Credit crunch

Updated: 2012-01-06 08:53

By Andrew Moody and Hu Haiyan (China Daily)

|

||||||||

|

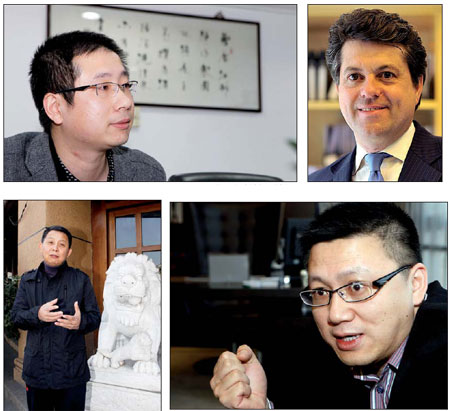

Clockwise from top left: Pan Shifei, head of small business lending at Wenzhou Bank; Simon Eckersley, founder and CEO of private equity company Hao Capital; Hu Xucang, president and CEO of the Wenzhou-based private equity firm Aroundasia; Hu Zhenhua, professor of economics at Wenzhou University. [Yong Kai / for China Daily][Provided to China Daily] [Photos by Yong Kai / for China Daily] |

The banks themselves claim there is plenty of money available for small businesses in Wenzhou and they themselves are not to be blamed for the funding crisis.

Wenzhou Bank, the largest local bank, lent 15.6 billion yuan in the first 11 months of 2011, a 17.5 percent increase on the 13.27 billion yuan of the whole of 2010.

Bad debts have increased from 0.87 percent of all loans at the beginning of 2011 to 1.03 percent by the end of November.

Pan Shifei, the bank's head of small business lending who cuts a youthful figure, was relaxed about the situation in his offices in Chezhan Road.

"No, I am not worried about it. The bad debts are way below the 3 percent we would regard as a warning sign. I don't think that is likely to happen," he says.

He adds it is not always straightforward lending to small businesses in the city because it is often difficult to assess the financial position of their businesses.

"There is often no clear dividing line between their personal and company accounts which makes it difficult to make lending decisions. Many also have little in the way of long-term planning and without planning it is easy to go bankrupt."

At Xiaonan Road in Wenzhou, Miao Wenlin, vice-president of the Wenzhou branch of the Agricultural Bank of China (ABC), one of China's Big Four banks, says the availability of bank loans is not the key reason for the funding crisis.

"The typical small business does not rely on bank finance. It is only when businesses aggressively expand that they become dependent on bank loans," he says.

ABC in Wenzhou issued 2,758 loans to SMEs in the first nine months of 2011 with an average value of 20 million yuan.

Miao says 80 percent of these loans were for either 6 months or 12 months and were for working capital, which he says is typical in Wenzhou. "Most small companies use it to boost their working capital. Those who borrow money to invest in technology or plant and machinery are rare."

Some believe the banks are not being completely open and are adding to the funding crisis.

Lu Peixin, executive director of Sunrise Capital, a private equity company, based in Wenzhou and Shanghai, says the bank statistics that show a growth in small business lending are misleading because they don't take into account other factors.

"Bank lending may have gone up because there has been a stronger need for SMEs to borrow from the bank since companies have had difficulty getting paid for their products from clients," he says.

"You also have to consider the costs have risen. Raw materials have gone up in price and wages in Wenzhou have gone up by as much as 20 percent. These are probably more to do with bank lending going up. So there is no real increase at all."

Since the crisis began to hit the headlines, the private lenders have been the ones that have often been demonized but that often ignores the important role they play in the economy, which even the mainstream banks admit.

"They are an important part of the financing system," says Miao at the Agricultural Bank of China.

"There are so many people taking part, including business people in a number of sectors as well as doctors, teachers and even public servants."

This begs the question as to how easy it will be to regulate, if the government does attempt to control the moneylenders.

Hu believes that the schemes proposed by the local government in Wenzhou to get small businesses to register all private loans will not work.

"They want to set up a private lending registration center but nobody will use it since there is no benefit to either the lender or the borrower since the local government is not acting as any form of guarantor," he says

"The actual characteristics of private lending are that it is hidden and basically free. It is also irreplaceable."

That it is irreplaceable is the essential problem as businesses try to steer their way through the Spring Festival period.

Many of them need the private lenders as well as the banks to start issuing new loans again - and fast.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|