Economic statistics in September indicate the risk of stagflation amid an environment featuring loose monetary policy and weak economic recovery. The government should lift its control over interest rates to ease risks, said an article in the 21st Century Business Herald (excerpts below).

As some local governments and State-owned enterprises have serious debt problems, they tend to borrow to pay old debt by investing limited money into industries with excess production capacities to secure immediate yields.

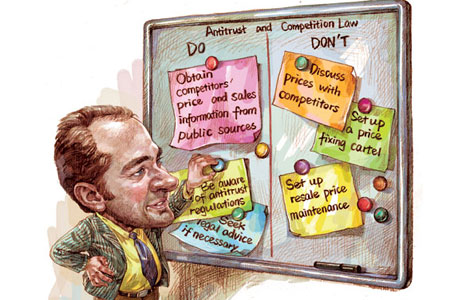

Such an environment makes decision-makers cautious in considering taking measures to boost market liquidity. The financial repression, which refers to market interest rates under control, distorts the allocation of financial resources and develops the economy’s reliance on loose liquidity.

The government should wait no longer to lift its control over deposit interest rates. Reforming the interest rate market will help China avoid bigger potential risks in the long run, despite immediate pains following the reform.