Change of direction

Updated: 2012-06-22 15:45

By Yan Yiqi (China Daily)

|

||||||||

|

Li Min / China Daily |

|

From left: Dirk Moens, secretary-general of the EU Chamber of Commerce in China; and Cai Fang, director of the Institute of Population and Labor Economics under the Chinese Academy of Social Sciences. Photos by Liu Zhe / China Daily (Left) and Provided to China Daily |

Services sector to propel the new wave of foreign direct investment in China

It was billed as one of the biggest foreign investment deals in China in recent times. But little did those who had gathered in Xi'an, the capital of Shaanxi province, on a bright and sunny day in April know the real impact of the $7-billion (5.5 billion euros) Samsung Electronics deal vis-a-vis FDI in China (see page 12-13).

|

Related readings: |

Though the investment amount and the industries involved in the two deals are totally different, they had one common thread - that FDI in China is ticking and contrary to expectations growing, rather than falling, albeit in a different direction.

For some time now there have been apprehensions in various industry forums and among experts that China is slowly losing its sheen as an FDI destination for low-cost manufacturing. Most of these apprehensions were triggered by the slowdown in the Chinese manufacturing sector and other ancillary factors like rising labor and raw material costs.

But as experts love to say, there is always something more to it than meets the eye. FDI in China has not slowed but rather taken a different path, one that could put the nation at the forefront of high-tech investments by foreign companies.

More importantly, there has also been a sea change in the direction of FDI flows. With low-cost manufacturing losing its edge, FDI is now moving away from the prosperous coastal and eastern regions of China to the lesser-developed inland and western regions.

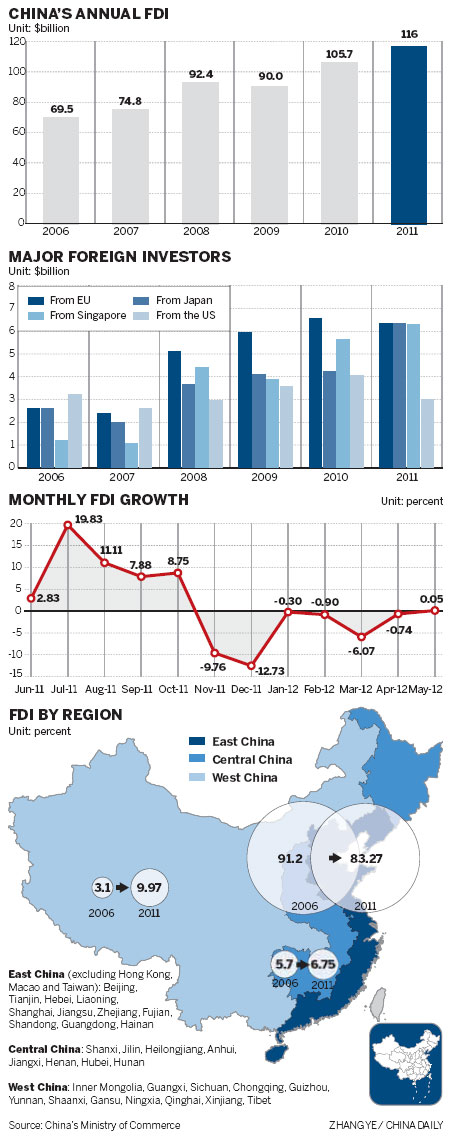

Foreign direct investment rose by 0.05 percent year-on-year in May to $9.2 billion (7.3 billion euros), the first increase in over six months.

What makes this small growth so remarkable is that it comes at a time when most of the other economic indicators and the global economy have remained sluggish.

During the first five months of the year, the number of new foreign companies setting up units in China fell to 9,261, a 12.16 percent fall from the same period in 2011. The total direct foreign investment brought in by these companies during the period dipped by 1.1 percent to $47.1 billion.

Investment from the European Union during the first five months dropped 5.06 percent from a year earlier to $2.8 billion,

according to information provided by the Commerce Ministry.

Shen Danyang, the commerce ministry spokesman, however, said that the lower numbers in the first few months of the year are not a cause for concern. He expressed confidence that the situation will change when the global economy and Europe come out of their economic crises.

Part of the reason why FDI is such a hot topic in China is because of the close links it has with economic growth. Foreign companies have created more than 30 million jobs in China so far and account for more than 35 percent of the total industrial output value. So in real terms, a slowdown in foreign investment will have a spillover effect on overall economic growth, experts say.

FDI trends, in the past, were often dictated by the low-cost, bulk manufacturing services provided by Chinese companies for foreign enterprises. But from 2008, the situation has been bleak as many orders were cancelled in the aftermath of the global financial crisis.

