China paying more attention to corporate governance

Updated: 2015-03-18 05:38

By PAUL WELITZKIN in New York(China Daily USA)

|

||||||||

China's explosive economic growth has caused it to pay more attention to corporate governance, and as the country sends more investment dollars abroad, it will realize the important role governance plays in producing more value for investors, according to a financial adviser.

|

|

Colin Melvin, CEO of London-based Hermes Equity Ownership Services Ltd |

Melvin advises and represents pension funds and other long-term institutional investors in Europe on environmental, social and governance issues especially though aggressive fiduciary management.

He said that he and his firm have observed a number of steps China has taken to improve corporate governance and practices, including advances in regulatory enforcement, financial reporting and reform of state-owned enterprises (SOEs).

Like their counterparts in the West, Chinese companies are also being pressured on environmental and social issues especially when it comes to the disclosure of sustainability practices, Melvin said.

"China's investment market is dominated by retail investors and short-term trading activities. Many of us would like to see increased participation by institutional investors like sovereign wealth funds like the China Investment Corporation and the National Social Security Fund in ESG (Environmental, Social and Governance) initiatives," he said.

Chinese companies can turn to the domestic or overseas markets when deciding to go public and list shares. Companies with A-shares are listed on the Shanghai exchange while H-shares are listed on the Hong Kong Stock Exchange. Last year China linked the two stock exchanges, allowing a combined $3.8 billion of cross-border equity trading. Companies that list on the Hong Kong exchange use a principle-based corporate governance system similar to what is employed in the United Kingdom, said Melvin. Companies that are listed on the Shanghai exchange use a two-tiered governance system composed of boards and administrative rules.

"We believe that a move in China from a rule-based and administrative approach toward a capital-market driven approach will be more consistent in achieving capital-market development and sustainable long-term economic growth," Melvin said.

He said corporate governance in Chinese companies can be improved through increased board accountability, an increased use of independent directors, ensuring the integrity of the audit process and additional minority shareholder protections.

"Of course many companies in other parts of the world would also serve their investors better if they strived to meet these measures," he added.

Improved corporate governance took on new significance in the aftermath of the global financial crisis in 2008-2009. Even with the implementation of the Dodd-Frank Act in the US, Melvin acknowledges progress seems slow in obtaining better corporate governance.

"Part of the problem is that large institutional investors like pension funds need to get more involved in asking their managers to exert influence on the companies they invest in," he said.

Melvin also said that the financial services industry needs to better align the interests of their clients into their business model. "Managers are rewarded now based largely on short-term gains. We need to move away from commissions and focus more on creating long-term value for the asset and the client that owns the asset."

paulwelitzkin@chinadailyusa.com

Skyscraper built in 19 days

Skyscraper built in 19 days

CCTV exposes cheating, fraud by companies

CCTV exposes cheating, fraud by companies

Philly wants more Chinese tourists

Philly wants more Chinese tourists

Made with China is a main feature of CeBIT 2015

Made with China is a main feature of CeBIT 2015

Smog shrouds Beijing after 'two sessions'

Smog shrouds Beijing after 'two sessions'

Traditional skill on the verge of vanishing

Traditional skill on the verge of vanishing

China's top 10 mobile apps by monthly active users

China's top 10 mobile apps by monthly active users

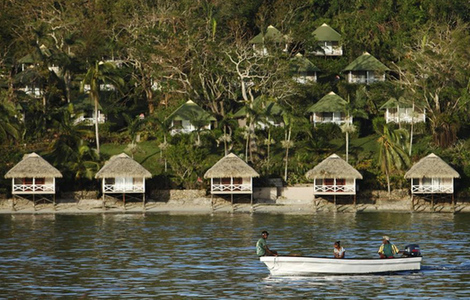

Cyclone Pam claims 24 lives in Vanuatu

Cyclone Pam claims 24 lives in Vanuatu

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Skyscraper built in 19 days

Xi recognizes Kissinger as 'trailblazer'

Huayi Brothers clinches films deal

China paying more attention to corporate governance

President Xi sees Harvard head

US easily top exporter of arms; China No. 3, but imports dive

Rising steel imports spur calls for action in Washington

Huayi Brothers Media Corp clinches US films deal

US Weekly

|

|