Crossing point

Updated: 2011-09-09 08:37

By Alexis Hooi (China Daily)

|

|||||||||

Hong Kong-Shenzhen integration plan still has wrinkles that need to be ironed out

Home appliances shop owner Liang Xiaoming remembers the heady times more than two decades ago. "Buyers would snap up loads of imported televisions and audio players by the bulk; it was a gold mine," the 58-year-old says.

Liang ran one of the numerous stores that lined the 300-meter-long Zhongying Street, a shopping lane at the southeastern end of Shenzhen that straddles the border between the southern city and Hong Kong.

The street is a product of a treaty signed between Chinese authorities and the United Kingdom more than a century ago, when Hong Kong was still under British rule. From daily necessities such as shampoo and socks to luxury items such as jewelry and watches, Zhongying Street drew shoppers from both sides with its duty-free prices and variety of goods.

| ||||

"We still attract people with our competitive prices, but of course our items are no longer that special," Liang says. "Shenzhen has developed rapidly and now you can buy almost anything in the city. We need to find new ways to keep Zhongying ticking."

In many ways, Zhongying Street reflects the evolving relationship between Shenzhen and Hong Kong as well as the growing interdependence and integration between the two.

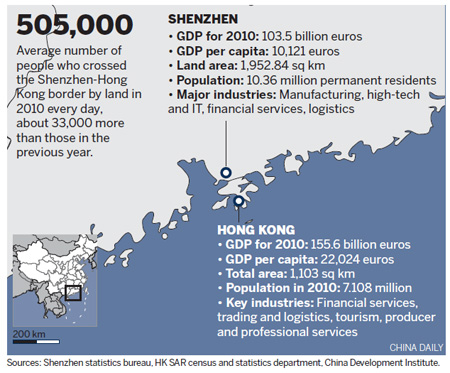

Shenzhen, a city in southern Guangdong province, became a special economic zone following the country's reform and opening-up in the late 1970s. The city is now one of the richest and fastest-growing Chinese cities, with a per capita GDP of 93,000 yuan ($14,560) last year and a GDP that grew 12 percent year-on-year to hit 951.09 billion yuan, the city's statistics bureau reported.

In the past three decades, many Hong Kong businesses have used their neighbor as a springboard to access the resources of the Pearl River Delta (PRD) and the Chinese mainland to help the region become an economic powerhouse of the country through low-cost manufacturing. The PRD is China's largest export hub, making up more than one-quarter of the national trade volume.

Guangdong itself achieved annual GDP growth of more than 10 percent for the past three decades. The province recorded 4.5 trillion yuan in GDP last year, 11 percent of the country's 39.8 trillion yuan GDP, official statistics show.

On its side, Hong Kong, as a special administrative region with its own legal and monetary systems as well as an established international financial and services hub, has provided investment and management expertise to support the factories and labor force of the mainland. Hong Kong's GDP hit HK$1.744 trillion ($223.8 billion) and boasted a GDP per capita of HK$246,733 last year, figures from its census and statistics department show.

During a recent visit to Hong Kong, Vice-Premier Li Keqiang also announced a series of measures by the central government to support Hong Kong's development and enhance cooperation between the mainland and the special administrative region.

|

|

These include allowing qualified foreign institutional investors (QFII) in Hong Kong to use yuan deposits to invest in the mainland equities markets, with the initial quota being 20 billion yuan. China will also launch exchange-traded funds that invest in Hong Kong-listed stocks in the mainland's stock exchanges. Similarly, Hong Kong will continue to be developed as a key center for offshore yuan settlement and the pilot program will be expanded nationwide, while more Hong Kong enterprises will be allowed to use the yuan to invest in the mainland.

But faced with the increasing challenges of the global economy, many analysts and businesses are now pushing to further increase and improve the links between Shenzhen and Hong Kong.

Anthony Wu, the chairman of the Hong Kong-based Bauhinia Foundation Research Centre, an independent major policy think tank, says the authorities must have a bigger vision to continue growing the two sides together and avoid focusing on "the small things and short-term gains".

"Ten years from now, Hong Kong and Shenzhen are going to be very integrated with the increased flow of people, information and goods. It is going to create a lot of value for both Shenzhen and Hong Kong. Both authorities must look forward and move on, not say 'I have 60 percent of the pie and you have 40 percent. I want to retain my share of the pie'. You have to look at the much bigger pie so that both sides win," says Wu, who has also been a national committee member of the Chinese People's Political Consultative Conference, the country's top political advisory body, since 1998. Wu is also chairman of the Hong Kong Hospital Authority and the Hong Kong General Chamber of Commerce as well as a council member of the Hong Kong Trade Development Council.

In an August 2007 report, the Bauhinia Foundation Research Centre had already identified the importance of promoting the economic integration of the two sides by working toward a "Hong Kong-Shenzhen metropolis with global competitiveness".

The report first singled out barriers to that growth, including gaps in the flow of people, capital, goods and information and services.

Proposed solutions for these barriers included strengthening infrastructure links to create a "Hong Kong-Shenzhen one-hour metropolitan life cycle" with three major crossing systems in the western, central and eastern parts of the border and connecting the railway networks of the two cities for a "seamless interface".

