As property curbs ease, investors may return

Updated: 2015-03-27 11:38

By Wang Ying in Shanghai(China Daily USA)

|

||||||||

China has eliminated decade-long restrictions on foreign investment in its property market, spelling good news for foreign investors in fields ranging from land development to the construction of high-end office buildings.

A number of restricted or off-limits terms have been removed from the 2015 version of the National Development and Reform Commission's Foreign Investment Industrial Guidance Catalogue.

This frees up foreign investors to develop larger tracts of land, build and operate high-end hotels, office buildings and international conference centers, and deal in property transactions as realtors, among other expanded jurisdictions.

The State Council has approved the new version of the catalog, which will come into force from April 10.

"If you compare the last four versions of the guidelines over the last decade, the government has been gradually easing restrictions on foreign investment," said Xie Chen, senior director of CBRE Research East China.

The latest amendments grant foreigners the same freedom to operate as Chinese investors, a move Xie expects will boost confidence and drive investment in satellite cities and high-end office buildings and hotels.

"This is a good opportunity for Chinese investors to learn from their foreign counterparts' experience,"he said.

China put a lid on foreign investment in its property market in 2006, one of a series of measures aimed at reining in escalating property prices.

Albert Lau, managing director of Savills China, said the former policy caused a number of headaches and delays that he hopes have now been consigned to the annals of history.

"It has been very difficult for foreign investors to get loans here," he said. "Many have had to wait up to six months to be improved their investments."

The new guidelines will create more opportunities in the office, retail and logistics markets, he added.

But it will take time to gauge their full impact, said Mark Suchy, executive director of Cushman & Wakefield's capital markets division.

"Overall sentiment among foreign investors is positive, with most investors taking a wait-and-see approach," he said.

According to Lau, question marks still hover over China's property market for many investors due to policy uncertainties, an unclear market outlook, a fluctuating foreign exchange rate and the ongoing slowdown in the domestic economy.

Such trepidation caused inbound foreign investment in the property market to plummet in 2014. Only $30.53 billion-worth of deals were reached last year, a 25 percent drop from 2013, according to data from Savills Plc, a UK-based real estate advisor.

Yet China remains the most attractive investment destination in the Asia-Pacific region, despite this and concern about a possible hard landing for the domestic economy, according to a recent survey by CBRE.

"We are pleased and encouraged by the new guidelines," said Iwan Sunito, CEO of Crown Group.

"We look forward to exploring more development opportunities in China and bringing Crown Group's iconic architecture and five-star-resort living experience with Asian-inspired elements to our Chinese clients."

The Australian property developer plans to open an office in China soon, Sunito said.

wang_ying@chinadaily.com.cn

- Australia announces it will join China-proposed bank

- Germanwings pilot planned big gesture, says ex-girlfriend

- 'Behind-the-scenes' visit at Paris Zoological Park

- Migrants risk lives crossing into Europe

- US denies visa to young man for transplant

- Germanwings' co-pilot 100 percent fit to fly: Lufthansa CEO

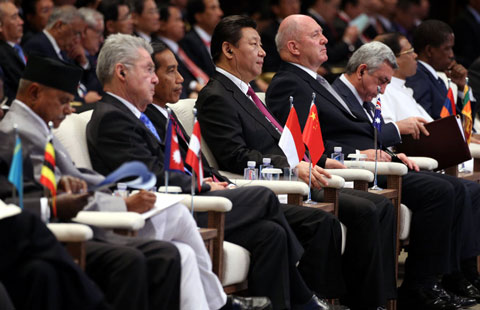

World leaders open Boao Forum for Asia 2015

World leaders open Boao Forum for Asia 2015

Buildings covered by fog in China's Qingdao

Buildings covered by fog in China's Qingdao

Across America over the week (from March 20 to 27)

Across America over the week (from March 20 to 27)

Walking tall

Walking tall

Press photo competition winners announced

Press photo competition winners announced

Strange but true: Gator takes a stroll on Florida golf course

Strange but true: Gator takes a stroll on Florida golf course

Top 9 hot-selling foreign products for Chinese babies

Top 9 hot-selling foreign products for Chinese babies

French photographer captures Beijing in the '80s

French photographer captures Beijing in the '80s

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Asian countries to seek win-win co-op: Xi

'Made in China' to 'Made in USA'

More countries to join China-backed investment bank

Grassland city looks to cloud computing

Scenic Hohhot wants to be smart based on emerging industries

Motive examined after

'deliberate crash'

Chinese CEO compares Apple Inc to Hitler

China's investment opportunities lauded

US Weekly

|

|