Private power

Updated: 2012-10-26 09:55

By Hu Haiyan (China Daily)

|

||||||||

Chinese entrepreneurs focus on innovation, reshape growth priorities to offset rough headwinds

It is that time of the year when there is high tension in the air, considering that businesses are finalizing their annual figures and discussing the way forward. Though trade undercurrents from Europe and the US have been frosty, policymakers in Beijing have more than enough reason to rejoice as the success of some private enterprises in overseas markets has managed to ward off some of the chill.

Though the recent tirades in the US and Europe against Chinese telecom equipment and solar panel makers are clear indications that the private sector is not immune to external threats, the determination of the companies to press ahead with their global plans indicates that private entrepreneurship in China is blossoming, thriving and moving on to newer markets and regions.

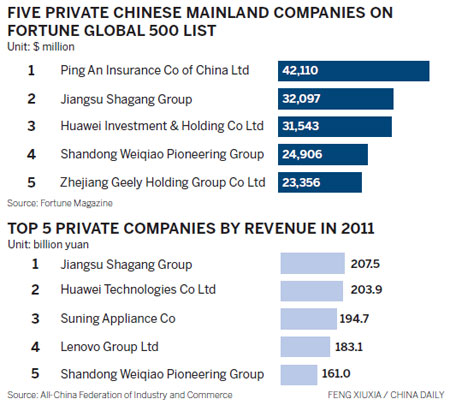

The robustness was more than evident when China zoomed past Japan in the latest Fortune Global 500 rankings to occupy the second slot with 73 companies on the list. Although the majority of Chinese companies on the list continued to be State-owned companies, private enterprises are slowly catching up. Five Chinese private companies are present in the rankings this year, compared with three in 2011.

Ping An Insurance Group Co of China Ltd was the highest ranked Chinese private enterprise on the list at 242nd, a considerable jump from its 2011 ranking of 328th. Huawei, the telecom gear maker, was ranked 351st while Jiangsu Shagang Group, the largest domestic private steelmaker by sales, came in at 346th.

|

Yang Wei, vice-president of Accenture Greater China. Provided to China Daily |

Textile company Shandong Weiqiao Pioneering Group at 440th and automaker Zhejiang Geely Holding Group at 475th were the debutants in this year's rankings.

"Although China's overall economic growth rate has been slowing, it is still an important contributor to global economic recovery despite sluggish international trade," says Yang Wei, vice-president for China operations at global consulting firm Accenture.

"If China's economy can realize its growth target of 7 percent and above in the consequent years, Chinese companies will easily overtake their US peers in the Fortune 500 rankings by 2025, while private companies will account for over one-third of the Chinese companies on the list," says Lu Jinyong, director of the China Research Center for Foreign Investment at the University of International Business and Economics in Beijing.

Hard facts

Private entrepreneurs are a relatively new breed in China and perhaps the ones who are most symbolic of the nation's current economic resurgence. Private companies began to be officially encouraged in China after the reform and opening-up and have since been slowly gaining in scale and reach.

According to the list of China's top 500 private enterprises in 2012, released by the All-China Federation of Industry and Commerce in August, the revenue of the top 500 private enterprises in China was about 9.3 trillion yuan ($1.5 trillion; 1.1 trillion euros) last year, a 33 percent year-on-year growth. Total assets amounted to 7.8 trillion yuan, 32 percent more compared with 2010.

Though these figures represent growth and robustness, amid a solid national economy, there are some pressure points that may prove troublesome for growth in the future.

Aside of the general prejudices against Chinese firms in the Western markets, private enterprises have also been suffering because of their relatively weak global management capabilities and lack of innovation.

Indeed, there is no doubt that many private companies have accelerated their overseas activities in the past few years, with a view to raise their profile in the international markets.

"Some private enterprises have successfully acquired leading global brands, such as Lenovo purchasing IBM's PC business and Geely acquiring Volvo's vehicle unit. These cases have demonstrated the strong desire of capable Chinese private companies to make global strides," Lu says.

|

||||

According to company officials, the AMC deal has helped boost the culture and travel business of Wanda Group.

Wang Jianlin, chairman of Wanda, in April mentioned that the group was expecting revenue from the culture and travel business to surpass 20 billion yuan this year. "We are expecting a revenue of more than 40 billion from the culture industry in the next five years and be ranked among the top 50 culture firms globally."

In Europe, eyebrows were raised when Sany, China's largest machinery manufacturer, acquired a 90 percent stake in German concreting machinery maker Putzmeister for 324 million euros in January.

Putzmeister had a 40 percent share of the global concrete machinery market in 2010 and nearly 90 percent of its sales came from overseas markets, according to Yengst Associates, an American market research group.

During the first six months of this year, 117 merger and acquisition deals worth about $30 billion were conducted by Chinese companies in overseas markets, according to information provided by the Ministry of Commerce.

Ouyang Xiaoming, deputy secretary-general of the All-China Federation of Industry and Commerce, says among the top 500 private Chinese companies, 150 have invested overseas, with a total investment volume of $12.35 billion, a 99.9 percent increase year-on-year.

According to the Internationalization of Chinese Enterprises Index 2012 released by China Entrepreneur magazine in the World Economic Forum held in Tianjin in September, this year has been a major milestone for Chinese businesses in the overseas markets due to the appreciation of the yuan and favorable government policies.

But going overseas has not always been easy for many Chinese companies.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|