"If there is a car picking me up from central Hong Kong now, I can be having lunch in Shenzhen 42 minutes later. The proximity and people flow are something we can continue to work on," Wu says.

"Throughout history, if you have got good people flow then goods, money and services will follow. It's about building on what we have now and making things easier.

"The interdependence between Hong Kong and Shenzhen is already happening and increasing every day, with students and workers crossing the borders daily," he says.

"The question is how to bring all of this forward and take a bigger leap. Like using certain areas to pilot innovative ideas."

Zhang Yuge, the director of the center for public policy under the Shenzhen-based China Development Institute think tank, says Hong Kong and Shenzhen used to be thought of as separate entities working together to help each other develop but the increasing integration between the two means they are now viewed as one singular area developing "as a whole".

He agrees that it is still the people who must spearhead the growing integration between the two sides.

"Last year, about 505,000 people crossed the border between Shenzhen and Hong Kong by land every day," says Zhang, whose institute has worked with the Bauhinia Foundation Research Centre on studies to develop the PRD.

That is an increase of about 33,000 people a day from in 2009, figures from the Hong Kong authorities show.

"These numbers indicate how much the two sides are becoming so dependent on each other," Zhang says.

More than 4.77 million Shenzhen residents have headed to Hong Kong and spent about HK$26 billion in the special administrative region two years after the launch of a scheme in 2009 that grants multiple-entry visas for eligible Shenzhen residents to visit Hong Kong, Wu says.

Alberto Vettoretti, managing partner of the China and Vietnam practice at business advisory Dezan Shira and Associates in Shenzhen, says the integration between Hong Kong and Shenzhen is linked to various variables, all playing vital roles that must be implemented together.

"We are looking at people, information, goods and money, not necessarily in this order. We need to have all these ticking if we want a smooth integration," says Vettoretti, who is also vice-chair of the Pearl River Delta board of the European Union Chamber of Commerce in China.

"The flow of people is a tough task. I recall 10-15 years ago when there were limited channels to commute between Hong Kong and Shenzhen. The trip used to take a long time. Since those days the situation has improved with the opening of new passages across, thus diluting the amount of people using one single route. Still, the trip across is not ideal for those businessmen doing business across borders."

"The Chinese mainland is still lagging behind Hong Kong in implementing smart ID cards/passes for those who travel a lot between Hong Kong and Shenzhen. If you are a Hong Kong resident or 'reside' in Hong Kong or apply for Hong Kong residency or have a business interest or company in Hong Kong, then you can apply for an ID card which allows you to cross the border through the digital finger print channel with zero queuing and zero time wasted. At the Chinese border then you are stuck in the queue and you need to fill out the papers," Vettoretti says.

"Of course, the super fast train between Shenzhen and Hong Kong reducing the traveling time to 14 minutes is well under way. Still, when it comes to crossing Customs, queuing is a major concern."

|

|

Barriers to the efficient flow of goods between the two sides also remain, he says.

"Exported goods need to be 'recalled' back into the Chinese mainland for reworking, fixing, repairing and so on. So a streamlining of Customs procedures or the creation of a joint bonded zone is important to speed up the time-to-market and after sales services provided from the PRD/Hong Kong area. If both want to compete on increasingly sophisticated products and supply chain integration, then speed and easing of procedures are vital," he says.

"Infrastructure is also being built to support this and the flow of people as more than 70 percent of the flow of goods is done via trucks these days in the PRD, creating huge congestion on the road. There must be more integration with the rest of the PRD in this regard."

Deepening financial cooperation and strengthening Hong Kong's position as an international financial center also factored high on the priorities marked out by the Bauhinia Foundation Research Centre.

The two cities can facilitate further cooperation and infiltration between their commercial banks, strive for the operation of an inter-bank borrowing market between them, facilitate Hong Kong banks to expand their presence in Shenzhen and promote cooperation between the stock exchanges of the two cities. The cross-boundary flow of yuan and Hong Kong dollars will also provide a monetary foundation to facilitate an interbank borrowing market between the two.

To that effect, encouraging Shenzhen commercial banks to launch Hong Kong dollar bill acceptance, expanding the scope of yuan convertibility in Hong Kong and gradually allowing Hong Kong lenders to operate offshore as well as establishing a Hong Kong-Shenzhen interbank foreign exchange borrowing market will help, the center reported.

Similarly, Shenzhen plans to have the added value of the financial industry to account for about 15 percent of its GDP in 2015 by focusing mainly on the capital market, business investment and wealth management. More foreign financial organizations are also being encouraged to set up offices in the city.

"Hong Kong is now already a renminbi trading center. But if we can work more closely together we can create the biggest offshore center and by doing that I'm certain you are going to attract more foreign investment and even major mainland companies," Anthony Wu says.

Chen Guanghan, professor of economics and director of the Center for Studies of Hong Kong, Macao and Pearl River Delta at the Guangzhou-based Sun Yat-sen University, says Hong Kong's services industry is also mature and can help Shenzhen, which boasts strengths in sectors such as high-tech manufacturing, IT and communications. But in terms of attracting top talent, research centers and education, it still lags behind Hong Kong.

