Shipyards enjoy big rise in Q1

Updated: 2013-04-24 05:31

By Wang Ying in Shanghai (China Daily)

|

||||||||

|

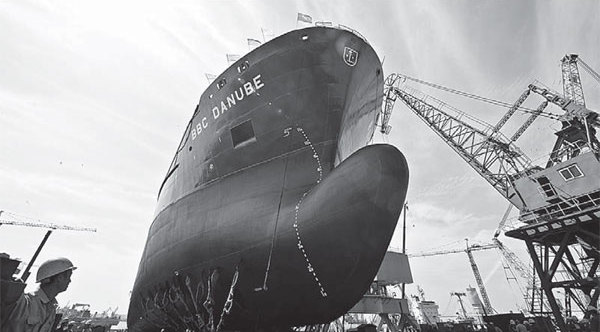

A ship build by Tianjin Xingang Shipbuilding Heavy Industry Co Ltd for a German company in 2012. China's shipbuilders got 9.57 million deadweight tonnage of new orders in the first quarter. Yue Yuewei / Xinhua |

The nation's shipbuilders received 9.57 million deadweight tonnage of new orders in the first quarter of the year, a 71.1 percent surge on last year, but analysts still expect vessel prices to remain low because of newly added capacity.

The first quarter figures compare to 5.59 million DWT in the same period last year, according to the China Association of the National Shipbuilding Industry.

The rising new order book is in line with global industry trends, which show that shipbuilding orders grew 44 percent from a year ago to 20.58 million DWT for the quarter.

Industry analysts believe the global shipping industry has bottomed out and expect to see a pick up in fortunes next year and in 2015.

"In a slow market, shipping companies place more orders due to lower prices, and it usually takes nearly two years to complete a shipbuilding order," said Meng Lingru, an industrial analyst with Shanxi Securities.

Despite the pickup in new orders in China, completed orders during the quarter dropped 15.6 percent year-on-year to 9.45 million DWT, and total ongoing order weight dropped to 107 million DWT from 141.94 million of 2012, a decline of 24.6 percent year-on-year.

Li Xiaoguang, an industrial analyst with Shenyin Wanguo Securities, said in a research note that the figures showed the shipbuilding industry is consolidating, and is still at the bottom of its cycle.

Completed orders, newly received orders, and total ongoing orders are the key indicators for the shipbuilding industry.

"Although global orders did not reach the 26.33 million DWT they did in 2011, the 44 percent increase marks an improved situation for the global market this year," said the Shenyin Wanguo report.

Shipbuilding costs have halved over the past two years, and many lower-tier yards in China are struggling to break even.

Without a recovery in process, the industry is unlikely to enjoy any actual recovery, added an analyst from Xiangcai Securities, who spoke on condition of anonymity.

China CSSC Holding Ltd, the Shanghai-listed arm of the country's largest shipbuilder China State Shipbuilding Corp, revealed in its annual report that it had posted a 26.87 million yuan ($4.35 million) net profit for the 2012 fiscal year, a 98.81 percent slump on 2011.

Similarly, Guangzhou Shipyard International Co Ltd's net profits tumbled 98 percent to 10.33 million yuan.

Data from the Ministry of Industry and Information Technology showed Chinese shipbuilders completed 21.4 percent fewer orders in 2012 from the year before, and newly received orders dropped 43.6 percent year-on-year.

In addition, total ongoing orders fell 28.7 percent.

"The shipbuilding industry is closely linked to world trade and shipping activities.

"Therefore, if the downstream industries are not rallying, we won't expect any immediate recovery in the shipbuilding industry," added Meng.

Since the fourth quarter of 2011, the China Shipping Prosperity Index has stayed below the demarcation line for six consecutive quarters, indicating the overall outlook for the shipping industry is turning from bad to worse, according to the latest China Shipping Prosperity Report issued by Shanghai International Shipping Institute.

wang_ying@chinadaily.com.cn

(China Daily 04/24/2013 page14)

Children gathered together as healing process begins

Children gathered together as healing process begins

Fears surface after hippo kills tourist from Shanghai

Fears surface after hippo kills tourist from Shanghai

Rescuers win people’s hearts

Rescuers win people’s hearts

Law to curb tourism price hikes

Law to curb tourism price hikes

House damaged, life continues in Sichuan

House damaged, life continues in Sichuan

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Industry faces recovery fight

China's 2nd aircraft carrier will be 'larger'

China thanks countries

for quake relief aid

China, US to enhance mutual trust

Beijing protests Diaoyu incident

Copyrights take a bite out of Apple

Four new H7N9 cases

Landslide kills 9 in SW China

US Weekly

|

|