China: Seeking a clear day

Updated: 2016-09-30 12:12

(China Daily USA)

|

|||||||||

China will launch its emissions trading system next year, aiming to make it the world's biggest carbon-trading market and help the largest greenhouse emitting country to reduce pollution, Paul Welitzkin reports from New York

It's the world's largest in just about everything, from population (1.4 billion) to man-made structure (the Great Wall, 5,500 miles). And now China is trying to get rid of one "largest" while creating another one.

Next year, China - the world's largest emitter of greenhouse gases - plans to implement a national emissions trading system (ETS) that will create the world's largest carbon-trading market and cover nearly half of its economy. The free-market approach to pollution control will be closely watched in the US and other developed nations.

It's an ambitious goal that Chinese President Xi Jinping committed the nation to after a meeting with US President Barack Obama in 2015 at which the world's two biggest economic powers pledged to reduce carbon dioxide (CO2) emissions to tackle climate change.

"Once China begins to implement this, then other countries will begin to think about how to address the issue," said Dale Jorgenson of Harvard University. "Certainly the US will be in the forefront of this because of the discussions that have already taken place between the two presidents."

At the Obama-Xi meeting, China formally unveiled a cap-and-trade program, or ETS. It's part of an effort to put a price on carbon as a means of bringing down emissions and driving investment into cleaner options.

"Instead of dictating who should reduce emissions where and how, a carbon price gives an economic signal and polluters decide for themselves whether to discontinue their polluting activity, reduce emissions, or continue polluting and pay for it," said the World Bank.

Pricing carbon

There are two ways to price carbon. The ETS, or cap-and-trade, places a limit on greenhouse gas emissions and allows industries with low emissions to sell their extra allowances to larger emitters. By creating supply and demand for emissions allowances, an ETS establishes a market price for greenhouse-gas emissions.

The other method of pricing carbon involves the use of a carbon tax on fossil fuels that contribute to the creation of greenhouse gases. For example, a country may increase the tax on gasoline to encourage less driving.

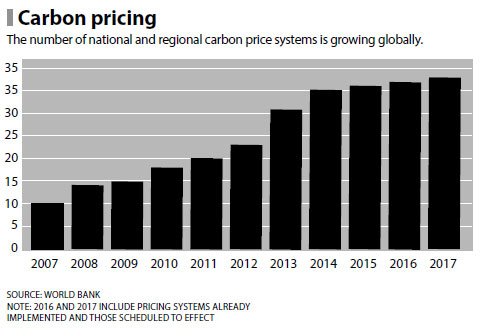

Some 40 countries and more than 20 cities, states and provinces already use carbon pricing mechanisms, with more planning to implement them in the future, according to the World Bank.

In the US, there is very little political appetite for a national emission trading plan. In 2010 legislation to introduce a federal cap and trade plan faltered in Congress. However, California, and the Regional Greenhouse Gas Initiative covering nine states in the Northeast, have implemented their own emission trading systems.

In 2011, China's National Development and Reform Commission designated four municipalities (Beijing, Chongqing, Shanghai and Tianjin), two provinces (Guangdong and Hubei) and the special economic zone of Shenzhen City as regions for emission trading system pilots.

"The goal is to integrate these pilots into the rollout of the national ETS to reduce CO2 emissions and incentivize clean energy development in China," Bo Kong, a professor at the University of Oklahoma, told China Daily.

Kong said the pilot programs means "China won't start from scratch and the experience at the local level has provided the government with knowledge that they can build on" for its trading platform.

EU's system

China was also able to draw upon the experience of the European Union's (EU) emission trading system. Launched in 2005, the system (EU ETS) is a cornerstone of the EU's policy to combat climate change and it's a key tool for reducing industrial greenhouse gas emissions cost-effectively. The EU ETS covers more than 11,000 power stations and industrial plants in 31 countries, as well as airlines.

China and the EU launched a cooperation project on carbon emission trading in 2014. With the support of EU observers and relevant agencies, almost 20 training programs were organized, helping to improve the abilities of administrative staff, technical personnel and other stakeholders in China.

Jorgenson said China's ETS will focus on the heavy industries, particularly industries that use a lot of coal and also metals, cement and utilities.

"ETS tends to focus on major industries and power plants - iron, steel, cement and paper. Services and transportation are not included," said Chris Nielsen, executive director of the Harvard China Project. The project is a research program involving schools at Harvard and Chinese universities that conduct studies related to air pollution and greenhouse gases in China.

Using a steel plant, Jorgenson provided an example of how China's ETS will operate. "Authorities will allocate permits to the steel plant based in part on the previous levels of its carbon emissions. The plant will have to monitor its emissions and then provide the permits to carry out its operation," he said. "If the plant anticipates it will use more carbon than its permits allow, it will have to go into the market and purchase more permits."

