Nigeria inflation rises, driven by non-food

Updated: 2012-05-16 16:22

(Agencies)

|

||||||||

|

|

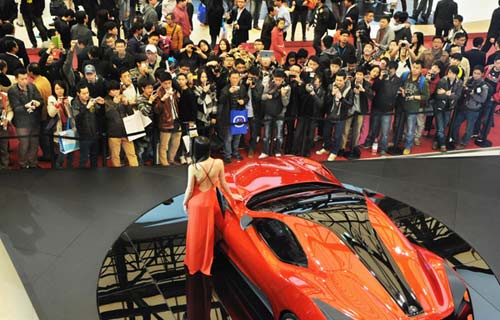

A girl holds a slate with alphabets and numbers along a path in the Koluama village in Nigeria's Bayelsa state May 15, 2012. [Photo/Agencies] |

LAGOS - Nigeria's inflation rate rose to 12.9 percent in April, year on year, driven largely by non-food items and a very price stable comparative month in April last year, data from the National Bureau of Statistics showed on Tuesday.

Nigeria - Africa's top energy producer and second biggest economy - is closely watched by emerging market investors and Africa-focused funds.

Though its economy is one of the fastest growing in the world and bond yields are attractive, poor fiscal management has had a tendency to build inflationary pressures.

The figure compared with a 12.1 percent increase in March, year on year.

Food inflation, the largest component of the index, fell slightly to 11.2 percent, compared with 11.8 percent in March.

The change in the overall index was largely because inflation in the month of April 2011 had been so subdued.

"The higher year-on-year change could be partly attributable to base effects as the index was relatively more stable in April of 2011 ... lower price levels in April 2011 will reflect higher year-on-year percentage changes in April of 2012," the statistics bureau said.

Inflation was worse in urban areas last month, registering a 13.4 percent rise, compared with 12.4 percent in rural areas.

Core inflation, stripping out volatile agricultural produce, rose by much more than the headline rate, by 14.7 percent year on year, the statistics bureau said.

Analysts expect the upward trend in inflation to peak later this year, before it tails off slightly.

"Inflation will probably peak at 14.4 percent y/y in Jul-Aug, which is close to CBN and market expectations," said Standard Bank's Samir Gadio, adding that a sell off in bonds, whose yields are very inflation sensitive, was unlikely.

"Inflation is set to drop in Q4 2012 and reach high single-digits in early 2013, based on our forecasts," he said.

The central bank has warned that inflationary pressures are too strong, hinting that it is likely to keep monetary policy tight this year, but nobody expects a rise in rates at the next meeting.

The bank held rates at 12 percent last month, and governor Lamido Sanusi noted a "resurgence of inflationary pressures", though he praised the government for efforts to introduce fiscal discipline into its 2012 budget.

"Given that inflation remains in the range projected by the CBN, we do not expect rates to be changed from 12 percent at the May MPC meeting," said Alan Cameron, a London based economist for Nigerian stockbroker CSL.

"The CBN has said that it expects inflation to peak at 14-15 percent in Q3 2012 ... inflation would need to move above this range in order for the CBN to reconsider its stance."

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|