Euro's big four propose growth package

Updated: 2012-06-23 09:14

(Xinhua)

|

||||||||

|

|

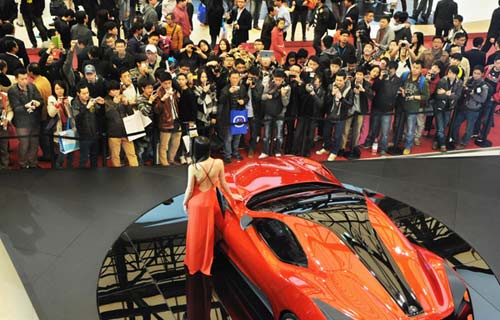

Spanish Prime Minister Mariano Rajoy, French President Francois Hollande, Italian Prime Minister Mario Monti and German Chancellor Angela Merkel attend a meeting at the Villa Madama in Rome June 22, 2012. [Photo/Agencies] |

ROME - As Italy sweltered in the summer heat, there were signs of warmer relations among leaders of the big four eurozone nations - Italy, Germany, France and Spain, as they met in Rome to consider the future of the euro and how to balance austerity with growth.

Dressed in a mint green suit, German Chancellor Angela Merkel looked cool and in control as she faced the media flanked by Italian Prime Minister Mario Monti, French President Francois Hollande and Spanish Prime Minister Mariano Rajoy.

The biggest surprise was the leaders' endorsement of a 130-billion-euro ($163.0 billion) package, or 1 percent of Europe's gross domestic product, to stimulate growth in Europe ahead of a crucial European Union summit in Brussels next week.

"Risk cannot be sustainable economically and politically if there are no conditions for growth," Monti told the media.

"We agree on the fact that what has been done so far is insufficient for economic growth, the stability of the eurozone and the possibility to offer European citizens a long-term vision of euro integration," he said.

"Growth and job creation should be the first objective to be brought about by national structural reforms to increase competitiveness and a new European agenda," he said.

Hollande endorsed the growth package, but he also spoke of the need for austerity in a concession to his colleagues.

Merkel backed the ambitious spending package and called for more action to stabilize the euro.

"We want it to be clear that we will do our best for the euro and are ready to fight for the euro so it can go back to be a stable currency," Merkel said.

Italian political pundits immediately welcomed the leaders' growth proposal but demanded more details about how the stimulus package would be funded.

"I think it is important from a political point of view," said Professor Miguel Maduro, head of the global governance program at the European University Institute in Florence.

"This is an important amount, equal to the entire budget of the European Union in a year," Maduro told Xinhua.

"It is relevant. But how will the contributions be made - from the member states or an increase in the budget of the European Union," he said.

Nicola Borri, an economics professor at Luiss University in Rome, described the stimulus package as an "interesting idea" but also expressed reservations about how it would be funded.

"There is no statement on how these funds will be raised," he told Xinhua.

"If they are to be raised with new eurobonds, the idea would be interesting, but there is also no statement about who will be the recipient or the use of these funds for current public expenditure or capital expenditure and new investment. There is a big difference," he said.

When asked by the media whether Germany would endorse an Italian proposal to use two rescue funds to buy Spanish and Italian debt, Merkel was reserved in her response on Friday.

"Every country wants to help another in trouble but responsibility and control go hand in hand," Merkel said. "For me and for taxpayers in France and Italy, who can guarantee that every thing is under control?"

"If I give funds directly to a Spanish or another bank, I cannot tell them how this bank should act. I am a German chancellor not a Spanish chancellor," she said.

Under the Monti proposal floated at the G20 summit in Mexico, both the European Financial Stability Facility (EFSF) and the European Stability Mechanism (ESM) which is yet to come into operation, would have the power to buy bonds but only after a request from the country in question.

Until now the European Central Bank has been active in purchasing the bonds of troubled eurozone countries and has bought more than 210 billion euros worth of debt since launching the program in 2010.

"The crisis in the euro means more Europe, not less Europe," Merkel said.

The bond yields of Spain and Italy remain close to levels considered unsustainable in the longer term, despite a slight improvement in recent days on hopes that European leaders will take concrete steps towards a fiscal union at next week's summit.

But in an encouraging sign, the spread between Italy's 10-year treasury bond and the German benchmark closed at 422 points with a yield of 5.77 percent while the spread between the Spanish 10-year bond and the German bond closed at 467.6 points at 6.25 percent.

While Merkel left Rome immediately after the talks to attend the football match between Germany and Greece in the Euro 2012 championships in Poland, Hollande and Rajoy continued their talks with Monti behind closed doors at Villa Madama.

With only a week ahead of the Brussels summit, the leaders still have a long way to go before they reach agreement on many issues. (1 euro = 1.25 US dollars)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|