Chinese smartphone company seeks more gains in US

Updated: 2015-02-26 11:52

By Li Jing in Beijing(China Daily USA)

|

||||||||

When Chinese smartphone brands like Xiaomi and Huawei vie to grab headlines domestically, Shenzhen-based ZTE seems to keep a low profile. Ask any Joe on the street whether he knows which Chinese brand is the top smartphone manufacturer in the US, ZTE would likely be the last answer.

However, in 2014 ZTE was the fourth largest smartphone vendor in the US market - behind Apple, Samsung Electronics and LG Electronics - and maintained the No. 2 position in the no-contract market with a 21 percent market share, making it arguably the top Chinese brand in the US.

According to Strategy Analytics, in the third quarter of 2014, ZTE's handset shipments to the US market rose by 40 percent year over year and accounted for a 7.8 percent market share in the US smartphone market.

"We now have 20 million active users using ZTE devices in the United States," said ZTE North America CEO Cheng Lixin. "We aim to become the third largest handset manufacturer in the US and continue increasing our market share in prepaid in the future."

In an interview with Jiemian, Cheng said ZTE has set a three-year goal of surpassing LG to become the third largest player in the US.

ZTE has been growing steadily in the US and is expanding rapidly in the prepaid market, said Wang Jingwen, mobility analyst from consultancy Canalys China.

"The success is driven in large part by its efforts to build to raise brand awareness," Wang said. "Brand recognition is a tough thing to get. They are doing the right thing to grow. The game plan is working."

ZTE has chosen to brand itself in the US market as "Affordable Premium" by selling affordable smartphones with technological features comparable to more expensive models from better-known brands. How to build a brand image that isn't just about low prices is always the big challenge for ZTE.

In 2014, ZTE tripled its US marketing investment compared to the previous year.

Last December, Cheng and Houston Rockets CEO Tad Brown announced their joint holiday charity program Season of Giving. One month earlier, the handset maker expanded its sponsorship deals with US National Basketball Association teams, becoming a sponsor for the New York Knicks and Golden State Warriors in addition to its existing partnership with the Houston Rockets that began in 2013 October.

"The rule of our marketing investment is that, we invest in anything that can create direct interactions with consumers, either through social media or other digital media. That's why we are working with NBA teams with a focus on social media and digital media," Cheng said in an interview with the Wall Street Journal.

The company's brand awareness has shot up dramatically over the year, "increasing from 1 percent to 16 percent," said Cheng.

ZTE's biggest challenge has become the brand's greatest opportunity. "We are doing very well to create visibility so far," added Cheng.

Distinct from the Chinese market, the US market is unique in the sense that 90 percent of devices are sold through mobile phone carriers.

Carriers play an important role in the US market and their store offerings determine which brands most consumers are familiar with. In the US, ZTE has edged out Huawei and other lower-cost smartphone makers with its ability to strike deals with several major carriers.

The company first entered the US market in 1998. It had previously worked with no-contract carriers such as Boost, MetroPCS, and Cricket to gain market share and has now added on strategic partnerships with all major carriers in the US.

Thanks to the efforts, an impressive 68 ZTE phones are now out there in the market, though not all of them are under its brand - some are labeled by various telcos instead.

ZTE sees big promise in the prepaid handset market, which is the focus for its growth in market share.

In January, it released Grand Max X Plus, a 6-inch smartphone with high-end specs, all for $200 when bought without a contract. Cricket Wireless sells it as a prepaid phone.

ZTE's ambition is helped by the increasing number of US consumers who want to buy prepaid phones, instead of entering into long contracts with mobile carriers, industry insiders said.

"I think we've seen some slight movement in favor of prepaid because (of) the economy and better, more affordable prepaid options," Tuong Huy Nguyen, principal research analyst at Gartner, said in an interview with CNBC.

Many prepaid phones offered in the US, however, tend to have older tech specs than contract phones offered by local carriers, which makes it relatively underserved.

lijing2009@chinadaily.com.cn

Chengdu citizens visit Du Fu Thatched Cottage to mark Human Day

Chengdu citizens visit Du Fu Thatched Cottage to mark Human Day

Tencent gifts red envelopes to employees

Tencent gifts red envelopes to employees Throwing coins to please God of Wealth

Throwing coins to please God of Wealth

7 companies that aim to fly high with drone deliveries

7 companies that aim to fly high with drone deliveries

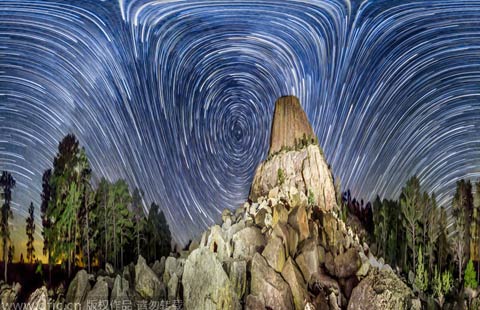

Starry Night created by lens

Starry Night created by lens

Dragons, martial arts and basketball

Dragons, martial arts and basketball

Stringing in the New Year

Stringing in the New Year

Top 10 Chinese innovators in 2014

Top 10 Chinese innovators in 2014

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese smartphone company seeks more gains in US

China, US work to make Xi's visit successful

Challenges loom as meetings approach

Obama blames immigration woes on Republicans

New fighter jet ready for PLA

Why China's youth is getting the needle

Most Chinese forced to return home were living abroad illegally

US State Dept calls for cyber security boost

US Weekly

|

|