Housing: Will the roof blow off?

Updated: 2013-04-12 10:26

By Michael Barris (China Daily)

|

||||||||

|

A woman looks at a model of a property project on Thursday in Kunming, Yunnan province. Chinese authorities have taken a series of measures to cool down the real estate market. Lin Yiguang / Xinhua |

Despite efforts to stabilize property prices, critics are talking about the possibility of a real-estate bubble popping, reports Michael Barris from New York.

It was a doomsday warning: China would face "disaster", including mass social unrest, if its overheating property market crashed.

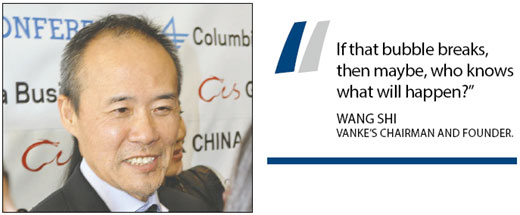

Those were the words of Wang Shi, head of Vanke, China's largest residential real estate development company, in an interview with CBS News' 60 Minutes last month.

"If that bubble breaks, then maybe, who knows what will happen?" asked Wang, Vanke's chairman and founder.

The 60 Minutes television report on March 3 included shots of "ghost cities" - "miles and miles and miles" of neighborhoods with vacant apartment towers, condominiums and subdivisions - owned by people who have "sunk every last penny" into the Chinese property market to capitalize on surging property prices.

Noting that thousands of low-wage earners migrating to cities from rural areas ostensibly could fill these units but can't afford the $50,000 to $60,000 cost, the report suggested that China is headed for catastrophe by creating "the largest housing bubble in history."

Notwithstanding some viewers' complaints that the 60 Minutes report exaggerated the bubble's size, there is reason to be concerned about the housing market in the world's second-largest economy.

Real estate accounts for about one-fifth of Chinese investment, and investment drives more than half of national economic growth.

A slowdown in Chinese real estate could even more adversely affect countries that sell to China's property and construction industry, as well as those that export to countries exposed to the China housing market.

"If the national real estate market collapses in China, it would be disastrous, not just for China but for the entire world economy," wrote Washington Post columnist Max Fisher. A collapse would risk a "third wave of the global crisis that began with the US financial collapse and worsened with the Euro crisis", he wrote.

Continuous attempts

Fueled by low interest rates and cheap credit, property prices in China began rising in 2000. As middle class buyers found themselves pushed out of the market, they complained.

To mollify critics, the government three years ago said it would allocate more than 20,000 hectares of land for the building of 36 million low-cost homes by 2015.

It also moved to cool the market. Measures implemented by 2011 included raising first-time buyers' down payment to 30 percent from 20 percent, and second-home buyers' to 60 percent from 50 percent.

The government also prohibited third-home mortgages, limited home purchases in certain areas, tightened credit-quota limits and raised benchmark lending rates, among other things.

The measures were credited with pushing prices down in the fourth quarter of 2011.

But the slowdown underscored the government's dilemma: it needed the housing market.

In 2012, a projected 10.4 percent drop in real-estate investment tied to the market-cooling measures was projected to cut 2013 GDP by about 1 percent. The government reversed its policies to boost the slowing economy.

Amid China's increasing urbanization, the country is seen needing about 10 million new residential units each year. But new home construction is on pace to surpass even the most upbeat projections. In 2012, 11 million units were built.

The number is expected to increase to 19 million units annually within five years, Mark Williams of Capital Economics in London wrote in a column for China Daily.

"That could leave a glut of housing that could only be sold if prices collapsed," Williams wrote.

Owing to public distrust of the volatile stock market and a penchant for investing in tangible objects, Chinese plunging into residential property ownership often buy several properties at a time. The torrent of speculative investment is partly blamed for escalating prices.

In March, the average cost of a new home in Beijing and Shanghai rose for the 10th straight month, climbing 1.3 percent from February to 16,803 yuan ($2,700) per square meter. Prices increased 6.1 percent from a year earlier.

Despite property's image as a safe and reliable investment, many see the market as artificially inflated.

One day, Fisher says, "it's possible that Chinese consumers will wake up and decide that those investment apartments aren't such safe investments after all, or maybe they'll just need to free up the cash they used to buy them, at which point they'll want to start selling. That will lead prices to drop, perhaps catastrophically."

China's leaders have again tried to cool off the market with policies that have included reducing bank loans, raising mortgage interest rates for people buying a second home and imposing a 20 percent capital-gains tax on home-sale profits.

But a leading Chinese property tycoon, Ren Zhiqiang, the chairman of Hua Yuan Real Estate Group, complains that the government's "property control policies have gone wrong from day one" and doubts the latest market regulations will rein in rising house prices.

"A series of policies, including the bidding system for land acquisition, the housing credit policy and the public finance system, have actually helped push up China's property prices, instead of cooling them," Ren told the Boao Forum for Asia in Boao, Hainan province, this week.

