China an historic opportunity: report

Updated: 2013-12-30 11:40

By Michael Barris in New York (China Daily USA)

|

||||||||

|

|

"Uneven" growth of China's consumer class and other developing markets presents "tremendous potential for companies" if they choose to play in fast-growing categories, according to a report by global management and consulting firm McKinsey and Co.

The report said that by 2025, when the number of consumers worldwide has swollen to 4.2 billion, those with discretionary income will outnumber those struggling to meet basic needs for the first time. That development presents "what may well be the biggest opportunity in the history of capitalism," according to the report.

For instance, Coca-Cola Co, "recognizing Chinese consumers' preference for pulpier juices", in 2004 launched Minute Maid Pulpy, which had a thick texture adapted to Chinese tastes and included bits of fruit, according to the report. The fruit juice became China's most popular fruit- juice brand in seven years and Atlanta-based Coke's first emerging-market billion-dollar brand.

In another category waiting to be tapped, the report said the growth rate of the skin-care market in the city of Shanghai is projected to triple that of the entire nation of Malaysia.

Multinational companies aren't the only potential beneficiaries as the consumer goods landscape is redrawn, according to the report. In the fastest-growing consumer packaged-goods categories in China, Brazil and Mexico, eight of the top 50 companies were based in emerging markets, according to the report released Dec 23.

"These local entities - companies like Mexico's Grupo Bimbo - are venturing outside their home markets and skillfully leveraging their emerging-market know-how, favorable cost positions, and proximity to a rapidly expanding customer base," the report said. As a result, their sales growth in emerging markets far exceeds that of US-based consumer packaged goods companies, 19 percent to 5 percent, the report says.

The report concludes consumer packaged goods companies should take "a more data-driven approach to understanding how competitors will grow in each market, and how their own strategic positions will change as a result. They will then be able to predict critical inflection points for particular products in particular cities and regions."

The report comes as China's leaders gradually steer the nation's economy toward consumption and away from export and investment.

Ernie Preeg, an economist for the Manufacturers Alliance for Productivity and Innovation, a Virginia-based manufacturing industry group, told China Daily in early November that third-quarter data which showed production in China growing faster than GDP indicated the country's "grand strategy of shifting resources to personal consumption isn't happening".

Third-quarter personal consumption in China represented 35 percent of GDP, Preeg said. To increase personal consumption to 40 or 45 percent of GDP, "you have to have annual growth of 15 to 20 percent a year" - more than twice the MAPI-forecast national growth rate of 7.1 percent in 2014, and 7.3 percent this year, Preeg said. Growth is expected to slow as the country confronts a "sluggish world economy", according to MAPI.

China's widening rural-urban income gap also is hampering consumption growth, according to government data. Last year, per-capita disposable income of urban residents more than tripled that of rural residents.

The Central Rural Work Conference in Beijing was told this week that income from a year's field work may be less than three months' work in a city. Annual per capita income in the highest income households was 20 times more than that of lower income families, the Chinese Academy of Social Sciences said Thursday.

Chi Fulin, president of the China Institute for Reform and Development, told a Peking University audience last week that consumption is expected to reach at least 30 trillion yuan ($4.9 trillion) in 2016 and might further rise to between 45 trillion yuan and 50 trillion yuan in 2020, Want China Times reported. Taking into account the investments such consumption would spur, domestic demand might reach 100 trillion yuan ($16.5 trillion) in 2020, Chi said.

michaelbarris@chinadailyusa.com

Second blast kills 14 in Russian city

Second blast kills 14 in Russian city

F1 legend Schumacher in coma after ski accident

F1 legend Schumacher in coma after ski accident

Net result

Net result

Fire on express train in India kills at least 26

Fire on express train in India kills at least 26

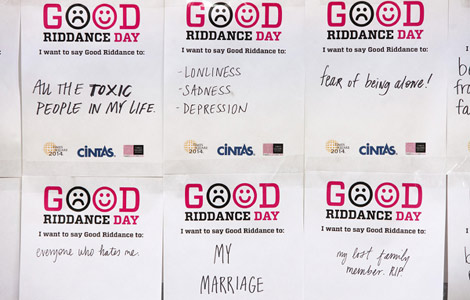

Times Square visitors purge bad memories

Times Square visitors purge bad memories

Ice storm leaves many without power in US, Canada

Ice storm leaves many without power in US, Canada

'Chunyun' train tickets up for sale

'Chunyun' train tickets up for sale

Abe's war shrine visit sparks protest

Abe's war shrine visit sparks protest

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Outrage still festers over Abe shrine visit

Suicide bomber kills 16 at Russian train station

Magazine reveals NSA hacking tactics

Pentagon chief concerned over Egypt

Broader auto future for China, US

Li says economy stable in 2014

Bigger role considered in the Arctic

3rd high-level official probed

US Weekly

|

|