With exports languishing, the government had no choice but to open up the vast and untapped domestic market for FDI. At the same time, there was also the lateral thought that rather than focus on low-cost manufacturing FDI, it would be better to concentrate on high-tech FDI that would help industries move up the value chain and stay competitive.

"FDI in China has undergone a process of restructuring. It has shifted from traditional manufacturing to industries with higher technology. We are no longer blindly absorbing all the foreign investment that comes to us, but more focused on those that add real value. Therefore, the current FDI situation is not necessarily a bad thing," says Zhang Xiaoji, a researcher with the Foreign Economic Relations Department under the Development Research Center of the State Council.

New strides

US footwear major Nike's journey perhaps best sums up the changing FDI perceptions in China.

In 2001, the Chinese factories of Nike accounted for 40 percent of the company's global sports shoe output, compared with just 13 percent for the units in Vietnam. By 2005, the output had moved to a more balanced 36 percent in China versus 26 percent in Vietnam. But in 2009, it was even stakes with both China and Vietnam accounting for 36 percent each. In 2010, Vietnam took the lead with a 37 percent share, while the Chinese stake fell to 34 percent.

Although Nike has not officially indicated any reasons for this, industry experts admit that China is no longer the top low-cost manufacturing destination for foreign companies.

"For labor-intensive companies like Nike, profit margins depend largely on the lower labor costs. When the companies find that one particular destination has lost its cheap labor advantage, it is obvious that they will look for better options elsewhere. This is what Nike has also done," says Nie Pingxiang, a researcher with the Chinese Academy of International Trade and Economic Cooperation, affiliated to the Ministry of Commerce.

Nike is not the only foreign enterprise that is considering other manufacturing locations due to the higher labor costs, experts say.

"Eighty-nine percent of the respondents in our survey believe that China is losing its competitiveness because of rising costs, while 82 percent feel that rising labor costs is having a negative impact on their operations," Ted Dean, chairman of the American Chamber of Commerce in China (AmCham China), said during the release of the 2012 American Business in China White Paper.

The situation is the same with most European companies.

Dirk Moens, secretary-general of the European Union Chamber of Commerce in China, says that overcapacity in some industries, especially consumer goods, has contributed to the FDI shift.

"In our annual survey of the 557 European enterprises in China, nearly 24 percent of the consumer goods companies felt that they needed to move investment outside China. It was the highest percentage, among all major sectors," Moens says.

According to Moens, one of the main reasons for companies to consider moving investment outside China is the lower labor costs in other Asia-Pacific countries like Vietnam.

"The situation is especially beneficial for those companies whose products are produced in China, but destined for export markets," he says.

Though there have been no big pullouts till date, the consequences of a "natural selection" are inevitable, experts say.

"Even the Chinese companies are looking at ways to reduce labor costs. It is only natural that they will explore all possibilities, including new manufacturing locations," Moens says.

Westward Ho!

Impacts of such moves have already been felt in the coastal areas of China as high labor costs are driving both Chinese and foreign companies to alternate locations in the western and central regions.

"Industries of lower added-value will first shift from the coastal regions to the central and western areas. But eventually they will relocate to other Southeast Asian countries where labor and land costs are much lower," Zhang says.

Cai Fang, director of the Institute of Population and Labor Economics under the Chinese Academy of Social Sciences, points out that China's labor shortage, which has led to higher labor costs, will continue to worsen.

"The existing supply of workers in the rural areas may not be enough to meet the demands of the factories by 2015," Cai says.

According to figures from the National Bureau of Statistics, the average monthly salary of rural workers in China reached 2,049 yuan ($321.8, 257.5 euros) in 2011, up 21.2 percent from a year earlier. In 2006, the same figure was just 1,226 yuan.

While low-end foreign manufacturers are moving to other locations to offset high labor costs, many high-end companies are looking to go back to their home turf.

Home advantage

Consultancy firm Boston Consulting Group reported on March 22 that many American companies might shift manufacturing back to the US. The consultancy says that the manufacturing in sectors like appliances and electrical equipment, furniture, plastic and rubber products and fabricated metal products, could shift back to the US before the end of the decade, adding $20 billion to $55 billion in output annually to the US economy.

"The US manufacturing sector has become a lot more competitive in the past decade. Many companies are now looking at achieving overall cost savings and hence tend to weigh the final marketing costs of 'Made in China' and 'Made in US' products," says Harold L. Sirkin, senior partner of BCG and co-author of the report. When factors like higher US productivity, logistics, and the many indirect risks and costs of sourcing products in China are taken into account, Sirkin says, more companies will find it makes good economic sense to make these products in the US as they are largely for consumption within North America.

