'Avengers' helps power Disney profit

Updated: 2012-08-09 11:03

(Agencies)

|

||||||||

|

|

A portion of the signage at the main gate of The Walt Disney Co. is pictured in Burbank, California May 7, 2012.[Photo/Agencies] |

Walt Disney Co quarterly earnings rose 31 percent, exceeding Wall Street expectations, lifted by higher spending at theme parks and the blockbuster "The Avengers" superhero movie.

The media and theme park company reported on Tuesday earnings per share of $1.01, beating the 93 cents a share that analysts had forecast, according to Thomson Reuters I/B/E/S.

|

Related readings: |

Driven by "The Avengers," which has made more than $1.4 billion worldwide, studio income increased to $313 million from $49 million a year earlier. Chief Executive Bob Iger announced the company had signed a deal with "Avengers" director Joss Whedon to write and direct an "Avengers" sequel, and to help develop a Marvel-based TV series for the ABC broadcast network.

The studio results offset a decline in earnings at Disney's powerhouse ESPN sports network, which the company said was due to the timing of deferred affiliate fees. Overall its cable TV unit, the company's largest, increased by 1 percent to $1.86 billion.

Advertising at ESPN grew in the quarter, helped by NBA games. Looking ahead, Iger said he was bullish about ESPN's ad prospects "for the next number of months, maybe for the next year."

Advertising revenue at ABC "decreased modestly" from lower ratings partially offset by higher rates, Disney said.

At theme parks, earnings rose 21 percent, the result of increases at its Tokyo theme park, where the company collects management and other fees, and which was impacted last year by a temporary suspension of operations following the March 2011 earthquake.

Park results also improved due to a new cruise ship and more guests at Disneyland in California, where the company just completed a major expansion that includes "Cars Land."

Disney "showed great momentum across all their business lines," said Lazard Capital Markets analyst Barton Crockett, who rates Disney a "buy." "I thought it was a great quarter."

In after-hours trading, Disney's shares declined 0.8 percent to $49.40, down from their earlier close of $49.81 on the New York Stock Exchange.

Disney shares are near a lifetime high and the drop may have been due to profit-taking, Crockett said. "The stock had a very good improvement into the earnings report."

'Taken 2' grabs movie box office crown

'Taken 2' grabs movie box office crown

Rihanna's 'Diamonds' tops UK pop chart

Rihanna's 'Diamonds' tops UK pop chart

Fans get look at vintage Rolling Stones

Fans get look at vintage Rolling Stones

Celebrities attend Power of Women event

Celebrities attend Power of Women event

Ang Lee breaks 'every rule' to make unlikely new Life of Pi film

Ang Lee breaks 'every rule' to make unlikely new Life of Pi film

Rihanna almost thrown out of nightclub

Rihanna almost thrown out of nightclub

'Dark Knight' wins weekend box office

'Dark Knight' wins weekend box office

'Total Recall' stars gather in Beverly Hills

'Total Recall' stars gather in Beverly Hills

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

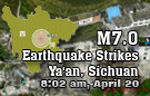

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|