Building an empire

Updated: 2016-10-07 09:34

By Amy He(China Daily USA)

|

||||||||

Wanda Chairman Wang Jianlin has set his sights on becoming the No. 1 media mogul in the world and he needs US properties to do it, but could he be heading for legal snags, Amy He reports from New York.

He's the richest man in China and hasn't been shy about his ambitions to be a global entertainment mogul. He plans to open 15 theme parks across China and wants to "smash" park competitor Disney. He's already acquired one Hollywood studio and says he wants to buy one of the "Big Six". And he owns the second-largest movie chain in the US.

"Considering my personality and how the company has been executing my plans, I think we will be No. 1 in the world in real estate, entertainment, tourism and sports," he recently told CNN.

But for Wang Jianlin, chairman of Dalian Wanda Group, those US investments are drawing the attention of members of Congress concerned about foreign acquisitions. And some industry observers in Hollywood say he may be going too far.

"We're starting to get to a tipping point because you're starting to see politicians involved," said Marc Ganis, co-founder of Jiaflix, an American distributor of films in China. "I admire Wanda and I think there's a broader strategy here that will become more apparent that Wang is working on."

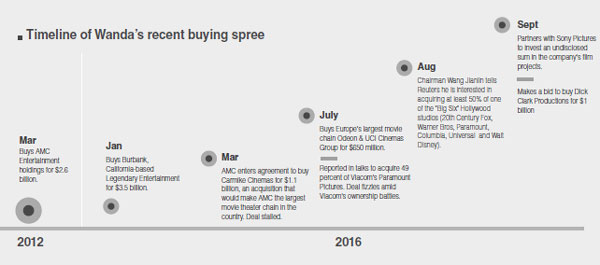

The alert came from 16 US lawmakers in a letter dated Sept 15 to the US Government Accountability Office (GAO), expressing concern over foreign acquisitions in "strategically important" sectors in the US. They cited Wanda's purchase of American movie studio Legendary Entertainment for $3.5 billion and its earlier purchase of AMC Theaters in 2012.

"Both of these examples raise serious security questions about what authority CFIUS [Committee on Foreign Investment in the United States] currently has, or may need to be added, to address these concerns," said the letter signed by 14 Republicans and two Democrats.

|

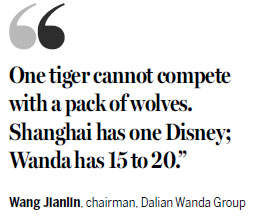

Wang Jianlin, Dalian Wanda Group chairman, has invested heavily in Hollywood over the last few years. He has said that Wanda would be interested in purchasing one of the "Big Six" Hollywood studios. Wanda already owns Legendary Entertainment and AMC Entertainment. Top, some of Wanda's holdings. |

In other words, if Wanda continues with its investment dump in the US - which experts see as vital to developing into a media giant - it could potentially trigger US regulatory oversight of the deals.

'Over-worried'

Wanda declined to comment to The New York Times regarding the letter, but on Sept 28, Wang told CNN that the lawmakers were "over-worried."

Wanda has been making headlines in the last several weeks with its investment alliance with Sony Pictures and discussions about acquiring control of Dick Clark Productions.

The Sony deal is being billed as an open-ended partnership, where Wanda will invest in Sony films and take a role in highlighting "China elements" of the movies it invests in, a contrast to the passive roles Chinese investors have played in the past, the company said.

Acquiring Dick Clark Productions would put Wanda in charge of a company that produces popular American award shows, such as the Golden Globe Awards, the Billboard Music Awards and Miss America.

In his Sept 28 interview with CNN, Wang also said that he would keep investing in US companies and was shopping for at least a 50 percent piece of one of Hollywood's "Big Six" studios.

It is a move that experts warn could bring up anti-trust issues, since Wanda already owns AMC and could potentially own Carmike Cinemas as well.

Stanley Rosen, director of the East Asian Studies Center at the University of Southern California, said that Wanda has to "be a little bit worried about how much they can push at this point, and they may want to stand back a bit" if they want to prevent more attention from regulators.

Rosen said Wanda has been getting a lot of negative attention recently with its ongoing battle with the Beverly Hilton for developing a $1.2 billion real estate project directly across the street from the Beverly Hilton hotel.

Union complaint

A hotel workers union filed a complaint in September with the California Fair Political Practices Commission and the FEC accusing Wanda of using its financial influence to oppose a ballot measure sponsored by the Beverly Hilton.

"It's ironic in the sense that Wang Jianlin and Wanda wanted to be as high profile as possible, paying too much for AMC but getting a tremendous amount of publicity," said Rosen, but now the publicity "may come back to bite him in a sense because it makes him seem like a vacuum cleaner, just piling up assets, some of which are raising red flags in the US."

