China's economy continues its transition

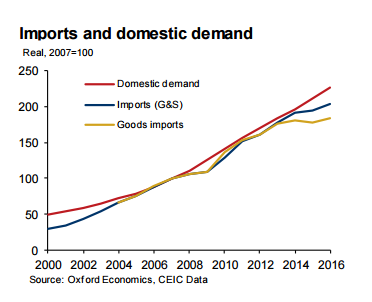

There are a number economic reasons why imports, especially those of goods, have slowed so significantly in recent years. One is the investment slowdown noted above. China’s investment is highly import-intensive, and the slowdown in investment hit imports substantially. While the impact of the slowdown in investment on overall growth has in large part been offset by solid consumption growth, consumption is much less import intensive. Second, in early 2015 a significant inventory correction exerted a major drag on imports, notably of raw commodities. This sudden contraction masked a more gradual underlying trend towards lower commodity intensity of China’s growth given the rebalancing and transition of the economy.

Third, as China has been improving its industrial structure and moving up the value chain, companies and individuals have been switching from buying imported components and goods to sourcing domestically. This includes companies in export-oriented manufacturing, leading to the increase in domestic value added content of exports noted above. At the level of final domestic demand (consumption and investment spending), domestic companies also have made inroads competing with imports and/or foreign brands. Notable recent examples include smartphones, SUV cars and instant noodles.

These trends should continue in the coming years

The trends we have described here are medium-term ones, not cyclical. We expect them to persist in the coming years and to remain key aspects of our outlook for China.

Specifically, we expect GDP growth to continue to ease gradually in the coming years but remain solid, reaching 6.3 percent in 2017 and 5.7 percent in 2020. We forecast continued rebalancing, with the share of services in GDP rising by 3.2 ppt to almost 55 percent in 2020 and that of consumption by 1.2 ppt to 55 percent. We expect urbanization to continue broadly at the pace in recent years. While we forecast a mild pick up in export growth this year we expect shipments to remain constrained by only modest global trade growth, while market share gains are unlikely to be large in the coming years. And we expect import growth to continue to lag domestic demand as rebalancing, transition and movement up the value chain continue.

The author is the Hong Kong-based head of Asia economics for Oxford Economics.