After-sales service prioritized

Updated: 2013-08-05 07:19

By Li Fangfang (China Daily)

|

||||||||

|

Two technicians check a car at Beijing Hyundai's dealership in Hainan province. After-sale service is now the key to domestic automakers' sustainability in China, according to the latest report from JD Power. Meng Zhongde / for China Daily |

Slump in sales prompts search for new revenue

Overall satisfaction with after-sales service at authorized dealerships in China is on the decline in 2013 largely due to rising customer expectations, according to a JD Power study.

The JD Power Asia-Pacific 2013 China Customer Service Index Study released last week found that overall customer satisfaction with after-sales service in China has dropped to 815 on a 1,000-point scale in 2013 from 832 in 2012, the first drop in recent years, driven largely by a decline in satisfaction with domestic, Japanese and European brands.

Customer satisfaction with domestic brands declined by 31 points to 751 in 2013, and satisfaction with Japanese brands dropped from 860 in 2012 to 831 this year.

The rating of European brands decreased by 17 points to 832, while US brands achieved an average score of 851, a 1-point decrease from 2012.

Only South Korean brands collectively showed improvement in customer satisfaction, with a year-on-year increase of 13 points to 874.

The decline in satisfaction is attributed to a significant increase in customer expectations about the service experience, according to the marketing information services company.

"The competitive landscape continues to be aggressive, driven by product proliferation and rising customer expectations, making it imperative for manufacturers and dealerships alike to develop points of differentiation on delivering a superior customer experience in after-sales service," said Tony Zhou, director of automotive research at JD Power China, Shanghai.

"The industry should also be attuned to macroeconomic dynamics and be agile in adapting dealer-service processes and standards in response to the changing business environment."

The latest statistics from the China Association of Automobile Manufacturers show that China delivered 8.66 million passenger vehicles in total in the first half, up 13.8 percent year on year.

"Despite aggressive dealer network expansion, the increase in the number of vehicles has put immense pressure on capacity at dealer service departments," said Zhou.

Profit center

He noted that customer loyalty is particularly important because after-sales service is a significant profit center for dealerships.

After-sales service accounted for 50 percent of overall dealer profits so far this year, an increase from 44 percent in 2012, according to the JD Power Asia Pacific 2012 Dealer Attitude Study.

"And profit from new vehicle sales declined to 33 percent, meaning that dealers should change their operational focus from sales to after-sales service," said Mei Songlin, vice-president and managing director of JD Power China, Shanghai.

The JD Power 2013 study found customer satisfaction with after-sales experience has a direct impact on dealer service volume.

Service volume among dealers with high customer satisfaction - 831 points or more - averages 14,692 service visits per year per dealership, compared with 11,224 visits among those with low satisfaction - 773 points and fewer.

"And we found that the dealers with higher customer satisfaction earned 14 percent more profit than those with low customer satisfaction," Mei said.

The importance of service is clear, said Charles Mills, vice-president for global retail experiences with JD Power China, Shanghai.

He told China Daily that 40 percent of vehicle dealers in China suffered a significant deficit last year.

Some 20 percent broke even, and another 40 percent profited.

This is a major change from three years earlier, when only 6 percent of dealers reported losses, he said.

He attributed the sudden turnaround to the rapid market cool-down in the past three years.

"When the demand surged in 2009 and 2010, dealers could gain huge profits from new vehicle sales, which made them ignore the after-sales service," said Mills.

"The high expectations for the market made them lose sight of preparation for other value-added services.

"It's too late for some dealers to start building a profit engine in services now that new vehicle sales have suddenly slowed."

In the US, dealers' profits mainly derive from after-sales service, trade-in vehicles and insurance rather than new vehicle sales, Mills said.

"On average, US dealers made 30 percent more profit than Chinese dealers," he said.

Li Guiping, president of Changjiu Group, a Chinese vehicle trader with more than 80 authorized dealers, said that car care business has been the biggest contributor to profit in its dealerships.

"China is going to introduce a car warranty policy in October, supporting customers' rights to return defective vehicles and seek a refund or replacement," said Mei.

"Dealers are at the frontline of ensuring a positive customer experience.

"Meeting or surpassing customer needs is critical to mitigating the potential adverse effect of this new policy on customer loyalty and profitability for brands and dealers alike."

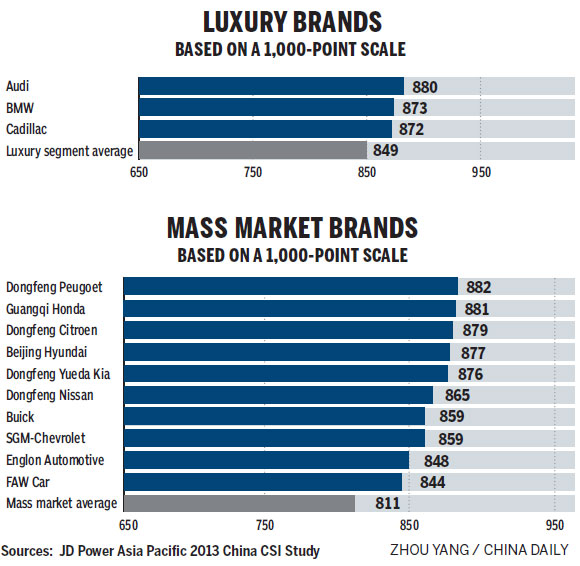

Luxury brands

For the first time, the service satisfaction study has separated luxury brands from mass-market brands.

The objective of the classification is to address the differences in customer expectations regarding after-sales service.

Overall customer satisfaction with after-sales service among luxury brands averaged 849, while mass-market brands averaged 811.

Audi ranked highest in the luxury segment with a score of 880, BMW ranked second, and Cadillac, third.

Among mass-market brands, Dongfeng Peugeot ranked highest at 882, performing particularly well in service advisory, service initiation and vehicle pick-up.

Following Dongfeng Peugeot in the rankings are Guangqi Honda, which trailed by a point behind, and Dongfeng Citroen.

The JD Power service satisfaction study, now in its 13th year, measures satisfaction among vehicle owners - after between 12 and 24 months of ownership - when visiting an authorized dealer's service department for maintenance or repair.

The time period - 12 to 24 months - represents a substantial portion of the vehicle warranty period.

The study examines five factors - service quality, service facilities, vehicle pick-up, service advisor, and service initiation.

The study is also based on street intercepts and face-to-face interviews with 15,370 new vehicle owners who purchased their vehicle between February 2011 and May 2012, and examines 71 passenger vehicle brands.

The study was fielded between February and May 2013 in 43 major cities in China.

lifangfang@chinadaily.com.cn

(China Daily USA 08/05/2013 page16)

British couple caring for special children

British couple caring for special children

Fly for adventure at US air show

Fly for adventure at US air show

Kobe Byrant meets fans in Shenzhen

Kobe Byrant meets fans in Shenzhen

New Zealand milk stokes fears

New Zealand milk stokes fears

Yemen enhances security over embassies

Yemen enhances security over embassies

Chinese heavy ground combat vehicles join drill

Chinese heavy ground combat vehicles join drill

Police find kidnapped baby alive in Henan

Police find kidnapped baby alive in Henan

Privacy 'needed' for young offenders

Privacy 'needed' for young offenders

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Pessimists ignoring China's strengths may lose out

Overseas investors welcome to bid in Beijing

US extends closure of embassies

New Zealand milk stokes fears

Riding the clean energy boom today

Magnetic attraction for EU SMEs

Mugabe wins Zimbabwe presidential election

EU solar deal hailed as blueprint

US Weekly

|

|