The BCG report cited some US companies, which have already moved their factories back to the US.

ET Water Systems, which used to make irrigation control systems in Dalian, in Northeast China's Liaoning province, since 2002, has relocated its production and assembly facilities to San Jose, California. The US company says that it is faster and cheaper to manufacture in San Jose, and also helps in improving the overall quality and accelerating innovation.

High-end cookware manufacturer All-Clad Metalcrafters is moving its lid production back to the US from China to be closer to both customers and its main factory and to reduce capital costs.

According to the report, the US economy has added more than 300,000 manufacturing jobs since the beginning of 2010, thereby showing a growth for the first time since the late 1990s.

"Most of the companies are in the high-end manufacturing sector and their moves have been necessitated due to the lack of talent and suitable equipment in Southeast Asian nations. There is also the fact that most of the finished products were in any case destined for the developed markets outside China," Zhang says.

Moving up

But Shen at the Commerce Ministry says that while this is not a welcome trend, the shift is yet to make any significant dent in the overall FDI levels.

He says that while traditional manufacturing is losing steam, newer sectors like the high-tech and professional services industries in China are fast catching the fancy of foreign investors.

"The government should not be too concerned about the FDI situation. It cannot last that long," says Gerard Worms, chairman of the International Chamber of Commerce, adding that many of his members are looking to boost investment in China.

"I cannot disclose their names, but China is still an attractive FDI proposition due to the huge consumption market it has," he says.

German luxury carmaker BMW plans to triple vehicle output in China over the next few years to 40,000 vehicles.

The company, along with its Chinese partner Brilliance China Automotive Holdings Ltd, will jointly invest another 500 million euros ($623 million) to fund the expansion, apart from the 1 billion euros it has spent so far since 2009.

Samsung is investing $7-billion to set up a memory chip plant in Xi'an that will start production by late next year.

"Many famous international IT companies have already established production bases in China. We believe that our production base in Xi'an will be of great strategic importance to our company and an important asset in gauging market and consumer trends," says Luke Cho, spokesman for Samsung China.

The Xi'an deal is the second biggest investment made by Samsung outside of South Korea for production facilities, after a 1996 deal in Austin, Texas.

European conundrum

Though Europe is reeling from an unprecedented sovereign debt crisis, it has not sapped the enthusiasm of European firms to invest China.

of Commerce survey, 77 percent of surveyed industrial goods/services companies and 72 percent of professional services companies still consider China among the top three destinations for new FDI.

"We feel that there is immense development potential for the professional services industry in China as the markets are slowly maturing. That is why many European companies are more than willing to invest in the services sector," Moens says.

TUI China, affiliated to Europe's largest travel agency TUI AG, is planning to make China its most important overseas market from this year onwards.

TUI is the only European travel agency that has a license to operate outbound travel programs for Chinese tourists. The company is pinning its hope on a surge in outbound tourists from China to shore up revenues. It has also nearly doubled its employees in China.

"There is big potential in China's outbound travel market. Compared to the Western travel market, the Chinese market is still in its early days. Outbound travel programs will be our top priority, and eventually, we want to make it the single most or the most profitable sector for our company," says Marcel Schneider, CEO of TUI China.

Moens says that professional service industries like tourism are proving to be a major draw with European investors.

"If the tourism thresholds are lifted in China, I believe it will open the doors for a flood of investments from Europe, the US and other regions," he says.

Service power

Nie from the Chinese Academy of International Trade, feels that the service industries would be the new growth engine for foreign investment in China.

According to statistics provided by the Commerce Ministry, service industries accounted for 47.62 percent of China's total FDI in 2011, surpassing manufacturing's 44.91 percent.

"China is gradually lifting its access barriers for foreign companies in the services industries, which indicate that these industries will now account for larger chunks of foreign investment," she says.

In the latest revised version of Foreign Investment Catalogue, released by the Ministry of Commerce and the National Development and Reform Commission last year, household services, intellectual property rights services and venture capital companies have moved from "limited investment" list to "welcome to invest" list. Domestic express services are no longer in the prohibited list.

"China is opening up more sectors for foreign investment," Nie says.

New locations

With FDI moving into more sectors, it was only a matter of time before the flow was directed toward newer destinations.

The prosperous Eastern and coastal regions of China are no longer the prime FDI destinations in China. The inner and western regions are the major beneficiaries of the service-led FDI push as they capitalize on inherent advantages like better incentives and cheaper labor, land.

In 2011, eastern China received foreign investment of $96.6 billion, up 7.51 percent year-on-year, while the growth rate in central and western regions were 14.26 percent and 28.24 percent respectively.

