Riding the big wave

Updated: 2011-09-30 09:12

By Andrew Moody (China Daily)

|

|||||||||

| ||||

Shanghai Disney, which is scheduled to open either at the end of 2015 or early 2016, is part of a 29 billion yuan investment ($4.4 billion).

Disney itself is stumping up 43 percent of that - 12.5 billion yuan with the rest being provided by the Shanghai Shendi Group, a 100 percent State-owned joint venture investment holding company. Disney will retain control of the management company, however.

Crawford, who has worked for Disney for 21 years, says Shanghai could be the first of a number of Disney theme parks on the Chinese mainland.

"We think as a company, both in terms of the theme park industry and every other line of business, it (China) represents a tremendous opportunity for us," he says. "We want to make sure we are doing it right and we extend the best possible experience to the guests and then we will assess growth when those other opportunities come."

With theme parks in North America and Europe being hit by the economic downturn, Asia represents a major growth opportunity for the global industry.

The region is the world's fastest growing market with attendances increasing 7 percent in the year up to 2010, according to AECOM, the global consultancy.

Disney already runs the biggest theme park in Asia - Disneyland in Tokyo - that attracted 14.5 million visitors last year.

The main focus is on China, however. Seven of the 15 theme parks with the largest attendance in Asia are in China.

Until now, the Chinese mainland has been served purely by domestic players, although borrowing influences from around the world. Disney is the first foreign operator to be allowed in.

The biggest operator OCT, which opened that first theme park, Splendid China, in the country more than 20 years ago, is the 8th largest theme park chain in the world with its best known brand being Happy Valley. It attracted nearly 20 million visitors last year.

Others include Ocean Park in Hong Kong, which is funded by a trust and run by a Hong Kong government appointed board, and had the seventh largest attendance in 2010 with 5.1 million visitors.

Fantawild Adventure, owned by the Shenzhen Huaqiang Group, currently has five parks with several other smaller projects in the pipeline.

Another major player is the Haichang Group, a conglomerate based in Dalian in Liaoning province in Northeast China.

It has eight theme parks, including the Polar Ocean Worlds at Chengdu, Wuhan and Tianjin.

The potential growth of the market - with ever more Chinese attaining middle class incomes - is what is exciting both Chinese and overseas investors.

Visitor numbers are expected to climb a massive seven-fold from 60 million in 2010 to 423 million by 2030, according to AECOM statistics.

If at some point in the century, the Chinese visit theme parks as much as Americans currently do - approximately 0.7 visits per capita each year - then visitor number could soar to 925 million, more than 15 times today's level of visits.

But the champagne corks were not quite popping at the Noppen China Theme Park Expansion Summit at the somewhat windswept barren location of last year's Shanghai Expo earlier this month.

The Chinese government announced in August it would refuse permission to all new theme park developments larger than 20 hectares or of an investment value of 500 million yuan.

Many, however, were interpreting it as being similar to an existing ban on golf course developments and that the aim was to stop local authorities giving the go-ahead to lavish hotel and property developments masquerading as theme park complexes. If so genuine theme park proposals may still get the green light.

Liu Weigong, deputy general manager of the Changzhou Amusement Park, a 33-hectare theme park in Changzhou, Jiangsu province, was one who was hoping it was business as normal.

The park is owned by the local Wujin district government and since opening in May last year has attracted 1.7 million visitors.

"I still believe the government will support real and serious projects. The measure is to stop the abuse of developers using theme parks as an excuse to do real estate development. I think a lot of developers are worried about the move, however."

Charles Read, managing director of Blooloop, a UK-based website which provides news and information for those working in the theme park industry, believes the government measure is an attempt to restore some sort of order.

"Developers were using theme parks as some sort of Trojan horse to get retail and real estate developments through," he says.

"I think the business needed regulation and what the government is trying to do is to get the industry sorted out. I don't see it as a problem."

How the major international operators will view the government's move remains to be seen.

The industry's big names such as US giants Sea World Adventure Parks and Universal Studios as well as the British operator Merlin Entertainment Group, whose brands include Legoland, Madame Tussauds and Sea Life, are said to be keen to get a slice of the China action.

They have been held back because the government has been keen to protect domestic operators. Negotiations with Disney itself were protracted.

"All the major operators are in Asia now and they want to be in China too, so I think it will only be a matter of time before they come too," adds Read at Blooloop.

"It will be driven by the population seeing what Disney has to offer and they will demand a five-star product. It is inevitable."

What actually is classed as a theme park in China is often different to Western markets.

