Source of Competitive advantage

Updated: 2012-07-27 08:42

By Hu Haiyan (China Daily)

|

||||||||

Strong government support helps outsourcing industry ride the high-tech growth wave in China

Jibin Arjunan paces the rows of cubicles in the spacious software outsourcing center in Shanghai as his team of employees gets ready to address the daily concerns and problems of several customers spread across Europe and the US.

Few of the employees at the center are Indians or Westerners, though. Most of them are young Chinese IT professionals, or in some cases fresh college graduates, who are harnessing their software development capabilities for global solutions at the Shanghai center of Indian IT company Wipro Technologies.

Arjunan, head of Wipro Technologies in China, says that the Shanghai center is now a key link in the company's global operations and a key contributor to the overall revenues. "It is an integral part of the complex global supply chain for global economic development," he says.

Wipro is not the only Indian IT company to have set up outsourcing centers in China. Other big names like TCS, Infosys and HCL have development centers. Also present are big consulting firms like Accenture and conglomerates like General Electric, apart from a host of other Western manufacturing companies.

|

Related readings: |

Outsourcing as an industry has often got more brickbats than bouquets in the past decade. But over the years it has evolved into an over $13 trillion (10.7 trillion euros) global practice and an indispensable element in the success of big global firms like Apple Inc and Cisco Systems Inc.

In China, the relatively young industry has notched up impressive numbers. Industry revenues are expected to top $50.5 billion by 2014 from $13.8 billion in 2009, says a recent report published by KPMG. Added to this is the additional advantage of creating millions of new jobs across a wide spectrum of sectors, experts say.

Though the $13 trillion industry is facing increasing global headwinds due to financial maelstroms and a clamor to move jobs back home, it looks assured of a robust future in China. Much of that comes from the initial days when it was largely focused on the domestic market and on companies from countries like Japan and South Korea.

There are several other factors that set China apart from the competition - like its willingness to branch out into newer markets, and the ability to cash in on the strong infrastructure, talent pool and diverse language skills. But the key differentiator in the long run will be China's ability to provide outsourcing services for intellectual processes.

"The outsourcing market in China began to take shape in 2000, and moved on to a fast growth phase five years ago," says Ning Wright, the partner in charge of shared services and outsourcing advisory at global consultancy KPMG.

Samantha Zhu, vice-president of the business process outsourcing department at global consultancy Accenture's China operations, is also bullish on outsourcing in China.

"China is like a fast-growing teenager, while India is more like an adult. Although the teenager is not as mature as the adult, they have better development potential and growth prospects," Zhu says.

Positive numbers

According to the China Service Outsourcing Development Report 2012 released by the China Outsourcing Institute under the Ministry of Commerce in May, global offshore outsourcing revenues were about $110 billion last year, with India still in the lead. By 2015, global outsourcing revenues are slated to reach $210 billion.

The same report indicates that China's outsourcing revenue in 2011 was about $32.4 billion, a year-on-year growth of 63.6 percent, with $23.8 billion coming from offshore business.

The industry, which has recorded growth rates in excess of 60 percent for three consecutive years, is likely to be a $90-billion industry by 2015 and account for more than 50 percent of the global market, the report says.

"China's offshore outsourcing market will reach $100 billion by 2015, with a year-on-year increase of 40 to 50 percent in the next five years," says Wang Gang, an analyst at CCID Consulting Co Ltd, a Beijing-based IT industry consultancy.

A report on the outsourcing market in China published by KPMG in June this year says that China is a crucial part of the global services and pan-Asia strategies for many global companies. The same report says that outsourcing contracts carried out by Chinese companies currently account for 23 percent of the global total.

The real potential of China's outsourcing industry can be gauged from the latest data provided by the Ministry of Industry and Information Technology. According to its figures for the first five months of this year, the combined value of China's exported outsourcing services grew by 26.4 percent year-on-year to $2.94 billion.

Domestic power

"Many multinational companies are expanding their outsourcing from China not only because of the low costs, but also to gain more business from the fast-growing Chinese companies," says Mao Qiong, an analyst with the US-based IT research company International Data Corp.

The "China-to-China" market is expected to be the fastest growth segment for the industry as more State-owned enterprises and private companies have started to realize the advantages of outsourcing, says the KPMG report.

Fast-growing industries like banking, financial services and insurance, telecom and healthcare have spurred demand for outsourcing services, the report says.