"Labor costs in the western regions are lower than the coastal areas. Infrastructure is also growing steadily, while abundant resources have ensured steady market expansion. These are the prerequisites that foreign companies look for when taking FDI decisions," says Wang Zhile, director of the research center of transnational corporations at the Chinese Academy of International Trade and Economic Cooperation.

"In addition to new investments, 52 percent of the European companies said they are planning to expand to other Chinese provinces in the coming years. These expansion plans suggest that the Chinese government's endeavors to encourage investment in the western regions of China are paying off," says Moens, adding that these companies are also expanding across China as a direct consequence of rising costs in coastal regions.

Sichuan province, Chongqing municipality, Shaanxi province and the Xinjiang Uygur autonomous region are the new hot destinations for foreign investment.

During the first quarter (??or four months?) of this year, under the circumstances that China's total FDI has been dropping for six consecutive months, Sichuan's FDI reached $3.2 billion, up 28.9 percent from a year earlier. The growth rate was 26.7 percent for the central provinces of Shanxi, Henan, Jiangxi, Anhui, Hunan and Hubei.

Volkswagen, which has teamed up with Chinese automaker SAIC Motor Co for the Xinjiang venture, expects the new investment to help the company access markets outside the Yangtze River Delta and further expand its business in western China.

"The central and western provinces and cities are also equipped with advanced facilities and skilled workers to attract foreign investment," Zhang says.

Chongqing, for instance, is building the world's largest laptop-manufacturing base, and has already attracted the attention of leading laptop makers like HP, Acer and ASUS.

Cho from Samsung says the company chose Xi'an as its investment destination because of its advanced facilities in producing semiconductors, skilled workers and Xi'an's abundant IT talent.

Yet another benefit for foreign investors under the government's go-west policy is the host of tax incentives like the 15 percent rebate for companies.

"The story of western China is indeed appealing to foreign investors," says Andy Serwer, managing director of Fortune magazine.

Asian cheer

Though there has been a lull in FDI from the US and Europe, it has been the other way around in the case of investors from other Asian economies like South Korea, Singapore, Malaysia and Japan.

In 2011, foreign direct investment from Japan reached $6.35 billion, up 49.8 percent year-on-year, while investments from Singapore reached $6.33 billion, a year-on-year growth rate of 11.8 percent.

A recent report by the Japan Bank for International Cooperation shows that China and India are still the top two destinations for Japanese companies.

"Ten years ago, Japanese companies considered China as the biggest production base for exports. In recent years, they have come to regard China as an enchanted market with great potential. Today, an increasing number of them feel that China is the most essential market for their victory in overseas markets," said Takatoshi Ito, professor of economics at the University of Tokyo, during a keynote address to commemorate 500 Japanese companies setting up bases in Suzhou, Jiangsu province.

"China's era of cheap labor has gone, and its economy is now moving from labor-intensive to capital and technology-intensive. This implies the nation's great potential," he says.

According to a report released by Japanese consumer electronics company Sharp, China accounted for 37.9 percent of its overseas sales revenue last year. This year the company expects China to account for nearly 50 percent of the overall sales.

"The appreciation of yen, labor protection laws and energy shortage in Japan are all suppressing the development of Japanese companies in their own country, and China is like a life saver for them," Nie says.

The recession in Western economies and the steady growth of the Chinese economy has also spurred Asian economies to boost their investments in China.

"They (Asian economies) feel it is insecure to invest in Western countries as no one is sure when the crisis will blow over. China, on the other hand, offers a huge market with a relatively stable economic environment," Zhang says.

A recent report by the United Overseas Bank of Singapore has indicated that China is the top priority for middle-sized Singaporean companies that are planning expansion.

Singapore has already partnered with China to set up a high-tech innovation park in Sichuan province with an investment of 20 billion yuan over the next eight years.

Lawrance Wong, Singapore's minister of state for defense and education, who co-chaired the trade and investment committee, says Singapore will contribute to the building of the park by contributing its expertise in modern services industry, lifestyle and advanced manufacturing.

"Another way where our companies will benefit is by partnering with Sichuan companies for joint opportunities in other markets," he says.

Many experts, however, feel that more efforts are needed by China to stay in the FDI limelight.

"It is too early to predict whether China's FDI will bounce back in the subsequent month. What we are really worried about is that a stalling regulatory environment in China may prompt many European companies to consider other FDI destinations," says Moens.

Dean from AmCham China also expresses similar sentiments. "To position itself for the coming decades of growth, we believe that China should open up market access in many industries that are still restricted to foreign investors. This will help China's transition to a market economy and also promote greater consistency and transparency in government policies across the nation," he says.

yanyiqi@chinadaily.com.cn

(China Daily 06/22/2012 page1)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|