RMB's inclusion in SDR basket supports China's reforms: IMF deputy managing director

Updated: 2016-10-06 09:39

(Xinhua)

|

||||||||

|

|

International Monetary Fund (IMF) deputy managing director Zhang Tao speaks at the Peterson Institute for International Economics in Washington D.C., Oct 5, 2016. [Photo/Xinhua] |

"The inclusion of the Renminbi thus recognizes a significant increase in the internationalization of the Chinese renminbi (RMB) in recent years, underpinned by policy reforms to achieve China's transition to an increasingly open and market-based economy," said Zhang Tao at a forum held by the Peterson Institute for International Economics and China Finance 40 Forum in Washington.

Last November, the IMF decided to include the RMB in the SDR basket as a fifth currency, effective Oct 1, 2016. It's the first time for the IMF to include a currency from emerging market economy in its SDR basket.

It means that IMF members can use the RMB in the IMF-related transactions. "In essence, the renminbi becomes integral to a future crisis response," said Zhang.

According to Zhang, the inclusion of RMB in the SDR basket will make the currency more attractive as an international currency, contributing to greater risk diversification.

It will also strongly support China's continued efforts to reform its monetary, foreign exchange, and financial systems, and help facilitate its increased integration in the global financial community, said Zhang.

"In this regard, inclusion should help consolidate the process of renminbi internationalization," said Zhang, adding that the internationalization development could encourage fostering deeper and more liquidity financial markets.

IMF is working on the broader use of the SDR, including the issuance of SDR-denominated bonds and broader reporting in SDR terms, said the official, adding that the issuance of SDR-denominated bonds by the World Bank marked the first step for the developments.

- Breakthroughs in RMB internationalization

- China's RMB embarks on new journey towards global reserve status

- IMF launches new SDR basket including China's RMB, historic milestone for China, int'l monetary system

- IMF announces RMB in SDR starting on Oct 1

- RMB’s SDR inclusion a new chapter as global currency

Top 10 Chinese cities with 'internet plus transportation’

Top 10 Chinese cities with 'internet plus transportation’

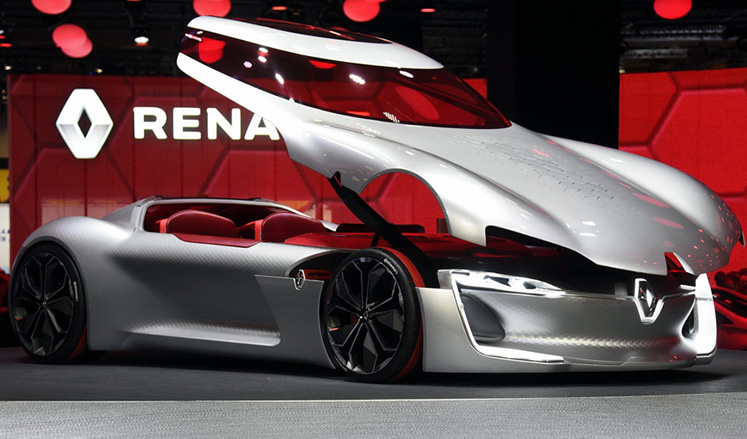

New energy cars shine at Paris Motor Show

New energy cars shine at Paris Motor Show

23 baby giant pandas make debut in Chengdu

23 baby giant pandas make debut in Chengdu

Heritage list salutes Chinese architecture

Heritage list salutes Chinese architecture

Happy hour for prince and princess in Canada

Happy hour for prince and princess in Canada

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Rescue work at the typhoon-hit provinces

Rescue work at the typhoon-hit provinces

Wonderland-like sunrise in East China

Wonderland-like sunrise in East China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|