New tax policies introduced in Shanghai

Updated: 2016-02-06 03:35

By YU RAN in Shanghai(China Daily USA)

|

||||||||

Ten innovative tax measures designed to bring more convenience and benefits to enterprises and entrepreneurs in Shanghai were unveiled at the end of last year as part of the government’s efforts to speed up the city’s transformation into a scientific and technological innovation center.

One of the reforms enables people to submit their tax forms and relevant documents online instead of having to make a trip to the taxation office. Tax payers now are also able to submit their payments on a quarterly basis instead of every month, and this helps them save on labor costs while increasing efficiency. This measure will benefit more than 130 high-tech software companies in the city.

“These 10 measures offer more convenient and efficient ways for enterprises and individuals to deal with tax-related issues, and at lower costs too,” said Guo Jingfei, director of the Shanghai Municipal Bureau of Taxation.

“We will be making use of more Internet-related methods to be innovative in tax matters. This will also help to speed up the city’s transformation and create an expanded impact on other cities in the region.”

Going digital looks to be the new trend for managing tax issues and the move has already yielded benefits.

The launch of an information platform in 2015 that helps enterprises in the Yangtze River Delta region with tax matters has generated useful policy analysis and data sharing among 11 regional and municipal tax departments. As of the end of 2015, nearly 400,000 documents have been shared among companies in this region.

Companies in the import and export businesses will also benefit from a new policy that allows them to pay for taxes on their overseas and domestic trading via one system. The move has already garnered praise from many people.

“The newly introduced integration of import and export taxes provides more convenience to our company as it decreases the expenses on storage and logistics of import and export goods as well as maximizes the overall efficiency,” said Pan Jianhua, deputy president and chief financial officer of Shanghai Mengtian International Logistics Co Ltd.

In terms of individual benefits, expats holding the R-Visa no longer have to state their tax subsidies before they pay taxes as they are permitted to deduct the tax-free portions themselves.

“These measures will be applied together with the reforms taking place in the zone. We hope to lower the tax burden for entrepreneurs and attract a greater number of talents with more accessible and innovative services,” said Wang Jing, deputy director of the management committee of China (Shanghai) Pilot Free Trade Zone.

yuran@chinadaily.com.cn- General strike against pension reform brings Greece to standstill

- Madrid airport sounds alarm after bomb threat on Saudi plane

- Obama proposes new oil tax to fund clean transportation

- UN special envoy announces temporary pause of intra-Syrian talks

- Taliban kill 10-year-old hailed as militia hero

- Obama slams anti-Muslim rhetoric during first visit to US mosque

Kindness walls bringing extra warmth to the needy

Kindness walls bringing extra warmth to the needy

A robot that grabs red envelopes

A robot that grabs red envelopes

Culture Insider: 9 things you may not know about Start of Spring

Culture Insider: 9 things you may not know about Start of Spring

Talented artist makes tiny pencil lead sculptures

Talented artist makes tiny pencil lead sculptures

Ten most heartwarming stories about Spring Festival Rush

Ten most heartwarming stories about Spring Festival Rush

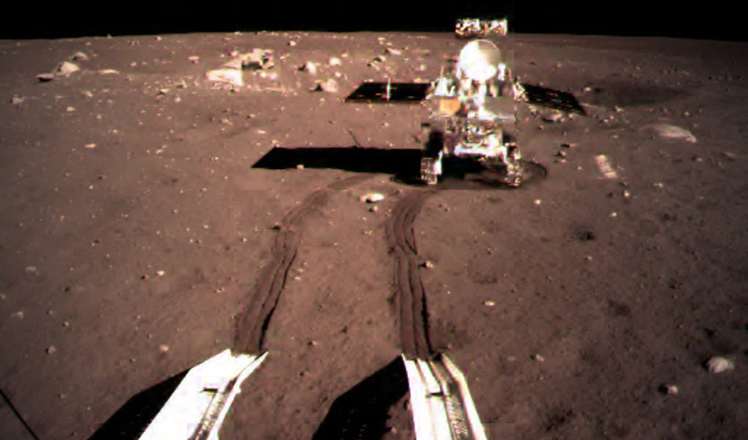

China's 'Moon Walker' sends back stunning HD photos

China's 'Moon Walker' sends back stunning HD photos

Starbucks, office rents and CEOs form alternative outlook on China

Starbucks, office rents and CEOs form alternative outlook on China

China's most beautiful wetlands

China's most beautiful wetlands

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

National Art Museum showing 400 puppets in new exhibition

Finest Chinese porcelains expected to fetch over $28 million

Monkey portraits by Chinese ink painting masters

Beijing's movie fans in for new experience

Obama to deliver final State of the Union speech

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

US Weekly

|

|