"Hong Kong is more international and Shenzhen still caters more to the domestic market. But both can complement each other very well in sectors such as services and Hong Kong businesses already have a significant number of offices in Shenzhen," Chen says.

Zhang from the China Development Institute says companies are increasingly tapping on the particular strengths of the two sides and can no longer be viewed as just centered in one spot.

"One company 'based' in Shenzhen can have multiple operations located throughout the region, increasingly making use of the various resources of each area," he says.

But Vettoretti in Shenzhen says the city must "open up" more of its service sectors to foreign-invested enterprises and Hong Kong companies as many sectors that are fully open in the special administrative region are still heavily restricted in Shenzhen.

"One of the goals of Shenzhen is to increase the percentage of GDP related to the tertiary industry or services, whereas in Hong Kong this is in excess of 95 percent," he says.

"In Shenzhen, I believe that is still well under 50 percent. As Shenzhen is reinventing its role, once again, it will not be a bad idea if the term SEZ (special economic zone) which helped the city make its fortune is now re-invested and re-engineered to give it the leading edge in terms of becoming fully integrated with Hong Kong."

The Bauhinia Foundation Research Centre also mentioned jointly tackling environmental challenges as well as strengthening educational and cultural cooperation as important areas to develop a Hong Kong-Shenzhen metropolis - itself a first step to building a metropolitan region encompassing the Pearl River Delta area.

But the political will is paramount for all these to work, Wu says.

"You have to get the support not only from the Shenzhen, Hong Kong and Guangdong authorities, but from Beijing as well because it affects the whole country's policies. The implications have to be carefully studied," he says.

"It's really optimizing what we can do under the 'one country, two systems' policy, under 'one metropolis and two currencies', under 'one metropolis and two sets of laws'."

|

|

"If you have the will, you can certainly do it. For example, if you want to merge the Hong Kong and Shenzhen stock exchanges, it can be done. If you look at a report we had in 2006 that talked about Shenzhen people coming to Hong Kong with fewer and fewer restrictions, that is happening now. If you look at integrating the usage of the Hong Kong 'Octopus' payment card on the two sides, that is also happening now," Wu says.

"Authorities on both sides should really continue finding ways to improve that integration. It shouldn't be just talking, it should be putting things into action. The problem is, in Hong Kong it's election year and politically, sometimes, you need to go through too many legislative hurdles and that may sort of delay a lot of the initiatives."

Zhang from the China Development Institute says the political and administrative differences between Shenzhen and Hong Kong cannot be addressed in the short term.

"The administrative procedures for businesses on the two sides, for example, are not seamless and identical. And you cannot expect them to be, based on the current situation," he says.

"Then of course you have the legal issues and differences as well. How do you resolve these in the short run? But the outlook is optimistic and my feeling is that Shenzhen might still have to try to get up to speed with Hong Kong in many aspects."

Chen from Sun Yat-sen University agrees both Hong Kong and Shenzhen need an integrated plan to develop together effectively.

"Hong Kong's governance is still very different from that of Shenzhen. Hong Kong's economy is also traditionally more laissez-faire and it might take longer for plans and ideas to get implemented," Chen says.

"But it's obvious that cooperation is the best way forward. With the renminbi strengthening, many Shenzhen people are buying up property and investing in Hong Kong. The border areas, especially on the Hong Kong side, are also developing fast, unlike the past when the British seemed to want to minimize contact between the two sides. Border areas are potential growth spots as integration progresses. That can only get better and better, much as how Zhuhai and Macao are developing in tandem."

Anthony Wu also cites the development of the Qianhai area as another example of how innovative thinking can carry the Hong Kong-Shenzhen link further. Qianhai is a proposed 2.18 square kilometer cooperation zone located in the Shekou peninsula in western Shenzhen and east of the Pearl River estuary. The area is being planned as a modern services zone developed by Hong Kong and Guangdong with four pillar industries - modern logistics, information services, and science and technology services. Shenzhen plans to pour at least $5.9 billion into Qianhai to build the area's infrastructure, establish a legal framework and woo services firms in Hong Kong, especially in the financial sector.

"We need to think out of the box and take all of this forward. If nothing is done, then Qianhai is just another town between Hong Kong and Shenzhen. Can we be more innovative, maybe have a set of new rules, a set of special taxes? In Qianhai, can we adopt all the laws and regulations of Hong Kong, including taxation laws, and meanwhile the criminal law and so on remain as mainland ones? Can we allow the free flow of residents into this area to work?" Wu says.

"Or even, if there is a hospital in the area and a mother from the mainland is giving birth there, can these people get a Hong Kong ID card? We have to be innovative," he says.

"If you look at the bigger context of the whole of Guangdong as well, you have Hong Kong and Shenzhen, you have Guangzhou, as well as Zhuhai and Macao you can have these centers within the PRD," Wu says.

"When the bridges are built and the high-speed rail network is complete, the growth potential will be unlimited. And look at what the PRD has done for China in the last 30 years. It is still going to be the engine of growth in the next 30 years."