Space movie tests big-budget strategy

Updated: 2012-03-11 09:09

(Agencies)

|

||||||||

|

|

Taylor Kitsch and the white apes in a scene from "John Carter".[Photo/Agencies] |

"John Carter," the 3D space adventure film that opens today, was supposed to be the Walt Disney Co's latest franchise movie, a blockbuster on par with "Cars" and "Pirates of the Caribbean" that generates profits beyond the film to television, books, and consumer products.

Instead, industry tracking suggests it will be the latest big-budget box office bust.

While Hollywood's hit-and-miss nature has always made it an inherently risky investment, the possible failure of "John Carter" underscores the increased risk studios have taken in recent years by reducing the number of movies they produce to focus on big-budget films.

Betting on big-budget movies -- called "tent poles" because they are meant to hold up the rest of the studio's slate -- is a high-risk, high-reward business. Winners pay hefty dividends for years with film sequels, toys, video games and even theme-park rides. A flop can cost tens of millions of dollars.

Evercore Partners analyst Alan Gould estimates "John Carter" could lose $165 million.

Disney knows the cost of failure all too well. The company last year took a write-down of more than $70 million after its animated movie "Mars Needs Moms" tanked. The poor performance of that film had repercussions beyond the studio division, dragging down the media giant's overall quarterly earnings to below analyst forecasts, sending its shares tumbling 3 percent.

"Green Lantern," the silver screen version of the superhero comic book character, was supposed to be a franchise film for Warner Bros last year. Instead, Time Warner Inc Chief Executive Jeff Bewkes, said it "fell fairly far short" of expectations, pulling in just $222 million around the world on an estimated production budget of $200 million, according to website BoxOfficeMojo.com.

That figure excludes the tens of millions that studios usually spend to market and advertise a movie with a production budget of that size.

Sci-fi Western "Cowboys & Aliens" also stumbled. The movie, from Steven Spielberg's Dreamworks studio and Comcast Corp's Universal Pictures, pulled in $175 million in ticket sales around the world on a production budget of $163 million, excluding marketing costs.

"I think you are seeing more misfires because, from a business strategy, the studios are green lighting more tent pole product. With more at bats, there is inherently more strike out potential," said Amir Malin, former head of Artisan Entertainment and current managing partner at Qualia Capital, a New York-based hedge fund that has invested in film and TV libraries.

"It does not mean it's the wrong business strategy," he added. "Imagine if Disney had not produced 'Pirates.'"

Indeed, studios have focused on franchise films in recent years because of the big rewards that can be reaped when one connects.

The fourth "Pirates of the Caribbean" movie, for example, grossed more than $1 billion worldwide last year, prompting Disney to begin work on a fifth. "Cars 2" brought in $554 million for the company last year and will sell more merchandise than the $2.8 billion from "Toy Story," Disney told analysts last year. Combined, the two franchises have grossed a total of $4.7 billion.

Big-budget movies "are succeeding more than they are failing," said Vincent Bruzzese, president of the motion picture group at researcher Ipsos MediaCT. Two-thirds of last year's top 15 films were franchise movies, he said.

The promise of big rewards from franchise films has incited studio executives to climb over each other in search of the next "Titanic," said Bill Mechanic, who ran News Corp's 20th Century Fox when it co-financed the 1997 mega-hit. "Titanic" became the highest-grossing film ever at the time, with more than $1.8 billion in global sales. It was surpassed by another Fox film, "Avatar," which grossed $2.8 billion after its December 2009 release.

Mechanic, who now produces mid-budget movies through his Pandemonium Films, said one problem with the franchise film strategy is that there are now so many tentpole films that they compete against one another. A week after "Cowboys & Aliens" opened, Fox released "Rise of the Planet of the Apes."

When that happens, "one of the bigs isn't nearly as big," said Mechanic.

Further, studios are churning out more franchise films at a time when movie attendance is in decline and sales of DVDs are crumbling, taking away a money-minting safety net for many films.

Even the big hits can no longer count on DVD sales to consumers and services like Netflix and Redbox, said Roger Smith, a former film industry executive and now a consultant with Roger Smith & Co in New York.

The 2006 film "Harry Potter and the Goblet of Fire" generated home entertainment sales equal to 90 percent of its $282 million U.S. and Canadian box office, Smith said. Last year's "Harry Potter and the Deathly Hollows -- Part 2," the series finale, will equal less than 50 percent of the $381 million the movie grossed at domestic theaters.