Wang Yijiang, a professor with Cheung Kong Graduate School of Business, agreed with Ren that policies have been inconsistent in the past decade. "Sometimes they have seemed to help push up property prices, while at other times they have been targeted at curbing prices," he told the Boao Forum. "I'm confused."

'Ghost cities'

Bubble-bursting skeptics include Stephen Roach, the often-quoted former chairman of Morgan Stanley Asia, now a Yale University professor. Roach has argued that the "ghost cities" highlighted in the 60 Minutes report eventually will become "thriving metropolitan areas" as rural people continue to pour into China's fast-growing cities in search of prosperity.

"China cannot afford to wait to build its new cities," Roach wrote. "Investment and construction must be aligned with the future influx of urban dwellers."

He cited a McKinsey study which estimated that by 2025 the country will have more than 220 cities with populations greater than one million, versus 125 in 2010. The study also projected that 23 cities will have a population of at least 5 million.

With a "large reservoir of surplus savings", a budget deficit of less than 2 percent of GDP, and its "ample scope for monetary easing", China is in "much better shape than the rest of the world", Roach wrote.

Ting Lu, the China economist for Bank of America Merrill Lynch, has acknowledged that bubbles exist, but claims that it is inaccurate to characterize China's entire property sector as a giant bubble.

China's emerging-market resilience to the market's ups and downs also is underestimated, according to some analysts.

Youguo Liang, a former managing director of Prudential Real Estate Investors, a unit of New Jersey-based Prudential Financial Inc, said a housing market crash in China along the lines of what Japan suffered in the late 1980s is "unlikely", because China is "still in a growth cycle".

China's per capita GDP is still "very low" - not only for a developing country, but even for a developed country, Liang said in an interview. "There's still tremendous room to grow." Moreover, he said, the country's infrastructure investments in recent years and its centralized system of government give it the power to use policy to effectively manage real estate market swings.

But he cautioned that the market still could implode. "You don't know if there's a bubble until it bursts," he said.

Raise taxes

Liang said the Chinese leadership should use taxes to keep residential units occupied and discourage speculative investment. "If you asked me to pick out one policy lever, to correct the Chinese real estate market, I would raise the tax on unoccupied residential units," he said. "If it's not occupied physically, you place a tax on it."

Bubbles cannot be created when units are occupied, thwarting potential speculators, he said.

Another crash scenario skeptic is Sonny Kalsi, founder and managing partner of Green Oak Real Estate.

Until early 2009, the global head of Morgan Stanley Real Estate Investing and president of the Morgan Stanley Real Estate Funds, Kalsi said he doesn't think a bubble has emerged in the Chinese property market because "core demand is still strong".

"I do think prices have been ahead of affordability for some time," he said. "So I expect sales prices to be flat or even decline until personal earnings improve, so affordability ratios improve."

Kalsi said China's leaders have been "prudent" in moving to rein in prices via bank loan reductions, mortgage rate hikes and taxing capital gains.

"The market needs to cool down. There is too much speculation and all of these will dampen speculation," he said.

What is often forgotten in the discussion, Kalsi said, is that "real estate is all about supply and demand." It's easier for China to absorb overbuilding in the residential sector than it is for some other localities, he said. "There is great demand, so supply can be absorbed."

An analyst, who asked not to be identified because of his company's rules barring him from talking to the media, characterized the overbuilding of residential dwellings as a "misallocation of capital."

"In China, local governments saw how easy it was to spur economic development and growth through the sale of land versus a more high return, high skilled area of development - industrial development, for example - and therefore pushed land sales to help fund growth," he said.

"Instead of investing into higher productivity development, they kept shoveling the money back to housing, infrastructure and helped drive speculation."

Liang said many observers are making a mistake by trying to compare China's housing bubble with the United States' market crash of 2008.

"The United States is mature. China is still a developing country," Liang said. "It is like trying to compare a 20-year-old with a 50-year-old. They have different problems."

What is likely, though, is that China will keep trying to prevent the housing situation from sparking Arab Spring-style public discord. Wang, known for his $53 billion homebuilding firm as well as his mountaineering exploits - he has climbed the highest peaks on all seven continents - told 60 Minutes that frustrated buyers "often" have demonstrated in Vanke's showrooms in protest of high housing prices.

The combination of economic fallout and social backlash from a popping bubble would be catastrophic, the developer said. "I believe that top leaders have the smarts to deal with that," he said. "But that's uncertain."

Contact the writer at michaelbarris@chinadailyusa.com

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese takeover not threat: German research

Forex purchases rise for 3rd straight month

Treasury chief calls Obama budget balanced approach

New housing rules planned for migrants

Teachers trained at int'l schools in Beijing

Taiwan greenlight mainland organization office

Li aims to build new China-US partnership

DPRK steps up the war of words

US Weekly

|

|