Cleaner future

Updated: 2012-02-24 08:24

By Meng Jing and Liu Yiyu (China Daily)

|

||||||||

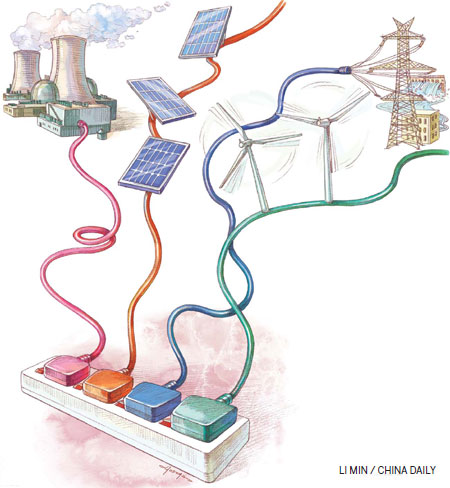

Alternate energy resources may give a green tinge to economic growth in China

If William Latta has his way, Beijing may soon have only clear blue skies. Sitting in his corner office on the 11th floor of a high-rise building near Beijing's Sanlitun Village, Latta, the managing director of US clean coal company LP Amina, says his company is working with Chinese coal-fired plants to reduce carbon emissions.

"See the smog out there? We can help with that," he says.

|

||||

Latta is just one of the many next-generation Western technocrats and entrepreneurs who are helping China's efforts to develop alternate energy resources and reduce carbon emissions. Over the last two years, China has intensified its efforts and has already leapfrogged peers from Denmark, Germany, Spain and the US to become the largest maker of wind turbines. It is also the largest solar panel maker in the world. At the same time, the country is also taking steps to build more nuclear reactors and energy-efficient coal power plants.

The frantic pace at which China is expanding its renewable energy push reflects its commitment to reduce carbon emissions as it strives for a more balanced growth model that is not reliant on costly fossil fuel imports. The government has already announced that it plans to increase the share of non-fossil energy in total energy consumption from 8.3 percent in 2010 to 11.4 percent by 2015.

China's National Energy Administration (NEA), the top energy agency, said in December that power generated by clean energy sources like solar, wind, biomass and nuclear will account for energy equivalent to that produced by 480 million tons of standard coal between 2011 and 2015. That in itself is a major achievement considering that power from clean energy sources was 300 million tons in the previous five years.

Despite hurdles like the safety inspections of Chinese nuclear stations last year after the nuclear disaster in Japan, the overcapacity in China's wind and solar power equipment industry and the difficulty of connecting power generated by wind to the grid, experts and analysts say that clean energy and clean technologies are strategic investments for China, not only for environmental reasons but also for energy security.

Frank Li, lead partner for the clean-tech industry at Deloitte Northern China, a member firm of Deloitte Touche Tohmatsu Limited, says that he anticipates not only growth in his company's clean-tech related business in China but also confidence in the country's general business climate for the clean energy sector.

"People often ask me for advice, trying to see if wind power and solar power are still worth investing in. It is true that there have been some problems in these sectors in China, such as overcapacity. But from a strategic point of view, none of these problems can be problems any more," Li says.

According to Li, China has the third largest coal reserves in the world and is ranked 14 in terms of the reserves for oil and natural gas. Coal contributes to more than 70 percent of China's energy needs while oil and natural gas accounts for 21.6 percent. But despite the impressive statistics, the rich fuel reserves are nothing when equated with China's huge population of 1.3 billion people, its robust economy and growing energy needs. The country accounted for 20.3 percent of the global energy consumption in 2010, and this is likely to go up considerably.

"Statistics from BP's 2011 world energy review show that based on China's reserves and its consumption in 2010, the coal reserves will be used up in 35 years, while oil will be used up in 9.9 years and natural gas in 29 years," he says.