The term "theme park" means an entertainment experience built around an actual story, a concept that Disney has been so successful with its characters such as Mickey Mouse and Snow White.

But in China, open green public spaces with a few amusement rides often call themselves theme parks.

According to industry experts there are only around 60 in China that should be classed as theme parks proper.

|

|

Because of the lack of a theme, Chinese operators often fail to generate revenue from souvenirs and other sales once customers enter their parks.

In the US, some 50 percent of sales are derived from such revenues, whereas in China it is just 20 percent, according to AECOM.

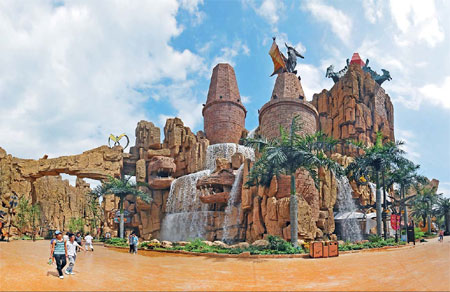

Li Hua, vice-general manager of DinoLand, a dinosaur theme park, also based in Changzhou in Jiangsu province, says his park has managed to push up souvenir sales.

The theme park has developed its own range of souvenirs based on a dinosaur cartoon series on CCTV (China Central Television) called Dinosaur Baby.

"Mickey Mouse has been around almost 100 years and Dinosaur Baby was first screened on CCTV in 2009 but we have still been able to drive up souvenir sales. Our non-ticket price revenue, including food and parking is now nearly 40 percent," he says.

The theme park, which opened in 2000 and extends over 47 hectares, is owned by the Changzhou government and claims it had some 2.5 million visitors last year.

Li, who has visited theme parks around the world, believes Chinese-owned parks are catching up with those in the West.

"There is still a gap between theme parks in the West and those in China but it is becoming narrower," he says.

For foreign operators one of the risks of coming to China is copyright infringement. A number of theme parks around China seem to borrow sets not dissimilar to that of Disney's Magic Kingdom.

Disney itself, however, is unconcerned about weak imitations since it is confident its product and service offering just raises the bar for everyone.

"We are extremely proud of the way we bring stories to life and create environments people can immerse themselves in. We are not concerned that others might duplicate and copy that," says Crawford at Disney.

Certainly, the expansion of the theme park market has presented major opportunities for suppliers to the industry in both Europe and North America.

Swiss Rides, based in Lochriet in Flums, Switzerland, built the world's largest water flume ride for the OCT East theme park in Shenzhen in 2005, which spectacularly runs through a hotel lobby.

Although the company has had to battle against the recent rise in the Swiss franc, China is now one of the company's biggest markets.

"We have already done three or four installations here and China is very much a future market for us," adds Thomas Spiegelberg, CEO of Swiss Rides' parent company BMF.

Brian Paiva, vice-president, business development of Funa International, based in Miami, Florida, which builds installations for both theme parks and cruise ships, says China provides an opportunity to do large-scale projects.

"Markets in the US and Europe are very mature and so there are no longer many substantial projects. Here you still get projects of scale," he says.

Jerry Chan, assistant director of Aquatique Show International, a Strasbourg company, which produces water fountains and effects, also says that China is now a key market.

The company's first project was at a shopping center in Ningbo in Zhejiang province 10 years ago but it later designed a music fountain for the Shanghai Expo and has now branched out into theme parks.

"Theme parks in China is a very exciting market for us. We are already co-operating with Disney in Shanghai but we are still very much at the design stage," says Chan.

A number of Chinese theme park operators are interested in the latest gadgetry and offering something not seen out of China.

Lenny Larsen, director of themed entertainment at Rubicon, an Amman, Jordan-based company that designs theme park attractions, says a number of Chinese operators are looking for something that sets them apart.

He says many are interested in theme park rides that incorporate computer software.

"This is the way attractions are evolving. You can have rides that are different every time you go on them. With the right software one day you might be visiting the Amazon rain forest, another day something entirely different," he says.

Keith James, chief executive officer of Jack Rouse Associates, a leading park designer based in Cinncinatti, says the theme park industry is very expensive to be in whether you are Chinese or foreign.

"You are talking of a $500 million, $700 million or even a $1 billion investment for a solid theme park and that is certainly not a Disney or Universal. You have got to sell hell of a lot of tickets to get a return on that level of investment," he says.

He adds the Chinese industry is still catching up as a result of being a late starter.

"What happened really is they skipped the entire learning curve of the industry. Because it is a theatrical business rooted in the film and theater industry, it is a little tough to learn. If show business was easy no movies would ever fail."

Xu Xiaomeng contributed to this story.