Li signals stronger economic reform

Updated: 2015-08-04 07:40

By Zhao Yinan(China Daily)

|

||||||||

First, seven new policies will be implemented to smash institutional barriers and free businesses from bureaucracy, including the cancellation of the outdated loan-to-deposit ratio for banks, which was seen as one of the factors that prevented banks from lending.

Second, policies have been formulated to encourage investment and consumption to boost economic growth. The moves will include the construction of faster Internet broadband networks to facilitate e-commerce, and will also entail massive infrastructure construction and the use of a huge amount of raw materials.The third thread centered on the promotion of trade, and greater opening-up. A wider range of popular Western products will be imported to boost weak domestic demand and reverse the outflow of hard currency by Chinese tourists traveling overseas.

Raising efficiency

Niu Li, director of the Macro Projection Department at the State Information Center, said the first three sets of amendments would be useless unless progress can be made on the fourth-greater government efficiency and less intervention in the market.

"Easier administrative procedures, as well as streamlined customs procedures, will lay the basis for the other developments," he said. "That's why this theme was reflected in the majority of topics under discussion. That shows it has a high priority on Li's agenda."

Niu described the restructuring program as a way of balancing long-term gain with short-term pain, as Li attempts to use a consumption-driven, services-oriented growth model to spur economic expansion to provide jobs and boost incomes.

"The once-turbocharged Chinese economy is on the verge of slipping further, after growing at its slowest pace for nearly a quarter of a century, and the situation in the backwaters, where the restructuring program was implemented later, is even worse," he said.

For example, coal-rich Shanxi province, is being hit by both the restructuring of the local economy and the global commodity recession. "The provincial economy grew less than 5 percent last year and has fallen well below the potential growth rate," he said.

Zhao from the Party school echoed Niu's comments. "An accidental break in one link of the chain could lead to a butterfly effect," he said, adding that the problem has been in evidence in the recent stock market downturn, which he described as a "semi-financial crisis", which has revealed deficiencies in the financial system and underlined the "immature mentality" of retail investors in China.

"One lesson we can learn from the stock plunge is that institutional defects in our economic system and the risks that underline them should not be underestimated, no matter how far we have moved forward in other aspects," he said. "The leadership must be aware that the continuation of unfinished reforms, including reform of the capital market, is the proper approach to avoid future hazards."

In a recent article on the Financial Times website, Henry Paulson, former US treasury secretary and the author of Dealing with China, said maintaining the present "halfway house" will make it harder for China to avoid the middle-income trap that has prevented many emerging markets from developing into prosperous economies. Paulson concluded by saying that China's top policymakers will be aware that they will have to expend even more energy to achieve the reform agenda laid out 20 months ago.

- Remains of Chinese guard killed in Somalia attack return home

- Gala promotes gender equality

- Trafficked woman appeals to be left alone, continue her life

- Wreckage discovery shouldn't disrupt search: MH370 families

- 3,000 students attend pre-exam session in huge hall

- 38.7b yuan in State assets recovered in campaign

Flying Tigers show in New York

Flying Tigers show in New York

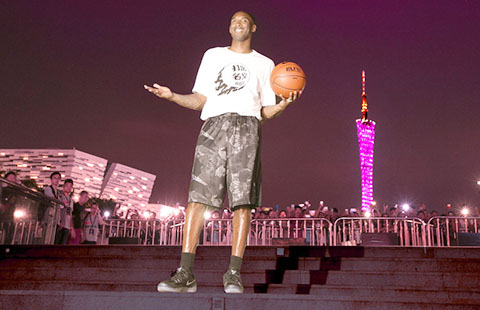

Kobe Bryant frenzy grips Guangzhou

Kobe Bryant frenzy grips Guangzhou

Three generations keep traditional lion dance alive

Three generations keep traditional lion dance alive

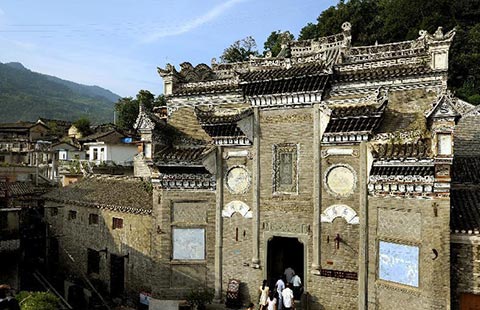

Shuhe ancient town in NW China's Shaanxi

Shuhe ancient town in NW China's Shaanxi

Top 10 regions with highest GDP growth

Top 10 regions with highest GDP growth

Remains of Chinese guard killed in Somalia attack return home

Remains of Chinese guard killed in Somalia attack return home

Top 10 international destinations for Chinese millionaires

Top 10 international destinations for Chinese millionaires

Rainstorm affects 940,000 in South China

Rainstorm affects 940,000 in South China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Malaysia seeks help to widen search for MH370

Obama issues challenge on climate change with power plant rule

China role crucial in UN plan

Biden associates resume discussion about presidential run

Rule covers HIV as work hazard

Professor accused of spying out on bond

Chinese defense concerned about US moves in South China Sea

Remains of Chinese guard killed in Somalia attack return home

US Weekly

|

|