Large telecom companies such as Huawei and ZTE have outsourced most of their software development needs and also set up call centers for customer solutions. In the healthcare sector many leading hospitals have outsourced their IT development requirements. Large banks like China Merchants Bank have also outsourced software development and card processing.

If there is one factor that all companies unanimously vouch for, it is the strong support accorded by the government to the outsourcing sector.

"We are amazed by government support for the industry," Arjunan from Wipro says.

In February 2009, China designated 21 cities as the trial ground for the outsourcing business, including Beijing and Shanghai. Each of these cities got annual grants of 5 million yuan ($783,000, 644,000 euros) between 2010 and 2012 from the central government to develop their outsourcing service platforms.

|

Left to right: Kenneth Poon, general manager of Capgemini BPO center in China; Sophia Wang, vice-president of marketing, growth and special initiatives at Genpact Asia. Photos Provided to China Daily |

Overseas players

With such a huge market in the offing and favorable development environment, there will be more windows of opportunity for Western companies and multinationals.

Big names such as Accenture and Capgemini have already been in China for several years and are busy adding more staff for their outsourcing operations.

"China is going to be an important emerging market for Indian outsourcing companies in the long run," Sangeeta Gupta, senior vice-president of the National Association of Software and Services Companies, an industry association in India, said at the recent China International Software and Information Service Fair held in Dalian, Liaoning province.

Other major Indian IT companies like Infosys and TCS already have presence in Chinese cities such as Shanghai and Beijing.

HCL Technologies, the fourth-largest ITO service provider in India in terms of outsourcing revenue, set up a unit in China in 2008. The company has a workforce of more than 90,000 employees spread across 31 countries. In China, it employs about 200, and "the number is expected to reach 2,000 by 2015", says Yu Zhongmin, regional head of HCL Technologies (Shanghai).

Yu says that despite the huge potential, there are several challenges for companies.

"For many Indian outsourcing service providers, performance in the US or Europe is what matters really for the overall business. However, it is not the same story in China's domestic outsourcing market.

"Rising labor costs and currency fluctuations are a drag on our profit margins in China," Yu says.

"The cost advantages are slowly eroding here, and the real competition now is about business model, talent and technology. Only those companies which can provide high-end services can stand out in the process of further consolidation of the market here," says Yu, who has been working in the outsourcing industry for more than 20 years.

He says HCL is considering developing new high-end services to catch up with the innovation boom in China, such as cloud-based services, as cloud computing is one of the key strategic investments for the Chinese government.

Genpact, a global business process and technology management company that was spun off from the industrial conglomerate General Electric, is stepping up its efforts to tap the fast-growing BPO service market in China.

Since its entrance to China in 2000, Genpact now has a workforce of about 5,000 in China. "Currently, the revenue from China's outsourcing market constitutes about 20 percent of our business, and it is expected that revenue from China's market will double by 2015," says Sophia Wang, vice-president of marketing, growth and special initiatives at Genpact Asia.

"We are considering opening some business delivery centers in less developed areas, for instance in the western part of China, not only for the sake of saving costs, but also to be in touch with the fast-growing market there," Wang says.

French IT services company Capgemini is also aggressively expanding its BPO services in China. Kenneth Poon, general manager of the Capgemini BPO center in China, says that China is a major market in the company's development plans.

Last year, Capgemini gained revenue of 9.69 billion euros, with 37.5 percent of it coming from its outsourcing sectors, including BPO and ITO. The revenue from China's BPO market constituted about 10 percent of the company's global BPO business in 2011, and it is expected to maintain the same proportion this year, Poon says.

"Although the proportion is the same as last year, Capgemini plans to realize revenue of 500 million euros from its global BPO services this year, compared with 400 million euros in 2011," Poon says.

Western edge

Western companies still have an upper hand when it comes to high-end outsourcing services despite the impressive strides made by Chinese companies, says Tang Tongmei, an analyst with US-based consulting company Gartner.

Zhong Mingbo, executive president and CEO of the outsourcing business group at Insigma, a Chinese IT services company, says the aggressive expansion of foreign players will lead to a healthy development of the market.

"Though we still lag foreign players in high-end outsourcing services, we are confident that the gap will narrow soon. More competition means more progress. China will lead the next round of development for the outsourcing industry with its innovation and skills, and also reshape the stereotypical image of the industry as a low value-added business," Zhong says.

