Tale of two cities

Updated: 2012-06-08 09:29

By Hu Haiyan and Feng Zhiwei (China Daily)

|

||||||||

Changsha and Xuzhou are 1,000 km apart but close rivals

For Richard Lavin, president of Caterpillar, the world's largest construction equipment maker, both Changsha and Xuzhou represent the rapid expansion of China's machinery industry.

"The two places are developing quite fast in the construction machinery industry," said Lavin at the China Beijing International Fair for Trade in Services in late May.

He said the development of the two cities as hubs of the construction machinery industry benefit from China's urbanization process, which is going to create a need for infrastructure in the long term.

"The demand for construction equipment continues to make the Chinese market attractive. Caterpillar is looking for more opportunities to invest in China to tap this promising market further, including to invest in these two places," Lavin said.

In March, Caterpillar announced a $100 million expansion plan for the company's facility in Xuzhou, in East China's Jiangsu province. It is expected that Caterpillar Xuzhou Ltd will increase hydraulic excavator production by 80 percent in 2016.

According to the China Construction Machinery Association, the cities' construction machinery products account for almost a third sold in the nation.

Changsha, capital of Central China's Hunan province, is home to 30 major construction equipment manufacturers. Among them, Sany, Zoomlion and Sunward have become the market leaders in China.

According to International Construction's Yellow Table report this year, ranking the world's 50 largest construction equipment manufacturers, Sany, China's largest construction equipment group, climbed to sixth place in sales globally. Zoomlion ranked seventh.

Nearly 1,100 kilometers away, Xuzhou has Xuzhou Construction Machinery Group (XCMG), which ranked 11th on the list.

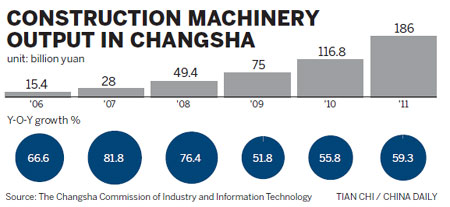

Analysts say that although Changsha and Xuzhou see construction machinery as their pillar industry, accounting for more than 30 percent of each one's GDP, the cities have faced different situations in the development of that sector.

"Changsha's construction machinery industry began its rapid development five years later than Xuzhou. In contrast to the soaring development of local whole-machine manufacturers, the development of Changsha's component suppliers has fallen behind, which creates a huge obstacle to the development of the industry generally," says Liu Rong, an analyst with China Merchants Securities.

"For instance, local giants such as Zoomlion and Sany have to adjust their production plans frequently because the international component suppliers cannot deliver parts and components punctually, and sometimes, they have to deliver key components and critical materials by air to produce machines on schedule and ship to customers on time, which sharply increases the production costs," says Liu.

Zhao Yuesi, director of the Changsha Commission of Industry and Information Technology, says that local government has been aware of this challenge and has taken measures to assist.

Zhang Jianfei, mayor of Changsha, says Changsha will build a component supply industry zone by 2015.

"We will improve the local component supply levels to whole-machine manufacturers through invitations to invest, technology introduction, independent research and development and self-development. It is expected that by 2015, the total value of the component industry in Changsha will hit 100 billion yuan ($15.7 billion, 12.6 billion euros," Zhang says.

Wang Min, the president of XCMG, says the lack of key component technologies such as hydraulic components, has become a development bottleneck for China's construction equipment industry.

"The foreign producers have gained huge profit margins and bargaining power because they have the technology for producing key components. To win in the increasingly fierce competition, both Xuzhou and Changsha, and China's construction machinery industry as a whole, should invest more in developing this technology," Xu says.

He says XCMG invests 5 percent of its sales annually in R&D.

Zhang Fan, an analyst with Citic Securities, says the big construction machinery makers in the two cities are strong in innovation without having to rely on foreign partners.

"But because Changsha has more big companies in the construction machinery industry, it enjoys bigger potential in R&D than Xuzhou. What's more, it is the capital of Hunan province, and can enjoy more favorable policies than Xuzhou does from its provincial government," Lu says.

According to their respective governments' 12th Five-Year Plan (2011-15), Changsha aims to become the largest R&D and manufacturing base for construction equipment in the world, and to realize total sales of 300 billion yuan by 2015. Interestingly, Xuzhou set the same sales target.

Zhao, of Changsha's industry and information technology commission, says that for the Chinese construction equipment industry, the biggest challenge comes from foreign competitors, and both Changsha and Xuzhou should learn from each other and cooperate to win a greater share of the market.

(China Daily 06/08/2012 page12)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|