Food exporter expects soy purchases to rebound

Updated: 2014-04-28 08:44

By

By MICHAEL BARRIS in New York

(China Daily USA)

|

||||||||

|

|

Offering Brazil's rattled soybean exporting industry a ray of hope, the CEO of agribusiness giant Bunge Ltd said poor soy crushing margins in China that have caused it to default on soy purchases are short term and should improve in two to three months.

"Margins in China are bad for everyone," but "it's a short-term problem", CEO Soren Schroder said in Brazil ahead of the inauguration of US-based Bunge's terminal in Barcarena, Para on Brazil's northern coast.

The CEO's comments come as China, by far Brazil's top buyer of soybeans, cancels soybean orders amid a depressed local market. The country's top buyer, Shandong Sunrise Group, last week said Chinese buyers may default on a further 1.2 million tons of soybeans worth about $900 million being shipped from the US and South America, to avoid incurring huge losses, Reuters reported.

On April 22, Brazilian soy crushing association Abiove said the nation would export 43 million tons of soybeans from this season's nearly harvested crop, down from its forecast of 44 million tons a month earlier due to weaker Chinese demand.

Schroder said the long-term trend is for China's soybean demand to increase, though he did not explain why he sees improvement for Chinese crushers in two or three months.

Chinese importers have canceled at least 500,000 tons of soybeans purchased from Brazil and the US in recent weeks, according to Asian market sources, as buyers struggled to get credit amid losses in processing beans.

Weaker soy demand from China puts one of Brazil's main sources of trade income at risk at a time the South American country's economy is slowing. Brazil, the world's top soybean exporter, sends the vast majority of soy shipments to China.

US soybean futures have dropped recently, pressured by talk of imports of soybeans or soymeal into the US and worries that top global buyer China could reject more purchases, traders said.

Bunge is part of a quartet known as the "ABCD" companies that dominate global grain trading, serving as middlemen between farmers that grow crops and buyers such as food makers. The others are Archer Daniels Midland Co, ADM, Cargill Inc and Louis Dreyfus Ltd.

Raul Padilla, who will take charge of Bunge's Brazilian operations, said China had not canceled any Brazilian soybean purchases from the company.

Bunge Brazil is not seeing any losses from the problem with China, said Padilla, who replaces Pedro Parente.

Bunge planned to ship its first soy cargo from Barcarena on April 26, launching a short cut that will make Brazilian soy more competitive by relieving the overcrowded ports in the southeast.

Some 10 companies are expected to start exporting from the Barcarena region in the coming years. Parente said shipping soy by road and river barge north from Mato Grosso in central Brazil through the Amazon to Para state's coast would help Bunge gain market share in Brazil.

Bunge, based in White Plains, New York, is already the top agricultural exporter in Brazil, the world's top sugar and coffee producer. With the Barcarena terminal, Bunge will have capacity to export 35 million tons of grains from Brazil per year.

Young laborers shun tea harvesting

Young laborers shun tea harvesting

Old US nuclear explosion images released

Old US nuclear explosion images released

Ballerina-to-be in audition

Ballerina-to-be in audition

Red alert for rainstorm issued in S China's Liuzhou

Red alert for rainstorm issued in S China's Liuzhou

Forest team tackles fire drill in NE China

Forest team tackles fire drill in NE China

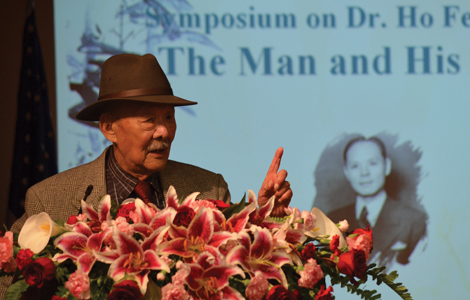

'Global citizen' becomes head of C-100

'Global citizen' becomes head of C-100

At 96, a legendary chef can still inspire 'the best' Chinese food

At 96, a legendary chef can still inspire 'the best' Chinese food

China's wine consumption is growing

China's wine consumption is growing

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Dominic Ng completes term as C-100 chairman

Easier visas aim to attract more Chinese

"The Other Woman" beats "Captain America" with $24.7m

NBA probing alleged recording of Clippers owner

S Korean PM resigns over disaster

China Customs seize fake products to protect World Cup

Officials praise ASEAN-China ties

US, EU seen imposing sanctions on Russia

US Weekly

|

|