China automakers pass on Detroit show

Updated: 2014-01-14 11:18

By Michael Barris in New York (China Daily USA)

|

||||||||

A venue that can give a boost but can also backfire on those unready

It is a magnet for auto makers with global ambitions. But for the first time in eight years, Chinese car companies are shunning North America's largest auto show.

As the North American International Auto Show (NAIAS) in Detroit opened for the media Monday, automakers from China were not among the exhibitors. That hasn't happened since 2006, when Geely Automobile Holdings Ltd made its debut at the exposition, now in its 107th year.

Generating wide media coverage thanks to Detroit's reputation as the home of the Big Three US automakers, NAIAS has the power to boost brand development. But Tim Dunne, director of global automotive industry analysis for California-based market-research firm JD Power and Associates, said exhibiting at Detroit also can backfire if the media decides the products displayed are not competitive.

"That happened in the past when some car magazines and auto enthusiast websites and blogs panned some of the Chinese vehicles, or the overall Chinese brand presentation at the show," said Dunne, who said he has attended about 25 Detroit auto shows.

Last year, State-owned Guangzhou Automobile Group Co, or GAG Motors, was the lone exhibitor from China. This year, China's sixth-largest auto maker is staying home. Wang Shunsheng, head of international business at GAG, said the Guangzhou-based company skipped Detroit this year because entering the US market "requires a lot of study and investigation and we're still in the process," Wang was quoted in the Wall Street Journal.

BYD Co, the Shenzhen-based electric vehicle automaker backed by billionaire US investor Warren Buffett, also is giving Detroit a pass despite announcing this month it plans to introduce several models to the US by the end of 2015. A BYD spokesman said the show's focus made attendance inconvenient, the Journal reported. Spokesmen for Qoros Automotive Co, a joint venture between Chery Automobile Co of Wuhu, Anhui province, and Tel Aviv investment group Israel Corp, and Great Wall Motor Co of Baoding, Hebei, also said they would not attend the show, according to the newspaper.

China's leaders have made going global in the automotive industry a priority. The goal, articulated in the latest five-year plan, builds on the country's 2009 achievement of overtaking the US as the world's largest automotive market by sales.

Although China has made inroads as a parts supplier through acquisitions of foreign suppliers and joint ventures with international parts makers, it is seen as at least five to 10 years away from selling a passenger car that would meet the North American market's safety and emissions demands. China's motivation to use its automotive industry as an exporting platform is questionable considering the domestic market already accounts for one-quarter of global light-vehicle sales.

But it is difficult for Chinese auto makers to resist the legitimacy that cracking the North American market is seen as conferring.

Reflecting the perceived prestige that comes with selling a vehicle in North America, a number of China's domestic automakers over the years have announced plans to sell to the US. But no vehicle has materialized.

In August, China's Geely Automotive Holdings said that in two years it would begin exporting to the US cars it co-develops with Sweden's Volvo. David Sedgwick, an analyst and the former editor of the Automotive News, told China Daily at the time he doubted that US consumers were ready for a Geely-badged car in the US, even one on a Volvo platform.

That view ties in with China's absence from the Detroit show, according to Dunne. "The presence of Chinese automakers at the auto show in the past was probably premature - they weren't ready for the US market, but they didn't know it yet," he said.

"If a Chinese automaker wants to launch in the US in 2015, they have more pressing issues than showing a car in Detroit," Dunne said. "This includes meeting US regulatory requirements for safety and emissions, improving the quality and appeal of their vehicles, setting up a US sales and distribution company (and) signing up dealers."

Over the past 30 years, Dunne said, China's practice has been "to build a product, or create a service, or erect an office building or apartment house, and figure out if there is market demand for it later. And if there is not, then adjust".

michaelbarris@chinadailyusa.com

(China Daily USA 01/14/2014 page1)

Cristiano Ronaldo wins FIFA best player award

Cristiano Ronaldo wins FIFA best player award

Xuelong carries on mission after breaking from floes

Xuelong carries on mission after breaking from floes

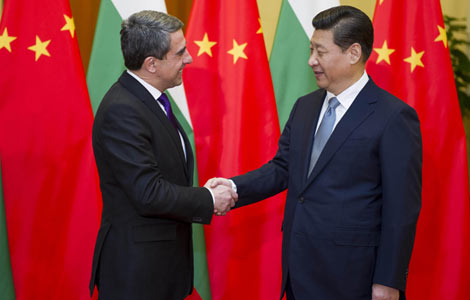

Beijing and Sofia vow new initiatives

Beijing and Sofia vow new initiatives

71st Golden Globe Awards

71st Golden Globe Awards

Bangkok unrest hurts major projects and tourism industry

Bangkok unrest hurts major projects and tourism industry

No pant for cold subway ride

No pant for cold subway ride

Tough army training turns boys into men

Tough army training turns boys into men

Blaze prompts concern for ancient buildings

Blaze prompts concern for ancient buildings

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Newspapers must change or die

Abe’s brother to explain shrine visit to US

Protests cannot end Thai deadlock: observers

Mercy killing still a hot button issue

China builds army 'with peace in mind'

UN plea made on war victims

Li: China's tech innovation a priority

Less school is better for finding love

US Weekly

|

|