Nothing serious but...

Updated: 2012-07-20 08:46

By Andrew Moody (China Daily)

|

||||||||

Global markets relieved as fears of low growth in China prove unfounded but economists say more reforms needed

Many around the world have been nervously taking the temperature of the Chinese economy in recent days.

The world's second-largest economy is acknowledged as one of the main drivers of global economic activity.

| |||

These were the second interest rate cuts in a month and led many to believe second quarter GDP growth to be announced on July 13 was to undershoot the target forecast.

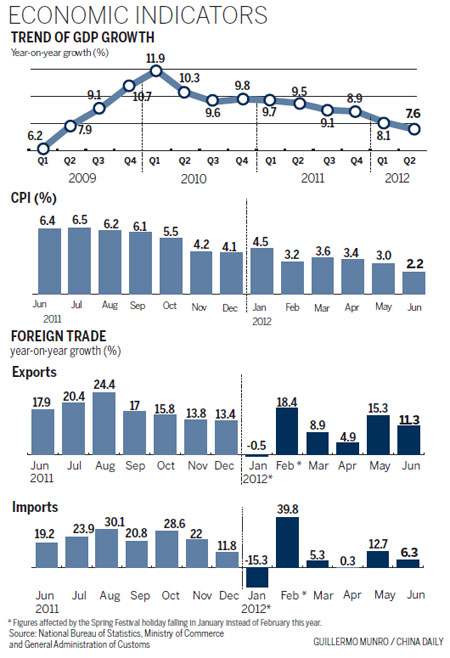

Instead the actual figure of 7.6 percent was in line with earlier expectations but still the lowest since early 2009 in the immediate aftermath of the global financial crisis. It was also well down on the 2011 rate of 9.2 percent.

After the latest economic data was revealed, Chinese Premier Wen Jiabao said on an inspection tour to Sichuan province in Southwest China that the economic recovery was not yet stable.

This was before the IMF, which is normally bullish about China, said a hard landing for the economy was now possible, downgrading its growth forecast for this year by 0.2 percentage points to 8 percent and next year by 0.3 percentage points to 8.5 percent.

It was also revealed on July 17 that foreign direct investment coming into China from Europe, North America and elsewhere was also falling, down 6.9 percent in June from a year earlier.

Before any assessment can be made about the economy, it has to be understood slowing down the economy has been partly a deliberate act of government policy.

The 4 trillion yuan ($628 billion, 511 billion euros) economic stimulus package in the wake of the 2008 financial crisis was a shot of adrenaline that created a series of asset bubbles, not least in the real estate market.

With inflation, as measured by the CPI index, hitting a three-year peak of 6.5 percent in July last year, there have been a series of tightening measures.

The big question for everyone is whether the patient has responded to the harsh medicine well and will soon bounce back to good health.

Nomura, the Japanese financial services group, is one which cast doubt on that, predicting in a report earlier this month that China has a one-in-three chance of a hard landing in 2014.

Zhiwei Zhang, Nomura's chief economist for China and based in Hong Kong, says such a fate is no longer an outside bet.

"It is no longer a tail risk and it is one we have to look out for over the next three to five years.

"The risk of a hard landing has been increasing because the so-called stimulus package created property bubbles and a number of problems in the banking sector. It is still not our baseline forecast, however, and we expect the economy to be growing at between 7 and 8 percent over the next few years."

That China does achieve some form of soft landing is vital to the struggling economies of Europe and still nascent recovery in the United States.

According to IMF figures, China contributes some 31 percent to global GDP growth, up from just 8 percent in the 1980s.

Tim Condon, head of research, Asia at ING Financial Markets in Singapore, says China's economic significance was reflected in the global stock markets' response to the second-quarter GDP announcement.

"There was a relief rally around the world. They had it in their minds it was going to be a lot lower and the fact that it wasn't was a source of relief," he says.

"China is viewed as a major driver of commodity prices and consumption generally so there is always a great scrutinizing of the numbers."

Joy Yang, chief economist for Greater China Research, Mirae Asset Securities, based in Hong Kong, says policy easing should produce some form of rebound in the second half of the year.

"We were viewed as one of the most bearish in the market at the beginning of the year. We have always expected a policy easing in the middle of the year and for growth to be around 8 percent. We have now become one of the more bullish ones," she says.

Yang insists the real risks to the economy lie in the medium term and whether the government can deliver reforms such as a restructuring of State-owned enterprises, better welfare and healthcare provision so as to boost consumption and the freeing up of the financial sector.

"Our optimistic view only refers to the next six to 12-month investment horizon. Over the medium term, structural reforms are key to sustaining investors' confidence and growth."

Some observers believe there is more scope to be optimistic in the short term because inflation has responded well to the series of tightening measures the government has introduced.

The CPI rose just 2.2 percent in June, the lowest monthly rise in 29 months.

This, they argue, gives policymakers room for more policy loosening such as further interest rate cuts and relaxation in the reserve requirement ratio, allowing banks to extend more credit.

