Equities try to get footing after China-inspired selling

Updated: 2016-01-06 11:09

By Paul Welitzkin in New York(China Daily USA)

|

|||||||||

A day after a massive selloff that started in China global stock markets Tuesday turned in a mixed but steady performance.

In China, the Shanghai Composite Index fell 0.3 percent to 3,287.71 while the CSI 300 Index of large-capitalization companies managed a gain of nearly 0.3 percent to 3,478.78. Share prices in Europe advanced cautiously while equities were mixed in the US and Latin America.

"Clearly the fear over China hasn't abated," Ben Kumar, investment manager at Seven Investment Management, which has over $9 billion in assets under management, told The Wall Street Journal.

In a bid to shore up investor sentiment, Chinese officials unveiled measures to stabilize the mainland's markets. The People's Bank of China pumped nearly $20 billion into money markets, its largest cash injection since September, Reuters reported. It also intervened in the foreign exchange market to support a weakening yuan, The Journal reported, citing two people familiar with the matter.

The China Securities Regulatory Commission announced it was planning new rules to further restrict share sales by major stakeholders in listed companies, and said it would tweak the circuit breaker mechanism amid that it had fueled Monday's sell-off. After the CSI 300 fell 7 percent on Monday, trading in Shanghai and Shenzhen was suspended before resuming on Tuesday.

"Market participants will become familiar and comfortable with the circuit breakers over time. It is welcoming to hear the CSRC is willing to evaluate and solicit feedback on the implementation of circuit breakers. A well-functioning market needs good regulatory oversight and interaction of market participants," Brendan Ahern, chief investment officer at Krane Shares, a US-based provider of China-focused exchange-traded funds said in an e-mail.

Ahern called Monday's selloff in China "the culmination a weak manufacturing PMI number, a lower CNY (yuan) fixing rate and the coming expiration of the insider sale ban from the summer. Alone these events would have little effect though together they created a short term challenge to trading in the New Year. We do not foresee Monday's weakness leading to a broader pullback in the market, especially in light of the CSRC's language on pushing out the insider sale ban."

However, some analysts believe Monday's selloff was needed. ""We've been waiting for a market drop like this for a long time," Samuel Chien, a partner of Shanghai-based hedge fund manager BoomTrend Investment Management Co. told Reuters. "The economy is poor, stock valuation is still high, and the yuan keeps sliding, showing capital outflows are accelerating. The market drop is overdue."

"There are a lot of concerns on China and emerging markets in general," noted Anatoli Annenkov, senior European economist at Socit Gnrale, according to the Journal.

John Frisbie, president of the US-China Business Council, said investors should not view China's stock market as a reflection of China's economy and "should not overreact."

"Movement in China's stock indices has less to do with market or earnings fundamentals of the listed companies than it does with the need for further financial market reforms in China," Frisbee said.

The council is a private, nonpartisan, nonprofit organization of roughly 220 American companies that do business with China.

paulwelitzkin@chinadailyusa.com

- Obama says US must act on gun violence, defends new gun control rules

- Over 1 million refugees have fled to Europe by sea in 2015: UN

- Turbulence injures multiple Air Canada passengers, diverts flight

- NASA releases stunning images of our planet from space station

- US-led air strikes kill IS leaders linked to Paris attacks

- DPRK senior party official Kim Yang Gon killed in car accident

What's in store at CES 2016

What's in store at CES 2016

Li springs a surprise on coal mine visit

Li springs a surprise on coal mine visit

Man proposes to his beloved with a $23,010 ghost castle

Man proposes to his beloved with a $23,010 ghost castle

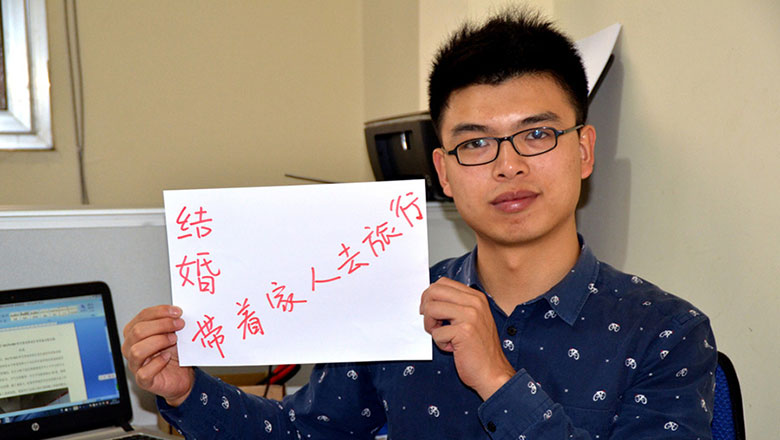

New Year's wishes from Chinese expatriates

New Year's wishes from Chinese expatriates

Xi begins new year with visit to Chongqing

Xi begins new year with visit to Chongqing

Top 10 events that moves the stocks

Top 10 events that moves the stocks

Top 10 travel spots around Hainan

Top 10 travel spots around Hainan

Highlights of second stage of Darkar Rally 2016

Highlights of second stage of Darkar Rally 2016

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|