At a recent investor conference, Disney Chief Financial Officer Jay Rasulo said the "melting ice cube of the DVD" had prompted a new look at the movie business. The company concluded that the "highest, most likely return" would come from franchise films. As a result, Disney cut the number of movies it produces each year to 10 or 12 from as many as 25, he said.

Even before "John Carter" hit the screen, the movie's budget increased from $150 million to more than $200 million, according to a studio executive with knowledge of the project. From the outset, the film's special effects were a problem. Disney had the rights to do the film in the mid-1980s and had hired action director John McTiernan to direct. Disney held off because the technology wasn't yet ready to do the film it envisioned, said the executive, and eventually lost the rights to Viacom's Paramount Pictures. Disney came back into the picture in January 2007 when the studio bought the rights at the urging of Andrew Stanton, one of Pixar's most valuable executives and writer for animated hits "Toy Story," "A Bug's Life" and "Finding Nemo." By 2009, Stanton had a three-part series ready to shoot, but Disney worried the price tag was rising too fast, said a studio executive. They asked for a new script, and in early 2009 Disney studio chief Dick Cook greenlit the film with directions to keep its budget under $200 million. The budget began grew after Cook left in September 2009. Stanton started production in early 2010, three months after former Disney Channel executive Rich Ross took over the studio. Ross had canceled or delayed other Cook projects, including an expensive update of its 1954 Jules Vern tale "20,000 Leagues Under the Sea." Ross allowed John Carter to proceed. The film was completed just as Disney's marketing chief MT Carney was leaving and was replaced a former Sony Pictures marketing executive Ricky Strauss.

With an estimated production budget of $250 million, "John Carter" needs to generate at least $400 million in box office receipts to generate enough theater, home video and television revenue to cover the film's production and promotion costs, Davenport & Co analyst Michael Morris estimated.

So far, "John Carter" has grossed $13 million since opening in some international markets on Wednesday and Thursday. Early Friday shows just after midnight brought in $500,000 in the United States and Canada.

Disney is hoping for a weekend domestic opening in the $30 million range, said Dave Hollis, executive vice president for motion picture sales and distribution at Disney.

That would leave a crater-sized gap before the story of a former military captain who is transported to Mars could earn back its production and promotion costs, given the fact that movies typically score their biggest box-office hauls during opening weekend.

Despite the risks, major movie studios can usually weather a big loss. When "Green Lantern" stumbled, Warner Bros. scored in the same quarter with "The Hangover 2," which earned $581.5 million around the world.

For conglomerates like Disney, "film studios are a fairly small percentage of the total corporate earnings. They can make it up in cable or they can make it up in theme parks," said Hal Vogel, a media analyst and head of Vogel Capital Management.

"Everybody is afraid to be the one who stops trying to take the plunge," former Fox studio chief Mechanic said.

After all, no one wants to miss out on the next "Star Wars."

'Taken 2' grabs movie box office crown

'Taken 2' grabs movie box office crown

Rihanna's 'Diamonds' tops UK pop chart

Rihanna's 'Diamonds' tops UK pop chart

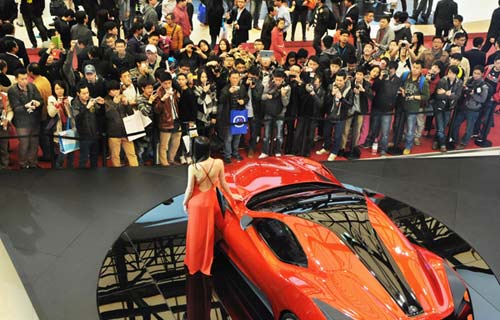

Fans get look at vintage Rolling Stones

Fans get look at vintage Rolling Stones

Celebrities attend Power of Women event

Celebrities attend Power of Women event

Ang Lee breaks 'every rule' to make unlikely new Life of Pi film

Ang Lee breaks 'every rule' to make unlikely new Life of Pi film

Rihanna almost thrown out of nightclub

Rihanna almost thrown out of nightclub

'Dark Knight' wins weekend box office

'Dark Knight' wins weekend box office

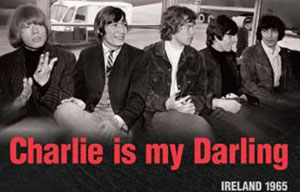

'Total Recall' stars gather in Beverly Hills

'Total Recall' stars gather in Beverly Hills

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|