Future shines bright in China

Updated: 2016-10-07 10:12

By Sophie He(China Daily USA)

|

|||||||||

Diamond giant De Beers is targeting China as the most promising market for its glistening stones, its CEO Bruce Cleaver tells Sophie He.

An expanding middle-class and an increasing number of women buying diamond jewelry is fueling China's insatiable appetite for the precious stone, according to diamond producer De Beers Group's CEO Bruce Cleaver.

De Beers, part of mining company Anglo American, set up shop in 1888 and is the world's leading diamond company with expertise in the exploration, mining and marketing of diamonds.

In its first-half results for 2016, Anglo American's underlying EBIT (earnings before interest and taxes) was $585 million - up 2 percent from the same period a year ago.

"We had total sales of about $3.2 billion - it was a good half-year," Cleaver tells China Daily.

However, rough diamond production at De Beers fell 15 percent to 13.3 million carats in the first half of the year, compared to 15.6 million carats.

China is now the world's second-largest market for diamond sales, accounting for 14 percent of the total share behind the United States (45 percent). India is the third-largest market, according to Cleaver.

This signifies the importance of the Chinese market to De Beers, he said, with the demand for polished diamonds in China experiencing huge growth in the past eight years. But this has slowed down more recently, with growth around 3 percent in 2015, Cleaver said.

"But we are very positive about the future of Chinese diamond and jewelry consumption. We think that as the middle-class continues to grow and as people continue to urbanize, diamonds are a very aspirational purchase, we would expect to see continued health growth in China in the medium to long-term down the road."

The company sells rough diamonds largely to retailers, manufactures and traders. It also has Chinese customers who are direct clients of the company.

"We cut and polish the diamonds and sell them into the Chinese market, while other retailers, manufactures and traders will sell to the whole world and 14 percent of it will then be sold to the Chinese market."

De Beers works closely with major Hong Kong jewelry retailers including Chow Tai Fook, Chow Sang Sang, Luk Fook and more, Cleaver said.

Expansion plans

The producer has identified China as the country with the highest growth potential, which is why it has embarked on a strategy to target the Chinese diamond and jewelry business.

"We are very focused in China, and the specific strategy is about growing in Chinese market."

The company spends about $120 million each year on marketing around the world, with a significant portion committed to China. Cleaver said it will relaunch its slogan "A Diamond Is Forever" in December in China in time for the New Year and the Spring Festival.

Chinese consumers display different patterns of buying diamonds compared to Western consumers, Cleaver says. Chinese buyers are attracted to larger diamonds between 0.3 and 0.7 carats, which is more than the global average. This compares to India, where buyers are interested in smaller diamonds.

Compared with the US market, Chinese consumers choose to buy diamonds for different occasions, preferring to purchase them for a wedding instead of an engagement like in the US.

"We are starting to see a trend of self-purchasers starting in China, as women have became more economically-empowered, so we think that's another growth opportunity," Cleaver says.

Another strategy De Beers will employ is targeting the "millennial" generation (aged 16 to 35), according to its Diamond Insight Report 2016 released on Sept 15. It found millennials spent more than $25 billion on diamond jewelry in 2015 in the four largest consumer markets (the US, China, India and Japan), more than any other age bracket.

Although, De Beers is more focused on the rough diamond business, it also has two brands in the retail market. Forevermark is sold through retailers and now runs more than 450 stores in China.

The second is the high-end brand De Beers Diamond Jewellers, with 35 stores globally and six on the Chinese mainland.

"A considerable proportion of our clients are from the mainland - about 55 percent - although they don't only buy in China," Cleaver says.

He says the company is unlikely to change the footprint of De Beers Diamond Jewellers, but the rollout of Forevermark products in more retailers will continue.

"As we expect to see more growth (from Forevermark), I think you can certainly expect to see us advertise significantly in China, and hopefully you can see us continue to grow. We are very positive about our ability to grow in China."

Contact the writer at sophiehe@chinadailyhk.com

Top 10 Chinese cities with 'internet plus transportation’

Top 10 Chinese cities with 'internet plus transportation’

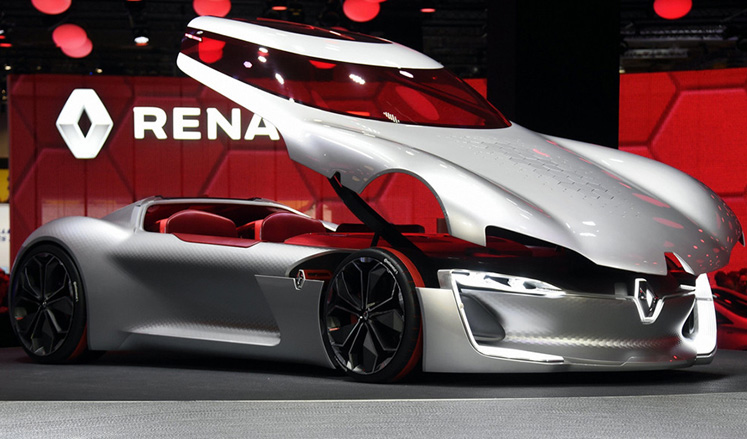

New energy cars shine at Paris Motor Show

New energy cars shine at Paris Motor Show

23 baby giant pandas make debut in Chengdu

23 baby giant pandas make debut in Chengdu

Heritage list salutes Chinese architecture

Heritage list salutes Chinese architecture

Happy hour for prince and princess in Canada

Happy hour for prince and princess in Canada

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Rescue work at the typhoon-hit provinces

Rescue work at the typhoon-hit provinces

Wonderland-like sunrise in East China

Wonderland-like sunrise in East China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|