Building on success in overseas markets

Updated: 2014-07-18 07:17

By Wei Tian (China Daily USA)

|

||||||||

Tycoon wants to leave a lasting presence with big-ticket projects

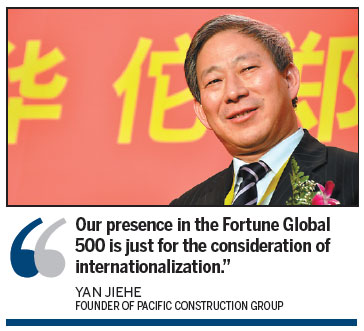

Yan Jiehe is often considered a different entity in the world of conventional business and entrepreneurship. The former teacher, big time developer and one of China's richest men is someone who is not afraid to speak his mind, irrespective of the stage. But the founder of China's largest private company Pacific Construction Group is also an outstanding entrepreneur and business leader known for his thoughtful, often innovative approach.

It is not uncommon to see the 54-year-old Yan going hammer and tongs against government policies in front of hundreds of reporters and even senior government officials. Yan, often referred to as "the maddest Chinese man on the planet", said he is not ashamed of the reference and uses it when talking to guests like former US president Bill Clinton, former French president Nicolas Sarkozy, former British prime minister Gordon Brown, former German chancellor Gerhard Schroder, former UN secretary-general Kofi Annan and so on.

If that doesn't help him make headlines, the latest Fortune Global 500 list sure would. Yan's firm - Pacific Construction Group - is ranked 166th in the list of the world's largest companies, only four notches lower than US-based tech giant Google Inc and five notches higher than UK-based financial services firm Barclays.

With annual sales of $59.6 billion in 2013 - up 40 percent from a year before - Pacific Construction is 50 percent larger than technology giant Huawei Technologies Co Ltd, or nearly twice as large as automaker Geely Group (owner of Volvo), which makes it the undisputed leader among privately owned companies on the Chinese mainland. Although Pacific Construction has for long been known in China for its size (operations and revenue), it is the first time that it has been ranked in the Fortune rankings.

Yan, however, does not attach much importance to the ranking. In his trademark style, at a press conference in Nanjing, capital of Jiangsu province, he said his efforts would instead be focused on making Pacific Construction a formidable name in the global infrastructure construction market.

"Our presence in the Fortune Global 500 is just for the consideration of internationalization," he said.

Indications that Pacific Construction was keen on bolstering its international presence became clear earlier this year, when Yan indicated that his company was in advanced talks with Australian and New Zealand officials for infrastructure projects. In May, Pacific Construction signed agreements with Mongolia, Chile and Ghana for infrastructure projects in those countries, said company officials.

"Our primary overseas market, however, will be Europe. I will retrieve the reputation of Chinese companies which was thrown away by State-owned enterprises," Yan said, adding that "the ultimate goal of Pacific Construction is to construct across the Pacific Ocean".

Building projects in overseas markets is not that easy as it seems, said a top official of a Pacific Construction project team on condition of anonymity. "There are completely different set of rules and very tough supervision, especially in the European market. It is also the reason why the bigger SOEs could not establish their presence," he said.

One example often mentioned as Chinese companies' failure in overseas infrastructure market is the A2 Highway project connecting Berlin and Warsaw. Three Chinese SOEs won the bid with a low price but eventually dropped out due to miscalculated costs, which resulted in a $271 million compensation claim and a three-year ban on their bidding for projects in Poland.

However, the failure of the SOEs has not deterred entrepreneurs like Yan. Experiences in the domestic market have shown that SOEs are not necessarily a match for Pacific Construction when it comes to building roads and bridges.

One of Yan's favorite stories was how he pulled off his very first infrastructure project.

After his career as a school teacher and manager of small SOEs, Yan formed his own company in 1995. His first contract was a subcontracted highway project from the Nanjing government, for just 300,000 yuan ($48,340). Even so, Yan found that his company would suffer a loss of 50,000 yuan if it built the project as per budget, or lose 80,000 yuan if it decided to use advanced technologies.

"If we're doomed to lose money, we might as well lose more," Yan said. It later became his most-repeated quote.

Having delivered the project in high standard and in half the stipulated time, Yan's 80,000-yuan losses soon turned into a profit of 8 million yuan, as the officials started awarding him more projects.

While participating in a series of major infrastructure projects such as Beijing-Shanghai Highway, Nanjing Metro and Nanjing Airport Express, Yan also found a shortcut for expansio - to purchase the poorly performing building enterprises owned by the government.

Since 2002, Yan has purchased 31 large SOEs nationwide. By bringing these companies back to life and providing job opportunities to local society, Yan has built up a close relationship with local authorities and ensured that he gets a steady stream of contracts.

Another reason that made Yan popular with local governments was his Build-Transfer model. Pacific Construction invests its own cash into the projects in the early stage and then sells it back to the government when complete. This model has helped ease the financial strains for some local governments, especially cash-strapped governments in less-developed provinces.

With China's massive infrastructure investment in the first decade of 21st century, the expansion of Pacific Construction also seems unstoppable.

Along with his business success, Yan's personal fortune also swelled. From 2004 to 2005, Yan's fortune grew from 1 billion yuan to 12.5 billion yuan, which put him in the second place on Hurun Rich List 2005, a ranking for China's richest people.

However, what came with fame and fortune were more questions about Yan's belligerent attitude and his BT business model. In 2006, rumors about funding problems saw lenders calling in their loans and a 30 percent depreciation in Yan's personal wealth.

Yan overcame the funding crisis and improved his personal wealth to $3 billion. However, in 2011 he decided to take a back seat and entrust Pacific Construction's chairmanship to his son - Yan Hao. The 28-year-old is now in charge of a company with total assets of $30 billion. The only comparable rival of the same generation might be 30-year-old Mark Zuckerberg, CEO of Facebook, which has total assets of around $17.8 billion.

Unlike his father, Yan Hao never speaks in a high voice, though he is much bigger in size. He strictly follows the script when speaking, different from the senior Yan who is known for his inspirational speeches.

"I will not be 'mad' anymore, I have my own path to follow," Yan Hao said.

But when you can dine with a former US president in your 20s and have a Nobel laureate as the chief witness at your wedding ceremony, the path is pretty much determined.

|

Construction work going on at the New Lanzhou City project in Gansu province. Pacific Construction Group, China's largest private company with annual sales of $59.6 billion in 2013, is undertaking the huge infrastructure project. Provided to China Daily |

(China Daily USA 07/18/2014 page19)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Malaysian airliner downed in Ukraine, 295 dead

Xi promotes cooperation on railway across South America

China urges U.S. not to abuse trade system

Couple's $15m to Harvard starts $100m fund for needy

China, US agree to boost cooperation on fighting terrorism

China increases holdings of US securities

China, US agree to boost cooperation on fighting terrorism

BRICS form new development bank

US Weekly

|

|