Govts move to cut burden of social security payments

Updated: 2016-03-31 07:41

By Zheng Yangpeng(China Daily)

|

||||||||

State Council approves regulation allowing national fund to manage local surpluses

In response to the central government's call to reduce the burden on businesses, 12 provinces and municipalities have cut social security payment requirements for employers and employees.

But analysts said the pension fund, the largest of all government programs, is unlikely to see cuts in payouts.

China Daily's compilation of information shows that the reductions mostly concentrate on smaller programs dealing with such things as workplace injuries, unemployment and childbirth insurance.

For example, in Tianjin, employers had to disburse 2 percent of an employee's monthly payroll to the unemployment insurance fund and 0.8 percent to the childbirth insurance fund. Now the ratios have been cut to 1 percent and 0.5 percent.

In a related move, the State Council, China's Cabinet, approved a regulation on Monday that applies to the National Social Security Fund. It allows the fund to take over management of local governments' social security surpluses.

Established in 2000, the NSSF supplements the numerous social security funds run by local governments. Unlike those funds, which mostly rely on payments from employees and employers, the 1.51-trillion-yuan ($233 billion) NSSF is mostly funded by fiscal revenues. Run by a professional council of investment experts, it earned 15.14 percent in returns in 2015.

Currently, only Guangdong and Shandong have entrusted their surpluses to the NSSF. Under the new regulation, more are expected to follow suit.

The cuts in social security contribution requirements by the 12 provinces and municipalities - while welcomed by companies and individuals - represent only a small fraction of the total pie. Employers' combined payments for unemployment, work injuries and childbirth insurance accounted for just 3.3 percent of payroll, while 20 percent of payroll goes to the pension fund and 8 percent for medical insurance. Without a drop in those two categories, the payment burden is only slightly reduced.

Of the places adopting the cuts, only Shanghai reduced its pension fund requirement (from 21 to 20 percent), which basically returned the city to the national norm. Xiamen, Fujian province, cut its medical insurance ratio to 7 percent.

Nationwide, employers and employees still pay about 39 percent of payroll to the five social insurance programs - among the highest in the world, despite a decrease from 39.6 percent.

Deeper cuts to the pension fund and medical insurance ratio are needed, experts say, but simply cutting the nominal ratio might miss the bigger picture.

Dong Keyong, a social security expert at Renmin University of China, said in most Chinese companies, particularly in the private sector, actual payments are lower than the 39.6 percent ratio often reported because the definition of "payroll" is not the same everywhere.

"Every local government sets a theoretical base for calculation - which is lower than an employee's actual salary in most cases. So, the actual payment is much lower," Dong said. "It is misleading to focus on the payroll ratio."

The right approach, Dong said, is to overhaul the pension system so employees not only rely on the basic pension fund scheme mandated by the State but on commercial pillars.

"Under the current system, it is unlikely that the pension fund payment ratio can be lowered" from the current 20 percent, Dong said, citing several localities that are struggling with deficits in their pension fund accounts.

- Govt issues new regulation to enhance social security fund

- State Council approves draft regulations of social security fund

- Lu Ming meets with Dalian Social Security officials

- Social Security Fund takes stake in Ant

- China social security fund reports 142b yuan in yields

- Social security reform needed so benefit exceeds cost for workers

- Cypriot court remands in custody man suspected of hijacking EgyptAir flight

- Govt eyes luxury tourists amid concerns over safety

- Sleep tight and don't let sharks bite at Paris aquarium

- Aung San Suu Kyi appointed as Myanmar's new foreign minister

- Hollande promises to tighten Euro 2016 security

- US officials applaud China for nuclear cooperation

Discover beautiful China in Spring blossom (II)

Discover beautiful China in Spring blossom (II)

Xi tells Obama disputes should avoid misunderstandings

Xi tells Obama disputes should avoid misunderstandings

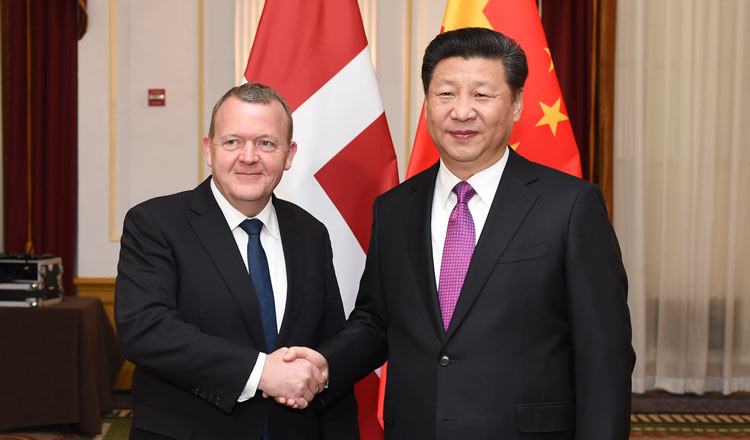

Xi calls for bigger progress in China-Denmark ties

Xi calls for bigger progress in China-Denmark ties

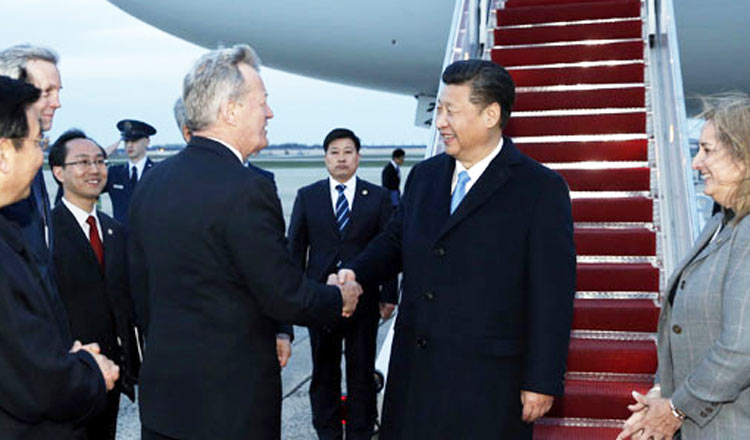

Chinese president arrives in Washington for Nuclear Security Summit

Chinese president arrives in Washington for Nuclear Security Summit

President Xi presented with 'key to Prague'

President Xi presented with 'key to Prague'

China move into the final stage of Asia qualifiers after 15 years

China move into the final stage of Asia qualifiers after 15 years

Grief, anger engulf Taiwan as suspected killer of girl arrested

Grief, anger engulf Taiwan as suspected killer of girl arrested

Stolen Buddha statue head arrives in Hebei museum

Stolen Buddha statue head arrives in Hebei museum

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

Accentuate the positive in Sino-US relations

Dangerous games on peninsula will have no winner

National Art Museum showing 400 puppets in new exhibition

US Weekly

|

|