Popularity of eye in the sky is really taking off

Updated: 2016-10-01 00:04

By ANTHONY WARREN(China Daily USA)

|

|||||||||

The three Ds, as they are known, included the likes of military use, terrain mapping and the survey of nuclear or chemical spills.

Today this is no longer the case, he said, and such limited three D opinions on drones are expressed only by “ill-briefed civil servants wheeled out onto a conference platform by their staff”.

In reality, it is now “almost impossible to watch television or a film without footage from a UAV that would not have been taken before”, Clayton noted.

“Buildings are inspected at a fraction of the previous costs and collateral damage, large construction sites are surveyed, crops are inspected and the environment is being monitored.”

Almost all industries have embraced the technology, he added, since the computing power and cameras of drones offer information that would not otherwise have been collected.

Although the UAV commercial market is still in its infancy, it has already shown vibrant growth.

According to the research firm MarketsandMarkets, global spending on acquiring civilian drones in 2014 was valued at $663 million. The research concluded that the civilian drone market would rise to $5.59 billion by 2020, with the biggest growth likely to be seen in the Asia-Pacific region.

The application of these drones in business could prove a money-maker for companies. In a recent report, Clarity from Above by the international auditing and consultancy firm PwC, the total value of commercial drone solutions (the use of drones for mineral surveying, movie making, security etc) would top $127 billion in the next few years.

The growing demand for precise, high-quality data, often linked to the compiling of big data (the analysis of large-volume information for trends), will see high yields for companies involved in everything from infrastructure to agriculture.

While the biggest investors in drone technology for commercial use are currently in the United States, according to its Federal Aviation Administration only 3,000 companies are currently licensed to provide drone services.

By comparison, Asia is the largest manufacturer, and likely soon to be the biggest user, assuming national or pan-regional legislation on the commercial use of drones can bring it from niche to mainstream.

Karan Girotra, a professor of technology management at INSEAD in Singapore, equates the primary driver of Asia’s interest in drones to its heavy industries and the cost-efficiency of drones in farming and policing.

“Entertainment and videography is an interesting application that draws media interest,” he said.

“But the major business buyers are firms in the petrochemicals, mining, agriculture and security sectors, where drones have found commercially viable applications.”

Indonesia is one Southeast Asian nation already using a legal framework for commercial drone use. Palm oil producing companies hire pilot firms to map and survey plantations and sometimes to check for illegal logging operations.

A government meeting of the Hong Kong Special Administrative Region in June also showed an interest in trialing the viability of drones in protecting the territory’s rare incense trees from illegal harvesters.

What commercial customers look for are examples of “turnkey, ready to go, systems that they can use to deploy and manage a fleet of drones… integrate them with existing systems and build more autonomy and intelligence into them”, Girotra said.

Top 10 Chinese cities with 'internet plus transportation’

Top 10 Chinese cities with 'internet plus transportation’

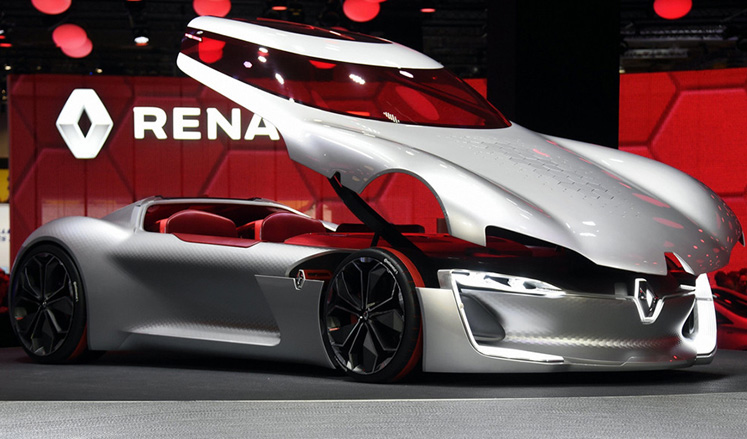

New energy cars shine at Paris Motor Show

New energy cars shine at Paris Motor Show

23 baby giant pandas make debut in Chengdu

23 baby giant pandas make debut in Chengdu

Heritage list salutes Chinese architecture

Heritage list salutes Chinese architecture

Happy hour for prince and princess in Canada

Happy hour for prince and princess in Canada

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Rescue work at the typhoon-hit provinces

Rescue work at the typhoon-hit provinces

Wonderland-like sunrise in East China

Wonderland-like sunrise in East China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|