The man who likes to cut a fine figure

Updated: 2013-10-10 07:21

By Wang Zhuoqiong (China Daily)

|

||||||||

As male grooming becomes more trendy, the competition heats up

When Scottish native Austin Lally, president of Global Braun and Appliances GmbH, a German electronic shaver producer, makes his annual visit to China, he likes to check out local department stores, starting with the skin care section.

The high quality and prestigious shopping environments in the country often amaze him.

"I think Chinese department stores are leading the world when it comes to quality of execution. And I want to see that quality of execution with brands such as Braun," said Lally, 48.

China represents more than a quarter of the global market for electronic shavers so it is crucial for the company to understand local customer needs, said the president of the brand that dates back to 1921 and has been owned by Procter & Gamble Co since 2005.

Braun's products range from shavers, body groomers, hair care appliances and even the cooking appliance hand blenders.

The Chinese market ranks as the leading market worldwide for Braun with sales rising in a stable fashion, the president said.

Compared with the gradually maturing overseas markets, retail of the products in China have achieved more remarkable growth in recent years and at a higher speed.

"We regard the Chinese market as a business with a lot of potential," said Lally.

"I don't want to estimate what percentage it will be. I want to make it as big as possible."

The brand entered China in 1994 and has expanded to 71 cities with 615 concessions.

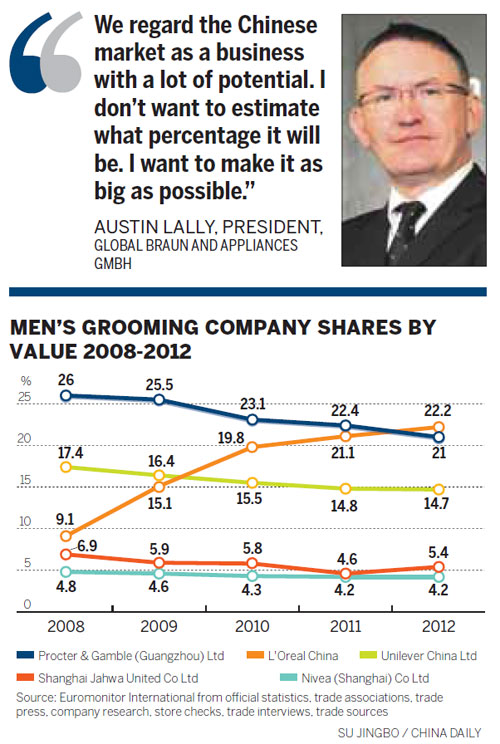

Men's grooming saw slower yet still high-value growth of 17 percent in 2012 in China, according to the report by Euromonitor International in April.

P&G's net sales in 2013 in terms of health and grooming globally have reached $17 billion. The group has more than 20 percent of the male shaver market and more than 40 percent of the female epilator market.

In the fiscal year that ended on June 30, 2013, net grooming sales of P&G decreased 4 percent to $8 billion.

Lally said 70 percent of Chinese men are using electronic shavers. He wants to bring his company's latest, high-tech products to expand its market share. Most men are using low-end shavers, so there is scope for developing the market.

One of the new products is called CoolTec. It was recently launched in China and cools the skin during shaving, also removing any irritation caused by the removal of hair.

"This is an important problem for Chinese men because they are very focused on their skin," he said.

An excellent appearance and the well-being of their skin are very important to Chinese men, said Lally.

The company spent time conducting customer research and invited their German scientists to China to understand male buyers' user habits and preferences.

Braun will introduce a shaver blending several innovative technologies in China next year, he said, without elaborating.

There are obvious cultural differences between the south and the north because of the country's vast size and abundant resources, he added. Therefore, the preferences and demands of customers from different regions are also very different.

There are differences between Chinese men and Japanese and Korean men regarding face and body care.

Chinese men are more cautious about face and body care, Lally said. They are still at the stage of accepting a variety of face and body care information.

"We prefer to allow Chinese men to experience the changes brought by face and body care to their lives such as the impact on their career development and the image they generate by deciding whether or not to look after their appearance," Lally said. He noticed the buying habits of men and women are very different.

Men tend to look just at the results while women often focus on enjoying the entire shopping process.

Male customers are relatively rational and pay more attention to technological functions and user effects in purchasing products. Brand image also greatly affects the purchase judgments of men.

In contrast, women take value-added elements into consideration while buying.

In consequence, Braun chooses to communicate direct data and technical information to male customers and clearly inform them of the practical effects of a product's use to help them decide.

The Chinese skin care market is very competitive but Lally believes Chinese buyers get more innovation from fierce competition.

"The customers have choices. One thing that makes me happy is that they are going to the Internet and discussing products and giving each other advice," he said. "They give reviews of products on the Internet. I am expecting to see very positive reviews and feedback on our new products."

He gave examples of their different product lines targeting various customer groups.

The Braun BOSS limited edition shaver targets high-end business people, with a focus on its four major breakthroughs in technology to meet high expectations. The cruZer series targets young men, emphasizing its function of providing beard trimming as a must-have item for trendsetters.

In terms of product lines, P&G's Gillette is a brand focusing on men's face and body care products while Braun has women's beauty series and hairdressing products as well as its lines for men. Braun has focused on a range of hair stylers, for example hairdryers for Chinese women.

"We are expanding the range of hair products and bringing them to China," he said, adding hair products are always an important category for Chinese women among their brands.

Philips NV entered the men's care product market very early on in China and may have a bigger market share in second- and third-tier cities because of its more popular prices.

The two have different media strategies, said Lally.

Philips spends more on soft-sell and hard-sell advertisements while Braun prefers to try to fully integrate marketing input and campaigns rather than a single advertisement placement in the search for greater benefits.

Top department stores continue to be the major distribution channels for Braun. The company pays great attention to the presence of its products so customers can interact with them, said Lally.

The brand has also strengthened its relationship with six major Chinese electronic goods retailers to diversify its trading channels, which make up more than 40 percent of its trade volume.

"The company will gradually increase the proportion of web marketing and strengthen cooperation with e-commerce, helping the brand to open up the Chinese market more effectively," he said.

wangzhuoqiong@chinadaily.com.cn

|

A male customer examines an electric shaver in an appliance store. Provided to China Daily |

(China Daily USA 10/10/2013 page16)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trending news across China

Americans to name panda cubs at Atlanta zoo

US investors say they are less bullish on China

Obama remarks show China high on agenda

Hong Kong benefits from rising renminbi

WB chief praises China for reforms

China is a major contributor to global growth

China, Australia agree to quicken FTA talks

US Weekly

|

|