Chinese firms in US advised to learn rules

Updated: 2014-09-11 13:13

By CHANG JUN in San Francisco(China Daily USA)

|

||||||||

Despite continuous growth of China's direct investment in the United States and China sponsored projects in California, Chinese enterprises still have a long way to go to get familiar with the American business culture, as well as government regulations and rules, warned policy makers and industry insiders.

To better educate Chinese enterprises on doing business in the US and share industry expertise across sectors, the Chinese Enterprise Association (CEA) teamed up with the China General Chamber of Commerce-USA (CGCC) to hold the 2014 CEA China-California Economic Forum|CGCC IT Committee Annual Conference in San Francisco.

Chinese enterprises, some Fortune 500 companies, in recent years have shown a tendency to keep expanding the scope and footprint of their business in the US, Xia Xiang, economic and commercial counselor at the Chinese Consulate General in San Francisco, told the gathering. "We've seen a lot of investment injected into the real estate and high-tech sectors in California, especially the Bay Area."

Chinese companies are operating in a more organized and structured manner nowadays, said Xia, adding many explicitly position themselves as international, multibilliondollar companies that cherish their integrity and credibility. "I don't doubt their competence in terms of future global industry leadership and influence," he added. Although the number of Chinese investments in California is not the first in the overall amount in the nation, as Xia pointed out, "but we have the largest number of deals made in the Bay Area."

However, a majority of the Chinese enterprises operating in the US face business hurdles and cultural barriers, said Skip Whitney, executive vice-president and partner at Kidder Mathews, a US business property management firm.

"They need to work with the local professionals to help them better do business in the US," Whitney said, adding that in the past two months his company has helped nine Chinese enterprises that want to open offices in the Bay Area.

Chinese investment into the US has increased dramatically in the last decade, starting from less than $1 billion in 2008 to $14.1 billion last year, which was the first time that Chinese direct investment in the US surpassed its US counterpart investment in China. The structural shift is highly likely to continue, said the Asia Society, and it "will profoundly alter the economic balance between the two largest economies".

In the second quarter of this year, Chinese companies have spent $2.1 billion on 35 direct investment transactions in the US, according to the Rhodium Group, a consultancy that tracks Chinese overseas investments. The group also indicates that Chinese funding now is more likely to invest in travel, financial services and the entertainment industry.

In Asia Society's newest report released in April, High Tech: The Next Wave of Chinese Investment in America, researchers find that more and more Chinese companies are investing in a broad range of American technology sectors, ranging from automotive and information technology to machinery, aviation and medical devices. The report also indicates that California has "increasingly asserted itself as one of the most desirable locations for inbound Chinese investment".

Ben Chen, president of CEA, said his organization of about 180 members is busy with answering inquiries from interested Chinese enterprises and helping those who have already set a footprint in the US.

"Besides finding them a business property for an office, we also show them around among professionals here, including attorneys and tax experts to help them expedite the whole process," Chen said. "Either way, we feel our association can and should play a bigger role."

Wang Jingxi, general manager at Suning Commerce R&D Center USA, which was established last year by Chinese retailer Suning Commerce Group in Palo Alto, said he had a rough year trying to maneuver his company between the American business environment and his parent company's ambitious marketing goals.

"I spent a lot of time explaining differences in operation and management between the US and China, and trying to convince our senior management back in China that it might take longer than they expect to transform our research findings into products and generate profits," said Wang, adding he is introducing the establishment of co-labs with well-established US companies such as IBM and Oracle.

Meanwhile, Wang spares no effort in promoting his research center as a transparent and trustworthy partner to potential US partners. "In business talks with Safeway, I would take time to explain who we are and what we do, try to be as candid and sincere as I can," said Wang, adding that he believes US companies also need time to get to know each other and build mutual trust.

Arthur Wang, president of Zarsion America Inc, the division of Zarsion Holdings Group which committed $1.5 billion to building the Oakland-based Brooklyn Basin in 15 years and just completed two transactions with the Oakland city government, said new real estate companies from China should bear in mind that they have to operate by rules and laws, and don't risk their credibility by engaging in any legal breach.

"There are lot of differences in the US and China real estate market," said Wang. "You need to be very careful for each step you are going to take." Zhao Litao, deputy general manager of Air China's San Francisco office, said she would use the CEA as a platform to better serve member companies and share information. "Although competition in the aviation market is fierce, we believe as a united group we can benefit from a closer relationship with other Chinese companies operating in the US," Zhao said.

junechang@chinadailyusa.com

Solemn Ceremony

Solemn Ceremony

American mark the 13th anniversary of the 9/11 attacks

American mark the 13th anniversary of the 9/11 attacks

Texas governor is on a mission to strengthen China ties

Texas governor is on a mission to strengthen China ties

Flute star tours China in encore

Flute star tours China in encore

One day of a male kindergarten teacher

One day of a male kindergarten teacher

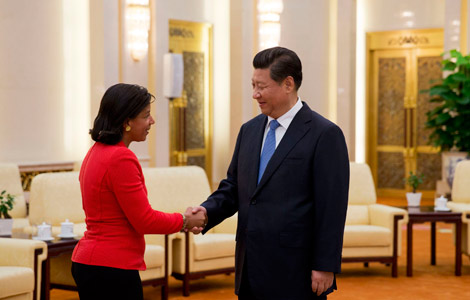

Xi welcomes Rice in Beijing

Xi welcomes Rice in Beijing

Apple unveils the Watch, larger iPhones

Apple unveils the Watch, larger iPhones

Jilin gets off to a dazzling start in LA

Jilin gets off to a dazzling start in LA

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Obama: Joint force vs ISIS

McDonald's faces woes in US, abroad

Obama to authorize air strikes in Syria against IS

Nation capable of hitting growth targets, Li says

Chinese firms in US advised to learn rules

Li reassures investors on investigations

Texas governor tours China

China 'largest economy' by 2024

US Weekly

|

|