, Obama agree on major-country ties

Wives work to boost cultural exchanges among economies

Wives work to boost cultural exchanges among economies

Express delivery bursts in Singles' Day

Express delivery bursts in Singles' Day

Veterans day parade in the US

Veterans day parade in the US

Orders set record at Zhengzhou auto show

Orders set record at Zhengzhou auto show

All cheers for wedding expos

All cheers for wedding expos

Magnificent fireworks showed at APEC grand banquet

Magnificent fireworks showed at APEC grand banquet

Chinese-style outfits designed for participants of APEC

Chinese-style outfits designed for participants of APEC

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US-China climate pact will pressure other countries: Experts

Express delivery bursts in Singles' Day

Veterans day parade in the US

Visit brings schools closer

Anbang US hotel deal raises queries

A stroll sets stage for diplomacy

Shanghai railway stations use US Wi-Fi technology

Tencent looks to the final travel frontier

US Weekly

|

|