A yen to try the balancing act

Updated: 2013-04-15 08:01

By Jin Baisong (China Daily)

|

||||||||

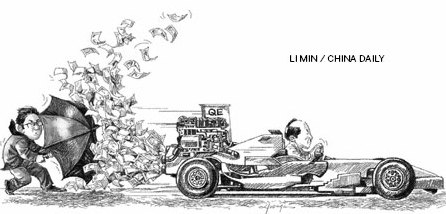

Bank of Japan's new governor, Haruhiko Kuroda, unleashed the world's most intense burst of monetary stimulus earlier this month, promising to inject about $1.4 trillion into the economy in less than two years. The radical gamble sent the yen reeling and bond yields hurtling down south.

For China, the most important issue is the negative impact of the move, that is, whether the yen's depreciation will trigger a currency war. But fears of a "currency war" are unwarranted. According to the currency management system in Japan, called "floating exchange rate system" like in many other countries, the yen always fluctuates with supply and demand. For instance, despite the interference with the dollar, euro and sterling after the outbreak of the global financial crisis, the basic trading rules have remained intact.

Besides, developed countries have an unwritten rule: the priority of making the arrangements lies with the United States. So Japan has to consider other developed countries' interests before devising its currency policy.

The unwritten rule came into full play during the global financial crisis when many mainstream economists in the US, and even the US government, "suddenly lost confidence" in the market because the real public debt was far beyond that revealed to the public. They feared the crisis had the potential to drive the US into bankruptcy.

It was then that the US financial leaders, led by the treasury secretary, put their special abilities into play. They decisively implemented various deleveraging measures to relieve the pressure and diverted the world's attention to the European Union debt crisis, taking the heat off the US.

The fact that the unwritten rule works perfectly well is evident when we take a closer look at the eurozone crisis. The situation in the eurozone, especially in countries like Greece, is no doubt bad, but overall the EU countries' national debt ratio is 88 percent compared with the US' 110 percent. This proves that as the "big boss" among the developed countries, the US has the privilege to judge others and make decisions for them.

To ensure a smooth economic recovery, what the US needed the most was a little depreciation of the dollar, which would boost its exports and increase the employment rate. And with the financial world's attention diverted to the eurozone crisis and the appreciating yen from 2008 to 2012, the US got the time and opportunity it needed to emerge out of the economic downturn.

So the depreciation of the yen, apart from the unwritten rule, can be attributed to three factors. First, a depreciating yen suits Japan's current economic situation. Since the global financial crisis didn't have that negative impact on Japan, the yen kept rising for about four years. Experts believe that a ratio of up to 90 yen to a dollar is good for Japan. Only if the ratio drops to 70 or 80 yen to a dollar can it a trigger currency crisis in Japan.

Second, Japan has received some unexpected shocks in the past two years. The March 11, 2011, earthquake, which triggered a tsunami and nuclear leak from the Fukushima Daiichi nuclear power plant, dealt a devastating blow to the Japanese economy. Later, the intensification of the Diaoyu Island disputes, because of the Japanese government's actions, undermined Sino-Japanese trade and worsened Japan's woes, prompting it to change its economic strategy.

Third, Japan faces an economic crisis because of long-term recession. International factors have indeed played a role in the recession, but Japan has been on the "economic downslide" for years. For example, Japan's nominal GDP increased less than 3 percent from 1991 to 2012, which means it has been caught in a deflationary cycle for more than 20 years. Moreover, to stimulate the economy, Japan has exhausted its financial resources with its debt rate rising to more than 200 percent. So if Japan does not improve its relations, especially trade relations, with China, it could slide into deeper recession.

According to Japanese government data, the country's debt ratio crossed the 100 percent mark in the 1990s, peaking at 235 percent in 2012. Japan is not yet in a debt crisis because it requires little fund from the market despite its long-term depression and it is a large exporter of capital with the largest creditor's rights in foreign markets. And since a major part of Japan's loans to the US is in exchange for government bonds, enterprise bonds and private debts, it will deal a big blow to the US if it withdraws them to save its economy, and this is something Washington will not allow to happen.

Given these factors, the yen's depreciation is within reasonable limits and according to Japan's needs. Also, with better communication between Tokyo and Washington, the US believes that this is a good time for the yen's depreciation, especially because the US economy is on the road to true recovery.

The negative impact of a depreciating yen for China will be limited because of the current international division of labor between the two countries. Japan has made China, instead of the US, its most important market since 2000. In fact, China has become a production base for Japan, and Japanese brand products are made in China and then exported to the US and Europe.

The intermediate products made in China account for 90 percent of Japan's total exports to China and 40 percent of its total exports to the world. The Chinese mainland provides the low-end goods and the four Asian tigers including Taiwan and Hong Kong, the middle-end products, with Japan specializing in high-end, value-added products.

More importantly, Japan is likely to increase its exports to China by applying a "localized strategy" to sell made-in-China products on the mainland, which will not necessarily be routed through customs but treated more like local goods sold in local markets. China has already accepted this strategy. So the depreciation of the yen will not have a major impact on China's exports or imports, and will not trigger a currency war.

The author is a researcher at the Chinese Academy of International Trade and Economic Cooperation under the Ministry of Commerce.

Related readings:

The weakening yen's impact on China

Yen depreciation to have limited effect on China

Yuan at 6-week low as PBOC cuts fixing amid yen concern

Tokyo stocks fall on stronger yen, China concerns

Japan logs trade deficit in August on strong yen

Yuan-yen direct trading 'a win-win game'

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Relationship 'relaunched'

Good start expected for summit

Xi, Mexican president discuss bilateral co-op

Cooperation to drive mutual growth

Chinese president arrives in Mexico for state visit

China is victim of hacking attacks

US to be largest trade partner

China joins fight against hacking

US Weekly

|

|