Many Asian cross-border deals headed for disaster: Fosun executive

Updated: 2014-04-09 06:20

By MICHAEL BARRIS in New York (China Daily USA)

|

||||||||

Numerous cross-border acquisitions by Asian companies will turn out badly in the next five years because the acquiring party will be under-prepared to succeed in the fiercely competitive global marketplace, an executive from China’s Fosun Group told a US financial forum.

“During the five years, we’ll see a shakeout,” Harvey Fine, the Shanghai-based diversified conglomerate’s managing director for global investment and strategy, said during a panel discussion at the 2014 International Financial Forum in Manhattan. “There’s going be Asian buyers out there making mistakes because they were fooled by the success of the markets and they weren’t ready for the global challenges,” Fine said.

“At the end of those five years,” Fine said during the discussion titled Asian Outbound FDI (foreign direct investment): the How, When, Why and Where, “we’ll see the ones who were able to deliver the results and help their acquired companies grow in China who will start to compete as global companies and not just as Asian companies.”

The discussion, moderated by Euan Rellie, senior managing director at Business Development Asia, also included panelists Hans Allegaert, executive director of CITIC Capital Partners; Shau Zhang, partner, Americas tax leader of China Overseas Investment, Ernst & Young; Savio Tung, CEO, North America, Investcorp; and Wendy Li, shareholder with the Greenberg Traurig law firm.

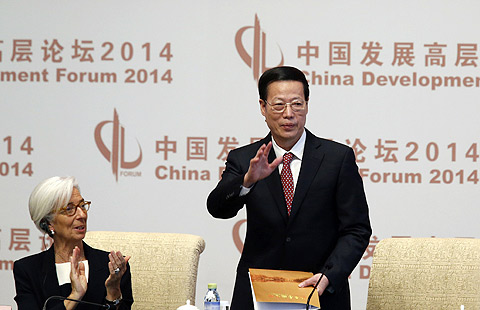

The two-day forum at the New York Athletic Club in midtown Manhattan involved more than 90 mergers-and-acquisitions professionals, policy makers and financial-market experts. A key message of the event was how uncertainty tied to a mix of recent global economic, political and social change has affected the M&A outlook in the developing world.

Companies in developed markets typically use cross-border acquisitions to reduce costs, bolster competitive positions, or raise their profile in high-growth markets. Acquiring companies from emerging markets, on the other hand, frequently approach an acquisition in another country as a quick route to a market, distribution network, brand name or technological expertise, and seek to get the most out of the low-cost edge they hold over traditional rivals.

Last year, merger-and-acquisition activity in China surged to an all-time high of $261.9 billion of deals, a 24 percent jump from the year before, with US companies a key target. China's M&A boom contrasted with a 2 percent drop in global deals which observers tied to a rise in activist campaigns, economic uncertainty and regulatory interventions. Analysts have projected a global M&A increase this year of 10 to 15 percent.

“It would appear that corporate leaders' reticence toward megamerger deals in 2013 will not persist during 2014,” Mike Bastin, a visiting professor at the University of International Business and Economics in Beijing, wrote in China Daily early this year. Observers say the US Federal Reserve’s recent moves to slow the pace of its monthly asset purchases after months of uncertainty has helped restore a sense of calm to the economic environment, raising the M&A outlook.

China completed $12.2 billion in US acquisitions last year, up 96.6 percent from 2012. The top deal was Shuanghui International’s $4.7 billion purchase of US pork giant Smithfield Foods Inc, the largest Chinese takeover of a US company. Deal volume in the Asia-Pacific region rose 10 percent.

In an interview, Fine predicted more Chinese cross-border acquisitions of goods and services companies to support the government’s rebalancing of the Chinese economy to emphasize consumption over investment and exports. Future acquisitions also could aim to bring China resources it needs – the way the Smithfield deal was a way to satisfy China’s growing demand for pork, for example – but the US would likely not be a major source of those deals, Fine said. M&A also could be a way for Chinese companies to gain expertise that could be applied back home in a specific field, such as food safety through the Smithfield deal, he said.

“There is going to be more acquiring of goods and process services that will help drive the Chinese market,” Fine said. “Resources probably not so much from the US, but from other parts of the world. Recognition would be the smallest part of it. Expertise would be part of it if it could be used in products and services in China.”

Tung called the Smithfield deal a milestone that “really opened up a lot of corporate M&A”.

Acquiring a popular US brand is a way for a Chinese company to build consumer loyalty, the Investcorp CEO said in an interview. “There is a very strong loyalty by the Chinese consumer toward US products and services. An acquisition will enhance that company’s ability to appeal to that consumer.”

Chinese schools vie in moot court

Chinese schools vie in moot court

Vigil marks one month since MH370 vanished

Vigil marks one month since MH370 vanished

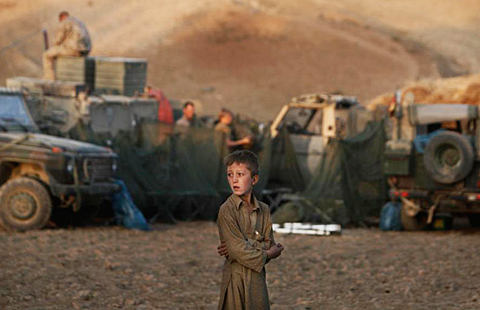

The world in photos: March 31-April 6

The world in photos: March 31-April 6

Simply child's play

Simply child's play

Photo special: Weird buildings in China

Photo special: Weird buildings in China

Jackie Chan holds charity concert marking 60th birthday

Jackie Chan holds charity concert marking 60th birthday

Microsoft to end support for Windows XP

Microsoft to end support for Windows XP

Poor weather greets baby prince

Poor weather greets baby prince

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Tech gap exposed in search mission

Carrier visit underscores transparency

The tough battle with the army of American lobbyists

Urbanization called major 'tectonic' event by expert

Chinese schools vie in moot court

Chinese, US defense chiefs begin talks

Time runs short in MH370 hunt

Zillow offers US real estate listings

US Weekly

|

|