Chinese students rank highest in financial literacy test

Updated: 2014-07-21 04:24

By AMY HE in New York

|

||||||||

Chinese teenagers scored highest on a global test of financial literacy, with Shanghai youngsters ranking No 1 and teens from the US ranking ninth, according to the Organization for Economic Cooperation and Development's financial literacy assessment.

Paris-based OECD tested students on their financial knowledge for the first time as part of their Program for International Student Assessment (PISA), conducted once every three years.

Students from Shanghai scored on average 603 on the financial literacy test, beating the global average of 500. American teens scored 492 and ranked behind Latvia.

The financial assessment portion is a 60-minute test of 29,000 15 year-old students from 18 countries that was held in 2012 with results released this month.

It tested them on their ability to solve financial problems and make financial decisions.

"Developing financial literacy skills and knowledge is critical now that individuals are becoming increasingly responsible at an ever earlier age for financial risks affecting their future," said Angel Gurría, OECD secretary general, at the launch of the report on Jul 9 in Washington.

"Some governments have started developing strategies and policies so that people have the skills they need throughout their lives. More need to move this up the policy agenda so that citizens are prepared for an ever-more complicated financial world," he said.

Annamaria Lusardi, chair of the financial literacy expert group that designed the financial literacy portion of the PISA assessment, said that it is "critically important" to measure students' financial skills.

"If you're thinking about what's happening in all countries, there is an increase in individual responsibility, so the individuals are much more in charge of making decisions than in the past, where they were made by, let's say, the government or employer," Lusardi told China Daily. "Imagine a person who is unable to read or write today, you would not be able to operate in society. The same I think is happening for financial literacy."

The OECD said in its report that its assessment of Chinese students includes data available on their saving habits: students in China save money when they have money to spare, and students who do so outperformed on this test than those who save only when they want to buy something.

The results "suggest that for students in Shanghai-China, setting money aside regularly or when they have some to spare, is associated with higher financial literacy than saving only if students need to buy something, even after comparing students of similar socio-economic status," the OECD said.

The assessment showed that 38 percent of students from Shanghai answered that they save money at regular intervals, 19 percent save the same amount every week or month, 17 percent only when they have money to spare, and 16 percent when they need to buy something.

"The fact that a majority of students indicated that they would save is encouraging for their future," the OECD said.

Lusardi said that China's ranking is not surprising, since scoring highly on financial skills is correlated with strong math skills, a topic that students from China have traditionally done well on in past PISA assessments. In the 2012 test, Chinese students from Shanghai ranked No 1 in math scores.

"Some of practice [in saving] might also help, but I also think that knowledge of math, what people learn in school, can be equally important," she said. "Given the high correlation between math and financial literacy, I think that this is a sign that what they teach in those schools can be pretty important to increase financial knowledge."

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

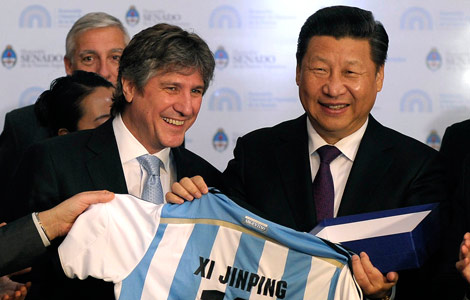

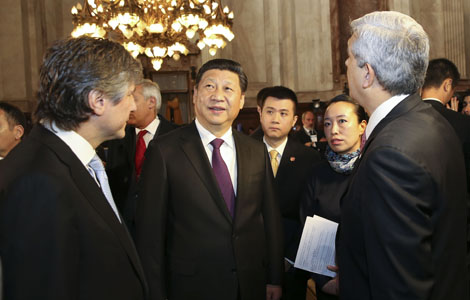

Xi arrives in Venezuela for state visit

Chinese students rank highest in financial literacy test

Chinese President Xi leaves for Venezuela

Black boxes of MH17 under 'control': rebels

China's Sany ready to act on US govt move

Super typhoon Rammasun batters China, killing 18

China, Argentina seek closer cooperation

President Xi calls for fair investigation into jet crash

US Weekly

|

|