US struggling to keep stance as its allies join AIIB

Updated: 2015-03-18 10:29

By CHEN WEIHUA in Washington and ZHAO YINAN in Beijing(China Daily USA)

|

||||||||

The US does not appear to have changed its mind on obstructing the Asia Infrastructure Investment Bank after several of its European allies decided to join the bank as founding members.

US Secretary of Treasury Jack Lew said on Tuesday that the US was not opposed to the creation of the AIIB. "There are obviously vast needs in Asia and many parts of the world for infrastructure investment," he told a Congressional hearing on the status of the international financial system.

He said the US concern has always been whether such an international investment bank will adhere to the high standards such as in protecting workers' rights, the environment and dealing properly with corruption issues.

"Our point all along has been that anyone joining needs to ask those questions at the outset," he said.

Lew's comment came as German Finance Minister Wolfgang Schaeuble said on Tuesday during the first China-Germany high-level economic and financial dialogue in Berlin that Germany has decided to apply for founding membership of the AIIB.

France and Italy have also agreed to follow Britain's lead and join the international development bank, a Financial Times report quoted European officials as saying.

Reuters reported on Tuesday that Luxembourg's Finance Ministry confirmed the country, a big financial centre, has also applied to be a founding member of the $50 billion AIIB.

Australia and South Korea have both expressed that they are yet to make a decision before the March 31 deadline in order to qualify as a founding member of AIIB, while Japanese Finance Minister Taro Aso said days ago that Japan is not likely to join now.

The US has been busy pressuring its allies, including Australia, South Korea and Japan, not to join the AIIB, seen by the US as a challenge to the World Bank and Asian Development Bank, where US wields decisive influence.

The foreign and finance ministers of Germany, France, and Italy said in a joint statement that they would work to ensure the new institution "follows the best standards and practices in terms of governance, safeguards, debt and procurement policies," Reuters reported.

A spokeswoman for the European Commission has endorsed member states' participation in the AIIB as a way of tackling global investment needs and as an opportunity for EU companies, according to Reuters.

In Beijing, Chinese Foreign Ministry spokesman Hong Lei did not confirm if the central government has received applications from France and Italy. But he said on Tuesday that China is glad to see more countries join the AIIB as founding members, and the bank's diversified membership will boost the regional economy and promote professionalism and efficiency in investment.

China's Vice-Minister of Finance Shi Yaobin has said that the AIIB will not challenge the roles of the World Bank or Asian Development Bank, as it will focus on infrastructure renovation in Asian countries, rather than poverty reduction.

The bank, proposed by President Xi Jinping in 2013 during a visit to Indonesia, could be launched formally by the end of this year, Shi said. All Asian countries can apply to become founding members until March 31.

Elizabeth Economy, a senior fellow and director of Asia Studies at the Council on Foreign Relations (CFR), wrote on the CFR website on Monday that Washington's priority should be on advancing US ideals and institutions through the pivot or rebalance rather than blocking Chinese initiatives unless absolutely necessary.

"Opposition to the Asian Infrastructure Investment Bank has become a millstone around Washington's neck. It is time to remove it one way or another," she said in the article titled The AIIB Debacle: What Washington Should Do Now.

Stephen Harner, a former US Foreign Service officer and once an executive with several banks, said that US objections have hardly been more than quibbles and haughtily presumptuous, a priori insinuations that a Chinese and Indian led financial institution would not be "transparent" or governed to acceptable international standards.

"The (Shinzo) Abe government's calamitous parroting of US opposition to the AIIB could prove the painful lesson that helps Japan toward a more independent and constructive relationship both with Beijing and Washington," he wrote on the China US focus website on Tuesday.

Chinese experts believe that economic integration among Asian countries will be accelerated by more European nations joining the AIIB.

Ding Yifan, an economist at the State Council's Development Research Center, said that if more European nations join the AIIB, this will strengthen its fundraising ability and the implementation of more infrastructure projects.

"It seems that the AIIB is being equipped with a stronger financial capability, and its ability to plot big infrastructure projects will increase, promoting regional connectivity — the premise of economic integration," Ding said.

"It is too early to say if better integration and more interaction among Asian countries will lead to a reshuffle in the region and eventually challenge the United States-dominated international financial system. But it is likely, since changes to the international order have all begun gradually," he said.

Zhang Yuyan, director of the Institute of World Economics and Politics at the Chinese Academy of Social Sciences, said on Tuesday that Britain and other European countries have profound management experience to share with the AIIB, apart from merely providing financial support.

Contact the writers at chenweihua@chinadailyusa.com and zhaoyinan@chinadaily.com.cn

Mu Chen contributed to this story.

Philly wants more Chinese tourists

Philly wants more Chinese tourists

Made with China is a main feature of CeBIT 2015

Made with China is a main feature of CeBIT 2015

Smog shrouds Beijing after 'two sessions'

Smog shrouds Beijing after 'two sessions'

Traditional skill on the verge of vanishing

Traditional skill on the verge of vanishing

China's top 10 mobile apps by monthly active users

China's top 10 mobile apps by monthly active users

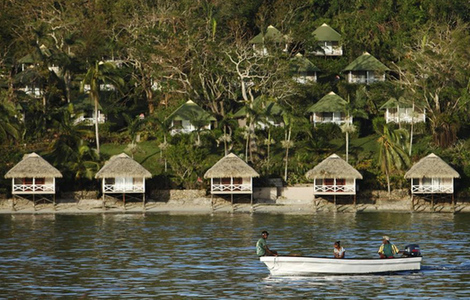

Cyclone Pam claims 24 lives in Vanuatu

Cyclone Pam claims 24 lives in Vanuatu

The world in photos: March 9-15

The world in photos: March 9-15

Freestyle skiing, game for adrenalin junkies

Freestyle skiing, game for adrenalin junkies

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China paying more attention to corporate governance

President Xi sees Harvard head in Beijing

US easily top exporter of arms; China No. 3, but imports dive

Rising steel imports spur calls for action in Washington

Huayi Brothers Media Corp clinches US films deal

More European countries to join AIIB

Philly wants more Chinese tourists

Wyoming may feel China's declining coal consumption

US Weekly

|

|