Junwei Sun, China economist at HSBC in Beijing, says the inflation figures give policymakers plenty of freedom to stimulate the economy without risking price rises.

"Inflation is no longer a policy concern after the June figure and it is almost assured that it will come in lower over the coming months. This creates further room for policy easing," she says.

"I think it is only a matter of time before all these measures work their way through and I think we have seen some early signs already that they have."

Since the release of the GDP data, there has been a debate as to how accurately the official figure reflects the underlying story of the economy.

Capital Economics, the London-based macroeconomic research consultancy, produces its own China growth figure based on various proxy data.

It believes second-quarter growth was more likely 7.0 percent, rather than 7.6 percent. One of the proxy indicators it uses is China's electricity production, which showed zero year-on-year growth in June.

Mark Williams, chief economist, Asia, Capital Economics, based in London, says despite the recent divergence the company's estimate of growth and the official figures have a strong correlation.

"We have been calculating our in-house proxy for the past three years and most times we have found the official numbers and ours match up very closely. It was striking, however, that in the first and second quarters of this year a gap opened up. You can't directly read across from electricity output but based on other measures, we believe the official figures are too high," he says.

Williams is forecasting a bounce back in the second half and a realignment of its own data and that of the government's.

"There is a good chance the economy will pick up over the next two quarters and some of that relative underperformance of our measure compared to the official numbers will diminish."

In Beijing, Wang Jun, deputy director-general of the China Center for International Economic Exchanges, a leading Chinese think tank, says evidence that the official data reflects the true position is that unemployment is not significantly rising.

"Things like the decline of electricity consumption reflects that the economy has restructured a lot since the financial crisis in 2008. Manufacturing, a big electricity user, is not as significant as it was, and there has been a move toward more service-based industries that use less energy," he says.

"A further factor is that industry has adopted more energy efficiency measures. I find electricity an odd way of looking at GDP."

One of the big headaches for the government is the property market. A key reason for the tightening measures was not just the need to control inflation but also to prevent a property asset bubble. The government has introduced a number of curbs to prevent property speculation.

Michael Klibaner, head of China research at Jones Lang Lasalle, based in Shanghai, says it is important not to underestimate the importance of real estate to the overall economy.

"The macro issues are that the housing sector is such a huge part of the economy. It is estimated to be about 10 percent of GDP on an apples-to-apples basis but that does not include the fact that it consumes 50 percent of the country's steel and cement and leads to demand for white goods and furniture," he says.

Klibaner believes, however, there is little risk of a property asset bubble if restrictions are relaxed because developers have a huge backlog of properties not completed, waiting for demand to pick up.

"There is a huge inventory overhang that is still coming through the pipeline and we think that even if transaction volumes pick up it is going to be quite difficult for prices to go up," he says.

For many the hard versus soft landing debate is becoming quite muddled with different timescales being deployed by different economists.

Williams at Capital Economics says the terminology is becoming increasingly "unhelpful".

"It seems to mean different things to different people. For example, if sustainable growth is 8 percent then 7 percent is hardly a disaster, although it seems to be portrayed that way," he says.

"Our forecast is for 8 percent next year and for 7.5 percent in 2014. I wouldn't characterize that as a hard landing. It is just an acceptance of the reality that China's days of growth of 9 and 10 percent are behind it."

Yang at Mirae Asset Securities believes a hard landing can be accurately assessed and that would be if the rate of growth fell by 1.5 percentage points in any one year.

Last year China's GDP grew 9.2 percent so it would have to grow more than 7.7 percent to avoid the dreaded bumpy bounce.

"We believe such a fall would probably trigger a hard-landing scenario. It does seem odd to define it as such when some countries are currently growing negatively," she says.

Most economists believe the real uncertainties for the Chinese economy are not in the short but in the medium term.

Klibaner at Jones Lang Lasalle says it depends how effective the government is at implementing reforms throughout and making the transition to a consumption-led economy.

"I think the risks to the economy are not in the near future when the government has the power to spend its way out of trouble. They are in the five to seven year horizon and dependent on what extent the reform agenda is embraced."

Condon at ING believes China's policymakers will successfully navigate many of the hazards ahead of them.

"They have been masters at avoiding problems for a very long time. I don't think many countries - and probably none - have done as well as China in terms of sustaining a very rapid growth for such a long time.

"I think the main risk would be another global financial crisis rather than something China inflicts on itself."

Wang at the China Center for International Economic Exchanges admits that risk could be a deepening of the eurozone crisis.

"If the euro collapsed, it would be just like the Titanic; no one could survive."

He, however, believes the economy itself is far from the sick patient some are currently making it out to be.

"Of course we won't see the growth rates of 20 to 30 years but I think 6.5 percent and maybe more will be achievable toward the end of the decade.

"There is an adjustment to be made to a more consumption-led economy but there is so much urbanization and industrialization to take place. Even by 2050 when per capita income might be of a similar level to that of the United States, growth could be at 5 percent. That might be a high figure for the West but it could still be our normal."

Lu Chang contributed to this story.

andrewmoody@chinadaily.com.cn

(China Daily 07/20/2012 page1)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|