In praise of the Chinese way

Updated: 2012-01-13 07:50

By Chen Weihua (China Daily)

|

||||||||

|

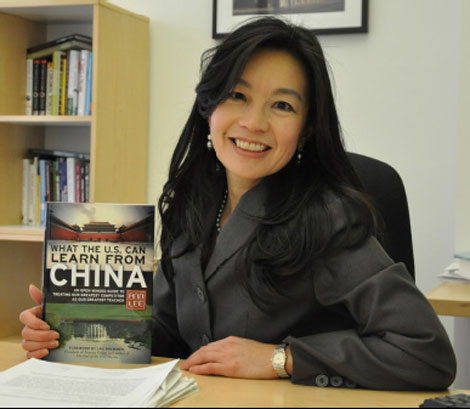

Ann Lee lists in her book a host of Chinese practices in areas such as education, Confucianism and banking that she believes the United States can learn from. [Zhao Yanrong / China Daily] |

Ann Lee believes China's best practices are a good model for other nations

Over the past 33 years since China started its reform and opening-up policy, the country has looked to the West in its modernization drive. The zest for learning has been reflected in almost every area of society.

Most Chinese and Westerners believe China has all the things to learn from the outside world and few have fathomed that the West should also learn from China.

Not according to Ann Lee, a professor of finance and economics at New York University and a senior fellow at Demos, a non-partisan public policy think tank.

In her new book What the US Can Learn from China: An Open-Minded Guide to Treating Our Greatest Competitor as Our Greatest Teacher, Lee argues that sharing some of China's best practices and enduring principles can help foster much-needed change at home and could prove beneficial for sustainable economic growth and development around the world.

Lee says China has become a convenient scapegoat for American economic problems and the nations in the West have often overlooked these practices because they assume that China stands for values that are the polar opposite of their own. In many cases that is wrong.

Lee agrees that the book is biased. "It's not as if I think China can do no wrong. It's about best practices. Why would I talk about things that are not good, which is not the point of the book?"

The book lists a host of principles in areas such as education, Confucianism, work ethic, banking practices and even soft power and the ways government officials are selected as models that Lee believes the United States can learn from.

For example, contrary to the conventional wisdom in the West, Lee argues that China's leaders have earned their authority through a lifetime of meritocratic service that is far from arbitrary. "Their system of earned authority actually resonates strongly with Western values, is surprisingly popular with its population, and may even be used to strengthen today's democratic institutions.

"Although China's system is far from an ideal democracy, its system of meritocracy contains elements of democratic representation that permeate the entire governance structure.

"The Chinese believe that the privilege of leading a country should belong only to those who have proven that they can serve the country over long periods of time in a selfless way and accomplish a great deal. Thus the process of leadership selection in China at its heart is based on merit rather than mere popularity contests during elections."

Lee finds that unlike some US politicians who are elected to the federal government with limited leadership experience in both government and in the corporate world, a Chinese leader will have served in a variety of government roles that may be as diverse as leading several provinces as governor, engaging in trade negotiations, heading a State-owned company and running regulatory agencies.

A 2010 Pew Global Attitude Survey reported that 87 percent of Chinese said they were content with their country's direction; only 30 percent of American respondents said they were content with their country's direction.

Lee also sees the brilliance of China's five-year plans, which she compares to a strategic plan drawn up by a US corporation.

She argues that the beauty of China's system is that market forces are permitted to flourish at the corporate and retail level, but the government role is to make decisions independent of fleeting considerations like returns on investment.

"Despite historically widespread corruption at the local level, Party policy is at least predictable," says Lee, who migrated with her parents from Hong Kong to the US when she was in the second grade.

She says that in the US, politicians realize that pleasing their constituents with promises of quick fixes, like big tax cuts across the board, is a more effective way to win elections than putting forward long-term solutions to deep, structural problems like overhauling the entire tax code.

She says the lack of long-term planning in the US also makes it difficult for the Chinese to work with US government officials. In negotiations, foreign leaders never quite know whether the treaties they negotiate will ever get through Congress.

Lee, a former investment banker and a partner in a pair of multibillion-dollar hedge fund firms, is critical of Wall Street and cautions of an over-powerful financial industry, declaring that "rather than Wall Street serving the real economy, Wall Street has enslaved it. Financialization has put the cart before the horse."

She reckons that a vast majority of financial transactions conducted by banks and private equity firms are done for purely financial reasons, which often clash with the national goal of creating jobs or driving innovation.

She praises China for putting money into the real economy.

"There would be no China miracle if China followed the same monetary and fiscal policies as the United States."

Lee defends China's currency policy and believes its strong economic engine as a result of its peg to the US dollar has been a blessing for almost everyone. "After the 2008 financial crisis, China single-handedly brought the world out of recession, assisting countries from Brazil to South Africa to resume strong economic growth comparable to the pre-Lehman levels," she says, referring to the bankruptcy of the financial services firm Lehman Brothers.

According to Lee, who has traveled many times in China since the mid-1980s, including teaching at Peking University in 2008, China was able to engineer this feat because its financial institutions were heavily controlled and regulated by the government.

While Washington and Western media have been relentless in filling the airwaves with scathing accusations of China being a currency manipulator, Lee says that if she were to advise Chinese leaders, she would advise against buckling under such pressure.

She believes that people such as the economist Paul Krugman and the former treasury secretary and former CEO of Goldman Sachs Henry Paulson, who push for drastic renminbi appreciation, represent special interests. Given the fact that many top economists do not want to reveal their sources of funding, Lee says these economists are no better than politicians.

Lee argues that China's way of dealing with countries, including those in Africa, is often more civilized than the American way of relying on military resources.

In the epilogue she reminds readers that China still has a lot to learn from the US, which has made enormous contributions to the world. However, the list she proffers is meager and includes the concept of respecting uniqueness, the spirit of risk taking and brand awareness.

Lee says one of the reasons she wrote the book was that opinion pieces she offers for publication are often rejected. In that respect she is not alone, she says.

"The US media propaganda is so sophisticated, so nuanced. They are very good at blocking things that are substantial and showing only things that are ridiculous," she says.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|