Battle of the real estate brokerages pits physical vs virtual

Updated: 2015-02-26 07:37

By Zheng Yangpeng(China Daily USA)

|

||||||||

Traditional brick-and-mortar property brokerages have entrenched flaws in how they do business, as their rivals in the Internet industry rightly point out, but replacement is not on the horizon either, reports Zheng Yangpeng.

There was no shortage of bad news for property brokerages last year and just when the industry thought it had seen the worst of it, more kept coming this year.

Last month, Century 21 China Real Estate, a real estate brokerage and the exclusive franchisee for the US-based Century 21 brand in China, was delisted from the New York Stock Exchange after persistent failure to meet the bourse's minimum capitalization requirements. The capitalization of the company ended at a miserable $10.11 million, a far cry from its peak of $4 billion.

The plunge in share prices reflected US investors' fast-changing views on the brokerage business. Five years ago, when Century 21 became the first Chinese real estate brokerage to be listed on the NYSE, its shares rallied, backed by the booming market in China. But a slowdown in China's property market, cutthroat competition and the market offensive from Internet companies have made investors jittery on company fortunes.

Domestic real estate brokerage Syswin Estate Co Ltd raised the industry ante further after it said it would cut commission fees to 1.5 percent of the transaction value, a sharp contrast to the 2.7 percent charged by major brokerages like HomeLink Real Estate Services.

Inmost cases, if one were to weigh the two developments, it would not have been uncommon to expect the industry to be in tatters. But visits to several brokerage stores in Beijing revealed exactly the opposite story. Though most of the stores were largely empty, except for a bunch of brokers sitting behind desktop computers, it was not due to slack business, but because most of the transactions had shifted online. Prospective customers often directly visit the houses on sale with brokers. Data released by HomeLink and 5i5j Real Estate, the two largest brokerages in Beijing, showed record high pre-owned home sales in the past four months, thanks to stimulus policies since the end of September.

A broker with HomeLink who declined to be named said he did not feel his business has been affected with the advent of the Internet.

Li Zhimin, a senior broker with a smaller company, Maitian Real Estate Agency Co Ltd, said Maitian is not expanding as fast as two or three years ago. It closed some stores in some communities but opened new stores elsewhere.

"Under the current circumstance, big companies become even bigger while small companies find it hard to survive. There is rarely a middle ground. We would not cut our commission fees, even if it means fewer customers. We think in the long run professional services are still what most customers care for," he said.

That is a standard answer provided by many other firms China Daily interviewed. Small agencies in Beijing offer big discounts, but most home seekers still choose major agencies like HomeLink, which takes up almost half the pre-owned home sale market. The privately held company did not disclose its earnings, but ubiquitous stores, bloated broker teams and unsubdued commission fees suggest it is not on the verge of collapse.

Quite the opposite, based on its strong offline presence and abundant home sources, the company was able to fight a war with SouFun Holdings Ltd, owner of China's largest real estate Internet portal.

In October 2014, HomeLink decided to stop its cooperation with Sou-Fun and scrapped all its listings on the website, citing rising fees charged by the latter. The decision, along with other brokerages' boycott, dealt a heavy blow to the website, which relied heavily on the listing fees paid by brokerages. The NYSE-listed company's share prices tumbled to $7.26 as of Tuesday, from a peak of $19.4. HomeLink switched to upgrade its own housing information website.

SouFun responded to the crisis by announcing its intention to expand from a pure-media platform to a "three-in-one" information, transaction and financial platform. But whether that would bring in new sources of revenue still remains unclear.

"Despite being a significant revenue opportunity, we view the visibility of such a transition as very low at the current stage. Moreover, unlike Ctrip.com International Ltd's investment and transition, SouFun's new initiatives could potentially create conflict between itself and current business partners and lead to a negative impact in the near future. We suggest investors stay on the side-lines until further visibility arises," wrote JPMorgan Chase & Co's analysts in a November note.

In the eyes of a new wave of crusaders in the industry, both brick-and-mortar brokerages represented by HomeLink, and e-commerce sites represented by SouFun are "old forces" whose traditional business model equates to redundant, if not totally useless, presences.

They see traditional brokerages opening too many stores, hiring too many staff, and charging too much fees. If the whole business model could be reinvented to skip stores and cut staff, commission fees could be brought down while business remains profitable.

That is what iwjw.com, a new venture created by some Internet veterans last March, is doing. Focused on the home lease business, the company cut the previous commission (a month's rent) to half, and poached brokers from brokerages by promising to at least double their base salary.

The strategy worked. In Shanghai, the company promised zero fee for rent seekers, and iwjw quickly rose from irrelevance to being the favorite of customers.

Deng Wei, founder of the company, said iwjw took the offensive by punching the "aching points" of the traditional industry, including unnecessary stores, poor service, fake home information on their websites and high charges. She said most brokers stayed idle all day long, which is a huge waste. And brokers take an indifferent attitude toward those wanting to rent houses, because selling a property is much more lucrative than a leasing deal.

Analysts agree with the criticism, but said despite its flaws, the role of traditional middlemen remain irreplaceable. Unlike trivial spending online, house purchases involve huge amounts and are the most expensive lifetime spending for most Chinese people.

Agents play a critical role from house tours, price negotiations and contract signing - no matter how much buyers and sellers resent them.

"In most cases prices would not be settled without agents. In a human capital-intensive industry, people, and the talent and expertise associated with them, play a key role," said Frank Chen, executive director and head of CBRERe search China.

"The value of Internet companies are that they shake up the status quo. But even after the disruption effect was made, most of the challengers ended up not making money - much like e-commerce in China."

Iwjw also faced some problems recently like inaccurate information, laggard service, money splurge etc.

SouFun is struggling to jump start its new businesses, while HomeLink is trying hard to preserve its broker pool, which is getting eroded by rivals. There seems to be no end in sight for the tangled warfare, and it is quite likely that none will end up as the winner.

Contact the writer at zhengyangpeng@chinadaily.com.cn

Han Xiaomeng contributed to this story.

(China Daily USA 02/26/2015 page13)

Chengdu citizens visit Du Fu Thatched Cottage to mark Human Day

Chengdu citizens visit Du Fu Thatched Cottage to mark Human Day

Tencent gifts red envelopes to employees

Tencent gifts red envelopes to employees Throwing coins to please God of Wealth

Throwing coins to please God of Wealth

7 companies that aim to fly high with drone deliveries

7 companies that aim to fly high with drone deliveries

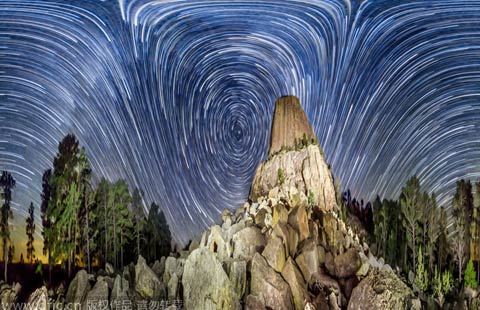

Starry Night created by lens

Starry Night created by lens

Dragons, martial arts and basketball

Dragons, martial arts and basketball

Stringing in the New Year

Stringing in the New Year

Top 10 Chinese innovators in 2014

Top 10 Chinese innovators in 2014

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Obama blames immigration woes on Republicans

New fighter jet ready for PLA

Why China's youth is getting the needle

Most Chinese forced to return home were living abroad illegally

US State Dept calls for cyber security boost

Anbang buys new piece of Manhattan

California here we come: Chinese

Port dispute over, shelves take time to restock

US Weekly

|

|