Potential regulatory action against Wanda could have a legal precedent in the US. The most prominent antitrust case in Hollywood had to do with a 1948 lawsuit against Paramount Pictures, in which it was decided that movie studios owning theaters - and therefore deciding which theaters could show their films - violated US antitrust laws. The landmark case was said to have started the unraveling of the old Hollywood studio system.

"They don't want someone owning all the channels and outlets of distribution and exportation," said Christopher Spicer, a film-finance lawyer with Akin Gump Strauss Hauer & Feld. "To me, if [Wanda] did acquire a studio, it would come under scrutiny. That to me would be an issue, and if you read the letter from the Congress members that's what they're getting at."

Rosen said Wanda could continue its "Big Six" studio shopping by purchasing less than a controlling stake, but "it would be difficult to purchase something above 50 percent."

Spicer said he suspects Wanda definitely wants to acquire another studio, but he says fears that Wanda ownership would alter the Hollywood landscape may be misplaced.

"If that happens, I really don't know how - in terms of governmental anti-trust rules, with owing such a massive amount of theaters - that would work," Spicer said. But "from what it seems Legendary is still run exactly the same way it was six months ago. I haven't talked to anyone who's said 'Legendary is so different in its operations now.'"

Wang has made it no secret that he wants to beat Disney at its own game, saying that in the entertainment and tourism realm, Wanda and Disney were "archrivals." He said his ambition to best the media conglomerate is "not personal - it's where the interest of the company lies."

Commenting on Disney's theme park in Shanghai, Wang has said that the company never should have entered China.

Tigers and wolves

"Its financial prospects don't look so good to me," Wang said, adding that the company's strategy was "'One tiger cannot compete with a pack of wolves.' Shanghai has one Disney, but Wanda has 15 to 20 [theme parks] across China."

Rosen said that Disney's entrance into China "really rankles" Wang.

"It's one thing to compete in the US, but when they come onto your home territory, that's to him unacceptable. It's very ironic, because Wang's coming into the US and competing with these companies," he said.

A Disney spokesperson told CNN that Wang's comments were "not worthy of a response," adding that Disney had wanted to build a theme park in China since the 1990s, finally opening one on the Chinese mainland in June after spending more than $5.5 billion, five years of construction and a decade of planning.

Ganis said Wanda's overall strategy seems to parallel Disney's from the 1960s, when the company started covertly purchasing parcels of land in Florida to build its second theme park in the US, eventually building the "largest, best, and most well-run entertainment company the planet" has ever known.

Reading tea leaves

"[Wang] can't do it anonymously like [Disney] did with the land in Florida," he added, "but I see what he's doing and it appears what he and what Wanda are doing is buying a lot of assets as they become available - that's the opportunistic part - and in some cases overpaying, but with the idea that the totality will be worth far more than the individual pieces added together."

"He's made many public statements about Disney, so we don't have to read too many tea leaves," he said.

Wanda opened its second theme park late September in Hefei, capital of Anhui province, spending $3.6 billion. The 365-acre attraction has an outdoor theme park, indoor water park, luxury hotels, cinema attractions, and a shopping mall, according to the Hollywood Reporter. Wang said at the opening ceremony that it would invest another $1.5 billion to build indoor entertainment facilities at the park in the next few years.

Wanda's ambition to develop into an entertainment empire with a strong sports component grew bigger recently when Wang announced on Sept 30 deals with major sports entities, with a clock running on the year for some reason.

"As long as time permits, Wanda will announce another one or two partnership agreements with major international sports federation before the year ends," he said. "We have been realizing our ambition."

As for his buying spree in Hollywood, and what effect it might have on national security concerns on Capitol Hill, time will tell. But Christopher Spicer offers some perspective.

"There's a long history in LA - and Hollywood specifically - of foreigners coming in and making investments and people here view it as a positive," he told China Daily.

"The studios always want a pipeline to co-finance their movies, to the extent that Wanda will co-finance movies," he added. "But people will always take the money, whether it comes from China, Russia, or Germany, for the most part. We'll take the check, there's no problem there."

(China Daily USA 10/07/2016 page18)

Top 10 Chinese cities with 'internet plus transportation’

Top 10 Chinese cities with 'internet plus transportation’

New energy cars shine at Paris Motor Show

New energy cars shine at Paris Motor Show

23 baby giant pandas make debut in Chengdu

23 baby giant pandas make debut in Chengdu

Heritage list salutes Chinese architecture

Heritage list salutes Chinese architecture

Happy hour for prince and princess in Canada

Happy hour for prince and princess in Canada

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Rescue work at the typhoon-hit provinces

Rescue work at the typhoon-hit provinces

Wonderland-like sunrise in East China

Wonderland-like sunrise in East China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|