SSE limits developers' issuance of bonds

Updated: 2016-09-30 09:18

By WU YIYAO(China Daily)

|

||||||||

The Shanghai Stock Exchange launched detailed benchmarks for guiding real estate developers' bond issuance. The detailed regulations will impact smaller developers because they are less likely to be qualified to issue bonds under the new rules.

As of Wednesday, A-share listed developers have issued 217 bonds year-to-date raising a combined value of 282.4 billion yuan ($42.3 billion).

A circular from SSE on Tuesday said that, in order to issue bonds, a real estate developer must fall into one of four categories: (1) listed in China or an overseas stock market, (2) a central government owned enterprise with realty development as core business, (3) a developer owned by a the government of a province or a province's capital city or a city of same level, and (4) one of the top 100 privately owned developers.

The circular also said that a developer which has three of the five unfavorable conditions will not be qualified to be bond issuer, including insufficient net assets (less than 20 billion yuan at the previous year end), insufficient sales revenue (annual revenue less than 3 billion yuan by the end of last year end), loss-making in the latest financial year, high debt-to-asset ratio (65 percent or above), and high inventory level (above 50 percent).

If a developer has two of these conditions, it will be required to submit more detailed disclosure materials to apply for approval for bond issuance, the circular said.

Analysts said that this move is the regulator's effort to strengthen risk management regarding developers' bond issuance and has little to do with "curbing financing" to real estate developers, because the threshold for developers to apply for approval to issue bonds remains unchanged.

The latest circular just specified risk management key points and benchmarks.

According to Zhang Dawei, an analyst with Centaline Property, the specified benchmarks and conditions for examining whether a developer is qualified to issue bond is beneficial to the realty market in the long run, because it helps investors to have more access to detailed disclosure and rule out unqualified players.

If less qualified developers could continue to get funding through issue channels, they would use the funding again to bid for land - further pushing up land and housing prices in the future, while they are fragile to risk exposure, said Zhang.

"Although the detailed regulation does not explicitly say that financing channels through bond issuing will be tightened for developers, the actual result will be that smaller developers with not-so-good performance in recent years will be unlikely to be allowed to issue bonds in the near future," said Xu Yang, analyst with Sinolink Securities.

"For big players, getting qualified is not a difficult task. Also, there are plenty of other channels for fundraising so the detailed regulation will have little impact on them," said a research note from CITIC Securities.

- Chongqing police crackdown on telecom fraud

- Expert: China needs a safety makeover

- Treasure hunters taken in by rumor of buried jade

- Deepest rail station coming to Badaling Great Wall

- Look down if you dare: world's most vertigo-inducing glass skywalks

- Boy with leukemia overcomes lonely hospital trips, keeps studying

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Rescue work at the typhoon-hit provinces

Rescue work at the typhoon-hit provinces

Wonderland-like sunrise in East China

Wonderland-like sunrise in East China

Real life 'Transformer' car turns into robot

Real life 'Transformer' car turns into robot

Israel's ex-president Peres dies at 93

Israel's ex-president Peres dies at 93

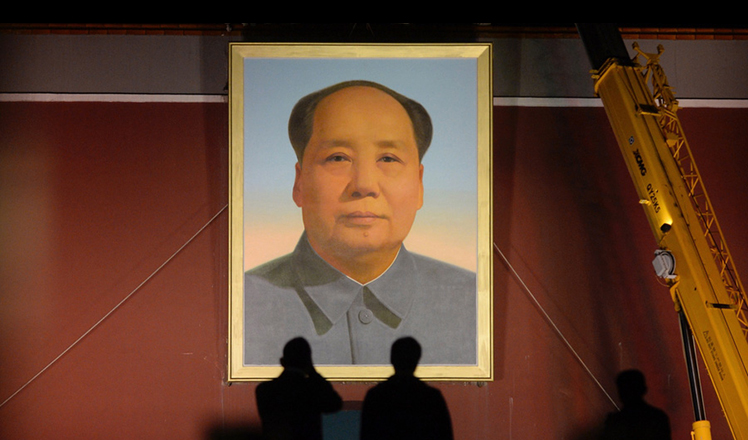

New Mao Zedong's portrait graces Tian'anmen

New Mao Zedong's portrait graces Tian'anmen

Clinton, Trump go head to head in high stakes presidential debate

Clinton, Trump go head to head in high stakes presidential debate

Miniature replica of Daming Palace shows craftsmanship

Miniature replica of Daming Palace shows craftsmanship

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|