Fonterra challenged in China's milk powder market

Updated: 2013-12-17 10:56

(Agencies)

|

||||||||

Milk powder buyers in China are starting to cut their reliance on New Zealand's Fonterra, opening the way for US and European firms to break the dairy giant's grip on an infant milk formula market set to double to $25 billion by 2017.

Chinese drinks maker Want Want has said it plans to reduce imports to diversify its supply chain, and at least two multinational infant formula sellers have either cut supply from Fonterra or plan to diversify supply for the China market, people in the industry told Reuters.

|

|

|

The Fonterra Te Rapa plant is seen behind a sign for cyclists near Hamilton, in this August 6, 2013 file picture. [Photo/Reuters] |

A drought in New Zealand earlier this year curbed milk powder production, highlighting the risk of over-reliance on one supplier. Those concerns escalated in August when Fonterra said it had found a potentially fatal bacteria in one of its products, triggering recalls of infant milk formula and sports drinks in several markets, including China. Tests later found the initial finding was incorrect.

"They know they're reliant on 80 percent of their imported milk powder from one place - and 80 percent of that from one company. That's just not a healthy position to be in," said William Baker, a Beijing-based investment professional who focuses on the Chinese dairy industry.

China's appetite for foreign milk powder has soared in recent years, spurred by distrust in local products since a scandal in 2008 when milk laced with the industrial chemical melamine killed six infants and made thousands more ill. Tighter food safety rules and disease among Chinese cattle have also stymied domestic output this year, pushing import volumes up by almost a third in January-October.

Fonterra said it was normal that some fast growing customers would look around for other supply options.

"When you've got customers who are growing like mad, it's not so much that they're wanting to diversify, it's that they know that if they're growing faster than we are, they're going to have to see volumes of product coming out of Europe and the US to fill what would be a supply gap," said Tim Deane, director of global sales at Fonterra."

"As growth in global trade outstrips New Zealand supply, increasingly more companies will have to (look at different suppliers). It's got nothing to do with their satisfaction or dissatisfaction with Fonterra."

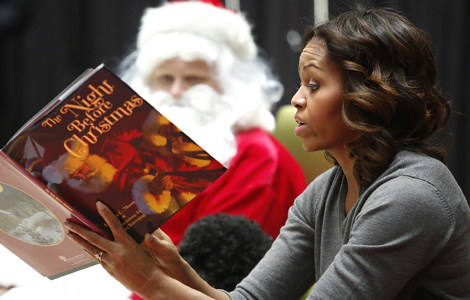

US first lady visits children in medical center

US first lady visits children in medical center

Harvard reopens after bomb scare

Harvard reopens after bomb scare

Snowstorms cause chaos for travelers in Yunnan

Snowstorms cause chaos for travelers in Yunnan

Kerry offers Hanoi aid in maritime dispute

Kerry offers Hanoi aid in maritime dispute

Cuddly seal enjoys some me time

Cuddly seal enjoys some me time

Shoppers dropping department stores

Shoppers dropping department stores

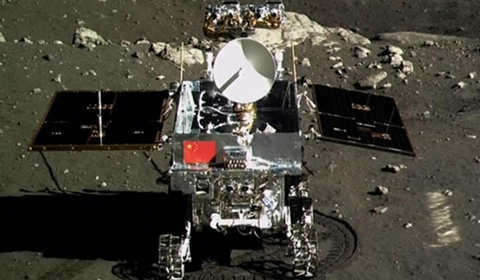

Moon rover, lander photograph each other

Moon rover, lander photograph each other

Snow hits SW China's Yunnan province

Snow hits SW China's Yunnan province

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Japan to bolster

military build-up

Continuity in DPRK policies expected

China keen on natural gas

China outlines diplomatic priorities for 2014

China's US debt holdings pass $1.3 trillion

Clashes with US can be avoided: FM

Kerry offers Hanoi aid in dispute

14 terrorists killed in Xinjiang

US Weekly

|

|