Analysts say Chinese service providers are maturing in scale and fast reducing the gap with global players in terms of service offerings and performance.

"Large domestic service providers such as Neusoft are expanding from ITO, and low-end BPO to high-end BPO. Foreign companies are now facing stiff competition from the domestic players," Wright says.

|

Wang Gang, an analyst from CCID Consulting. Provided to China Daily |

ITO & BPO power

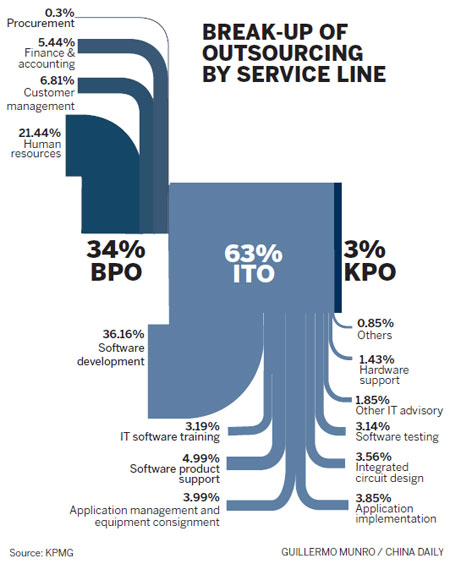

The term ITO refers to the outsourcing of computer or Internet-related work, such as programming, to other companies. But from an outsourcing perspective, it represents one of the fastest-growing sectors within the industry in China.

According to the China Service Outsourcing Development Report 2012, the combined value of the ITO market in China was about $19.78 billion in 2011, a year-on-year growth of 53 percent.

Wang from CCID Consulting feels that outsourcing services in China are now moving up the value chain, and creating an "innovation explosion".

"Outsourcing doesn't mean letting others do some low-end and repetitive work. China is rich in science and engineering talents, an integral asset for the ITO market. The expansion of China's outsourcing market is not just about cost, but more of innovation strengths," says Sam Zhong, group program manager of the strategic partnership group in the Microsoft Asia-Pacific Research and Development Group.

Business process outsourcing or BPO means the process by which an organization delegates part of or all of its support processes to an outside vendor, covering all centers, data entry of bills, prescriptions and traffic tickets at its lower spectrum to a higher end of managing human resources operations.

Common BPO services areas include finances and accounting, human resources and customer management.

According to the China Service Outsourcing Development Report 2012, the BPO market in China during 2011 was estimated at about $4.87 billion, up 22.1 percent year-on-year.

The BPO market is just less than one-third of China's outsourcing market, but it is growing at a fast pace and has the potential to outgrow ITO as businesses gain confidence in the operational excellence that China can deliver, says the KPMG report.

Problem areas

The commercial law environment is one of the major obstacles that may hamper the growth of the ITO sector, experts say.

"Unlike other major outsourcing service destinations, China still lags in the maturity of commercial laws and regulations, especially in areas like data privacy and intellectual property protection," Yu of HCL says.

But analysts say China is catching up fast with other outsourcing service markets in this aspect.

"This shortage is an unavoidable growth process for every market to experience. Some achievements have already been made as the government has taken up many measures to improve the situation, including amending laws and regulations," says Wang from CCID Consulting.

"There is, however, a serious dearth of talent capable in outsourcing skills like operations, sales and marketing," says Wang Yue, president of Dalian Hi-Think Computer Technology Corp.

But the shortage of talent is also a journey toward better development of the industry, Wang says.

"Every year nearly 600,000 engineering graduates enter the Chinese job market. Add to this also a growing number of Chinese students returning home after studying abroad. Talent shortage will soon be a thing of the past," he says.

"We will focus on developing talents through various training programs, including job-related training, soft skills training and six sigma programs."

Mindset is another major obstacle that often comes in the way of the development of the BPO sector.

"Because China's BPO market history is not long, it usually takes a long time for clients to decide on whether to outsource the business to China," Poon from Capgemini says.

He says the local outsourcing service vendors have concerns, not only from the point view of service quality, but also from data security.

"Even though our company is a famous service provider, and we have stringent codes to ensure data protection, some local outsourcing vendors still have some concerns," Poon says.

Despite that, Poon believes the outsourcing market will develop quickly in China.

"If other countries take 10 years for example, I am very confident that it will take only five years in China," Poon says.

huhaiyan@chinadaily.com.cn

(China Daily 07/27/2012 page1)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|