Striving to break new ground

Updated: 2016-09-26 07:58

By Sophie He(China Daily USA)

|

|||||||||

The world's largest institutional adviser for private sectors in developing countries has been an industry trailblazer for 60 years, IFC's regional head Vivek Pathak tells Sophie He.

International Finance Corporation (IFC) is not an organization that purely sets its sights on maximizing profit, according to its East Asia and Pacific Department Director Vivek Pathak.

IFC, a member of the World Bank Group, is the largest global development institution focused exclusively on the private sector in developing countries.

Instead, IFC considers itself as a profit optimizer. In the 2015 fiscal year, IFC's long-term investments in developing countries totaled $17.7 billion, a 17 percent increase over the previous year.

Pathak tells China Daily that IFC focuses on three aspects other than profit - profitability, development impact and sustainability.

"That's the difference between us and a typical private equity fund or commercial bank."

The institution is celebrating its 60-year anniversary this year, and Pathak reflects that IFC has been a pioneer in emerging markets.

"We've done things like helping countries draft banking laws, leasing laws, private insurance laws. We played a key role in a number of markets in terms of working with the government, drafting laws to attract private and commercial capital into commercial banks, leasing, factories and insurance."

In 1972 IFC sent two staff and 12 consultants to Jakarta, Indonesia, for two years to help build the country's first securities markets. In 1985 IFC provided investment-climate reform advice to China at the early stage of its private sector growth.

Pathak explains that in the past, there was minimal private commercial capital flowing into these markets, and IFC was a trailblazer in this field in its first 40 years, making it possible to utilize most of its investments.

He also points out that IFC has achieved success in capital markets through developing a country's financial infrastructure. It has also taken the lead in a number of cases in helping a country to establish stock exchanges and improving banking regulation.

"IFC has around 182 countries that are our shareholders, we have a capital base, and we are a regular insurer of the bond markets."

Moving forward

IFC will focus on the financial sector, sustainability and cross-border business in the future in Asia, according to Pathak. In the financial sector, IFC will concentrate on helping people who don't have immediate access to financial services.

"Secondly, we will focus on sustainability, which is green growth. How do we work with our clients to ensure that they are growing in an energy efficient manner? How do we conserve energy? How do we preserve water? How do we manage waste? I would call it green finance."

There will also be a strategy shift to cross-border business, in order to create new markets and opportunities.

Traditionally, mainly European and US companies invested in emerging markets, but the rise of local entrepreneurs in these locations means IFC is keen to work with them. The organization is also encouraging companies to move outside of their comfort zone.

"We are working on how to get a company in China to invest in South America, and we are working with companies in terms of outbound of China and Singapore, Malaysia, Indonesia, India, because as these companies grow with these economies, they are also looking for new markets."

So in the future, IFC will strive to match the supply of capital in Asia with demand outside of the continent, according to Pathak.

China's next step

Pathak says he often answers with "so what?" when people talk about investment opportunities drying up in China. He says China obviously cannot continue to grow at its former pace, given that the world's second-largest economy is worth nearly $13 trillion. He says for China's economy to maintain growth at 6 to 7 percent (or $700 billion to $800 billion), it is still tremendous for an economy of this size.

"Every economist predicted this five to 10 years ago, but still people are acting surprised. 'Oh my god, China is slowing down.' Well, of course it will slow down."

The way Pathak sees it, there are three sections of the Chinese economy representing opportunities. IFC is most interesting in the segment growing at 5 to 15 percent, which includes disruptive technologies, services, health, education, climate change and green finance sectors - this is where the growth will come from, he says.

IFC will also continue to watch the issue of consumption in China, which Pathak explains as people's lives improve, they will have more disposable income. This means they will chase a better education for their children, and also improved healthcare.

But he also issues a warning about volatility - especially in China's stock market. This is part of an economy, with market forces playing a major role that's set to result in further fluctuation.

Another concern IFC has about the Chinese economy are non-performing loans. How that will be tackled in the coming years will be crucial, says Pathak. Oversupply is another issue in China (and the world) that needs to be tackled.

When deciding whether to dive into a new project, IFC assesses a number of criteria, he explains. IFC first evaluates if the project makes commercial and business sense, and then estimates what possible impact it will have.

"For example, in services, we do tourism and hotels: Will we invest in five star hotels in Shanghai and Beijing? No, there are enough of them. But will we invest in hotels in Myanmar in Mongolia? Yes, as the level of service does not exist in those countries and we want to bring in value-added projects to these countries."

When embarking on a new concept in a particular country - whether it's introducing new technology or a particular business model - IFC wants to ensure it is able to draw on private capital, Pathak says.

"These are the areas we will look at, and to study the business and commercial viability of the projects."

Contact the writer at sophiehe@chinadailyhk.com

Top 10 Chinese cities with 'internet plus transportation’

Top 10 Chinese cities with 'internet plus transportation’

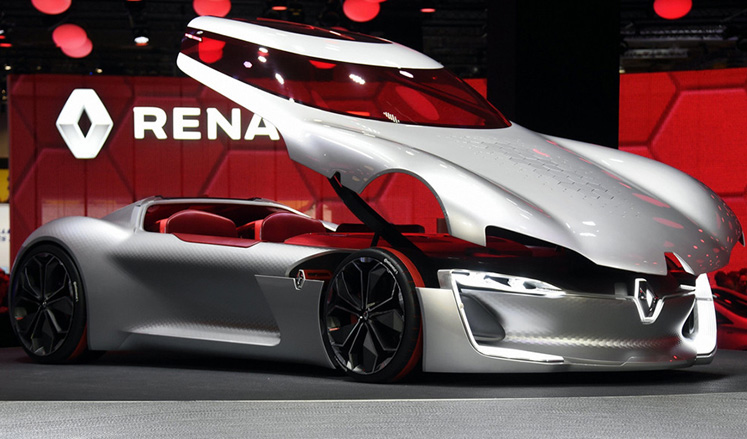

New energy cars shine at Paris Motor Show

New energy cars shine at Paris Motor Show

23 baby giant pandas make debut in Chengdu

23 baby giant pandas make debut in Chengdu

Heritage list salutes Chinese architecture

Heritage list salutes Chinese architecture

Happy hour for prince and princess in Canada

Happy hour for prince and princess in Canada

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Rescue work at the typhoon-hit provinces

Rescue work at the typhoon-hit provinces

Wonderland-like sunrise in East China

Wonderland-like sunrise in East China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|