Bagging rights

Updated: 2015-03-20 09:17

By Luo Weiteng(HK Edition)

|

||||||||

|

|

Provided to China Daily |

Cash-rich buyers from Asia and the Middle East are tipped to make bold M&A moves on European luxury labels facing lukewarm forecasts. Luo Weiteng reports.

As upper-income spending falters in Europe and in the emerging markets once considered the promised land for luxury sales, a host of high-end European brands have come out with gloomy business forecasts, triggering expectations of a wave of mergers and acquisitions (M&A) for cash-flush buyers from Asia and the Middle East.

Paris-based Herms, famed for its silk scarves and high-end Kelly and Birkin leather bags, foresees a sales slowdown this year while Swiss watchmakers like Cartier and Jaeger-LeCoultre are grappling with sluggish sales on the mainland amid a government crackdown on conspicuous consumption and gift-giving by officials.

M&A activity is not uncommon in the luxury industry, said Mavis Hui, research director at DBS Vickers Securities (Hong Kong). Global luxury groups like LVMH, Richemont and Swatch Group, have always bought individual premium brands to expand, she said.

"Slower consumer sentiment in China and key global markets, rising competition, as well as increasing operating costs have all expedited the trend in recent years," said Hui.

"To name a few, we have seen Swatch Group acquire Harry Winston's jewelry and watch division, and Kering buy (Hong Kong-based fine jeweler) Qeelin for growth.

"Others, like Herms, Prada and Gucci, have also acquired small- to medium-sized niche tanners and manufacturing partners to expand vertically."

Yet, uncertainties still loom over voracious buyers, even though Asian investors have rushed to stuff their portfolios with illustrious European fashion labels over the past decade, said Maurice Hoo, Hong Kong-based partner for the international law firm Orrick and head of the firm's M&A and private equity practice.

On the selling side, many family-controlled brands are far from being mere brands. They are carriers of family glory and heritage.

"It's emotionally difficult for family owners or designers, whose brands are named after them, to strike the takeover deals without much hesitation," said Hoo. "Many of them said a hard yes to the deal on the day but completely changed their mind the next day."

The challenging market features a general scarcity of sellers with some smaller, affordable luxury brands, particularly those based in Europe, increasingly willing to be put up for sale in recent years amid slow consumer demand and a lack of succession plans, added Hui.

Recently, Orrick's European offices in Paris, Rome and Milan, the happy hunting ground for luxe buyers, received enquiries from a set of second-tier brands for potential cash-rich Asian buyers.

But less well-known ones failed to spark much interest from Asian buyers, said Hoo.

- Australia announces it will join China-proposed bank

- Germanwings pilot planned big gesture, says ex-girlfriend

- 'Behind-the-scenes' visit at Paris Zoological Park

- Migrants risk lives crossing into Europe

- US denies visa to young man for transplant

- Germanwings' co-pilot 100 percent fit to fly: Lufthansa CEO

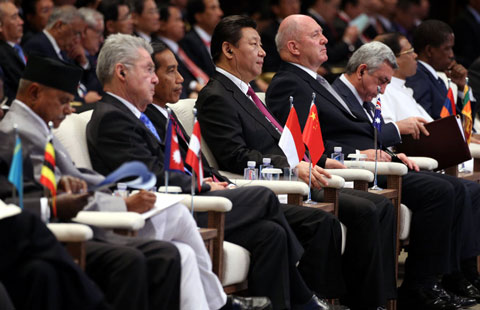

World leaders open Boao Forum for Asia 2015

World leaders open Boao Forum for Asia 2015

Buildings covered by fog in China's Qingdao

Buildings covered by fog in China's Qingdao

Across America over the week (from March 20 to 27)

Across America over the week (from March 20 to 27)

Walking tall

Walking tall

Press photo competition winners announced

Press photo competition winners announced

Strange but true: Gator takes a stroll on Florida golf course

Strange but true: Gator takes a stroll on Florida golf course

Top 9 hot-selling foreign products for Chinese babies

Top 9 hot-selling foreign products for Chinese babies

French photographer captures Beijing in the '80s

French photographer captures Beijing in the '80s

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Asian countries to seek win-win co-op: Xi

'Made in China' to 'Made in USA'

More countries to join China-backed investment bank

Grassland city looks to cloud computing

Scenic Hohhot wants to be smart based on emerging industries

Motive examined after

'deliberate crash'

Chinese CEO compares Apple Inc to Hitler

China's investment opportunities lauded

US Weekly

|

|