If the plant produces fewer emissions, it can sell its excess permits in the ETS.

Pricing and market liquidity will depend on several factors including information availability, said Kong.

"For this market to work, you have to have the ability to verify and correct your data," he said. "It will take some time, and they must also develop the professionals who will be needed to engage in carbon trading and making sure the market runs smoothly."

Pilot programs

Among the important lessons Chinese officials gleaned from the pilot programs was volatility in the market, price fluctuation and a growing trading volume. "These are good indicators that the market approach might work in China," said Kong.

The pilots also revealed innovation at the local level, Kong said. Allowances in Beijing, Shanghai and Shenzhen reflected those localities, he said.

Kong said one of the problems encountered in the pilots was a lack of sufficient liquidity for trading.

He believes that China's ETS must provide participants with confidence and integrity to succeed: "For society to embrace this, you have to have confidence in the market. And to instill integrity, China has to implement an MRU system - measurement, reporting and verification.

Chinese officials hope the system will become the world's leading carbon market. Spot trades may reach 8 billion yuan ($1.2 billion) per year, resulting eventually in 400 billion yuan in derivative trades annually, Chai Qimin, deputy director of strategy at China's National Center for Climate Change and International Cooperation, told Bloomberg.

One unanswered question is just how far and deep China's ETS will go when it debuts next year. "Some would argue that to implement a system means to actually start trading in 2017," said Nielsen. "Others are suggesting that it will be difficult, but it will work to at least get the framework of the rules for national emission trading."

If the ETS is established and successful, China must then figure out how to price carbon for the other parts of its economy like services and transportation. The nation's new economic goals include annual gross domestic product growth of about 6.5 percent and a greater emphasis on services and valued-added production.

"There is a recognition that it will be difficult for the ETS to cover the entire economy," said Nielsen, who, along with Jorgenson, conducted a seminar in Beijing this summer on how to regulate emissions from the rest of China's massive economy and the potential use of a carbon tax to accomplish that task.

"The Ministry of Finance has long advocated for a carbon tax," said Nielsen. "The National Development and Reform Commission has more of a commitment to building an emission trading system."

Jorgenson said the ETS will cover about 47 percent of the total emissions leaving large segments of the economy like services not covered. He said a pricing system for services presents a different set of problems than one covering the use of coal by a power plant.

Jorgenson said a carbon tax might be a more efficient approach for the services section of an economy. "The idea is that if the carbon tax is administered as part of a tax system, then the collection would be in the hands of the tax authority, which already interacts with all of these firms, even the smallest of them, through the existing tax system," he told the Harvard Gazette.

He said that if China does decide to use a carbon tax for a portion of its economy, the country will have to answer, "How do you integrate a carbon tax that prevails in one part of the economy with a trading system that prevails in another part?"

British Columbia

China may want to look at British Columbia for guidance on a carbon tax. The province is Canada's third-most populous, and it began taxing carbon dioxide and other greenhouse-gas emissions from combustion of fossil fuels in 2008.

According to the US-based Carbon Tax Center, since 2008 per capita emissions of carbon dioxide and other greenhouse gases covered by the British Columbia tax have declined, continuing a downward trend that began in 2004. Averaged across the period with the tax (2008 through 2013; no data are available for 2014), province-wide per capita emissions from fossil-fuel combustion covered by the tax were nearly 13 percent below the average in the pre-tax period under examination (2000-2007).

However, not all are supportive of a carbon tax. The American Energy Alliance (AEA), the advocacy arm of the Institute for Energy Research, said carbon taxes make gasoline and electricity more expensive, with a heavier burden on low-income earners. It will also increase the price of most goods and services since energy is a key cost component, the AEA said.

Jorgenson noted that Australia once had a carbon tax and repealed it.

Contact the writer at paulwelitzkin@chinadailyusa.com

(China Daily USA 09/30/2016 page18)

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Rescue work at the typhoon-hit provinces

Rescue work at the typhoon-hit provinces

Wonderland-like sunrise in East China

Wonderland-like sunrise in East China

Real life 'Transformer' car turns into robot

Real life 'Transformer' car turns into robot

Israel's ex-president Peres dies at 93

Israel's ex-president Peres dies at 93

New Mao Zedong's portrait graces Tian'anmen

New Mao Zedong's portrait graces Tian'anmen

Clinton, Trump go head to head in high stakes presidential debate

Clinton, Trump go head to head in high stakes presidential debate

Miniature replica of Daming Palace shows craftsmanship

Miniature replica of Daming Palace shows craftsmanship

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|