Though there are possibilities of finding more fossil fuels in China with the help of better exploration and exploitation techniques, there is no arguing that fossil fuels only have a limited life span. For better energy security, it is not prudent for a country like China to rely heavily on imported energy resources when its own reserves are going down. In China's case, 55.8 percent of its oil requirement in 2010 came from imports, compared with 51 percent in 2008. More importantly, China needs to develop alternate energy resources, if it has to honor its global commitments on reducing carbon emissions, say experts.

Sean Gilbert, director of climate change and sustainability at global consultancy KPMG, says in terms of reducing carbon emissions, one has to look into clean energy sources, because improving energy efficiency alone is not good enough for the planet. Hence it is a big incentive for China to have ambitious clean energy installation goals.

China has the most installed capacity of wind power in the world and the most nuclear stations under construction. The country also produces the most solar PV cells and has the biggest hydropower market in the world.

"China has nearly one-fifth of the world's population, so the total size of green energy installations in China over time should reflect this and be a very large absolute figure. The current investments are welcome, but it is just the beginning of more to come," Gilbert says.

One of the bigger concerns that have often been expressed about clean energy is that it leads to job losses. But experts say that not only does the sector hold promise of more jobs, it also creates a cleaner and healthier future.

The China Council of International Cooperation on Environment and Development said in November 2011 that by 2015 China may spend an estimated 5.77 trillion yuan ($909 billion, 692 billion euros) to improve energy efficiency and protect the environment. At the same time, nudging out high-polluting and energy-intensive industries could cost the country as many as 952,100 jobs and more than 100 billion yuan in economic output by 2015. But in return the country can save 1.43 trillion yuan in energy expenses, boost GDP growth by 8.08 trillion yuan and create 10.58 million jobs.

According to Tsinghua University estimates, investment in China's new energy and clean energy sector will reach 5 trillion yuan in the coming 10 years. With such a huge market in the offing, there is no doubt that there will be several windows of opportunity for Western companies and multinationals.

Much of that optimism comes from the fact that Western companies still have an upper hand when it comes to advanced core technologies for clean energy despite the impressive strides made by Chinese companies recently, says Zhu Junsheng, president of the China Renewable Energy Industries Association.

"The competition is more intense than five years ago, but the pie of China's clean energy sector is also getting bigger. There is still plenty of room for further growth," Zhu says.

Changing winds

The global trends for the wind power industry are not that encouraging considering the precarious financial situation in Europe and the weak US economy. Many wind and other high-cost forms of energy production are virtually on the backburner, with some European nations even deciding to end subsidies for the sector.

|

Above: William Latta, managing director of US clean coal company LP Amina. Provided to China Daily Below: Kay Weber, CEO of Siemens Wind Power Asia-Pacific. Jiang Dong / China Daily |

But the market for wind turbines has been growing steadily in China and that is also the reason why big European conglomerates like Siemens AG have strong confidence on the Chinese market. The German company, which is a leading supplier of wind power solutions in the world, has decided to team up with Shanghai Electric Group to form two joint ventures for wind power in an aim to strengthen its footprint in China.

"China has a very attractive wind power market, but the disadvantage of being in such an attractive market is the tough competition from both international and local players," says Kay Weber, CEO of Siemens Wind Power Asia-Pacific. "By forming joint ventures with a strong local partner, we can combine our strengths to be successful in China," he says.

Foreign wind turbine producers have seen their market share in China drop dramatically from 70 percent to 30 percent over the past five years after more Chinese companies entered the sector, says a study from Roland Berger Strategy Consultants, one of the largest consultancies in Europe.

When Siemens entered the wind power industry in 2004 by acquiring the world-famous Denmark wind turbine producer Bonus Energy, China was not a top priority. "To be honest, at that time, we wanted to focus more on easier markets, such as Europe and America. But you cannot be successful in the world, if you don't succeed in China," says Weber.

China has since overtaken the United States and is now the largest market in the world for wind power. Though China's newly installed capacity for wind power has slowed a little from the 100 percent annual growth rate between 2006 and 2010, it is still the most promising market for global wind power equipment suppliers.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|