Property buyers scouring the world in diversification drive

Updated: 2014-01-28 07:54

By Hu Yuanyuan (China Daily)

|

||||||||

|

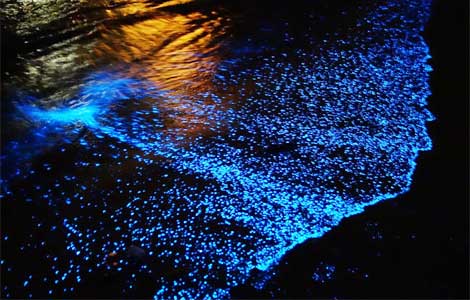

A New York property project display at an international housing exhibition in Beijing attracts investors. Continually rising prices and tightening measures are pushing more Chinese investors to seek opportunities overseas. [Photo / China Daily]

|

About 50 million Chinese people are living overseas at present, according to the Beijing-based Center for China and Globalization

Investment and education are the main drivers of Chinese migration. Four countries - the United States, Canada, Australia and New Zealand - are the most popular destinations, the center said. The expanding number of Chinese emigrants is creating business opportunities for a range of industries.

Chinese investors are increasingly looking at the big picture.

It took Sara Wang two days to decide to buy a two-bedroom apartment in London in October.

The 35-year-old executive in a joint venture enterprise acquired the home only as an investment.

She already has two apartments in Beijing, which means she isn't allow to buy any more properties in the capital. And soaring property prices in China also make her worry about growing investment risk.

She paid the equivalent of 4 million yuan ($645,160) for the apartment in suburban London. The down payment was 30 percent. She expects to rent it for about 12,000 yuan per month.

The purchase, Wang said, was a good deal based on the price-to-rent ratio and relatively low monthly payments.

If she wanted to buy another apartment in China, she wouldn't be able to get a mortgage, as she took out mortgages for her first two apartments.

In any case, the rent for a 4 million yuan apartment in Beijing would only be about 7,000 yuan now.

"Moreover, in London, I get a 999-year lease. But in China, I paid for 70-year use rights," Wang added.

Continually rising prices and tightening measures are combining to push more Chinese investors to seek overseas opportunities.

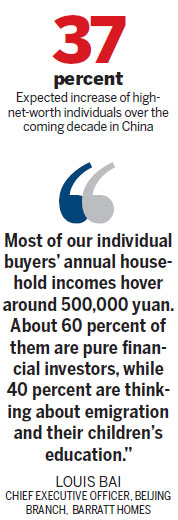

Chinese buyers are the most influential in the world's prime markets for new housing, according to Knight Frank LLP's latest Global Development Insight report on the spending habits of affluent individuals around the world.

- Chinese investors look to overseas opportunities

- Low Ethiopian labor cost attracts Chinese investors

- UK stays open for Chinese investors

- Roma have no special insight with Chinese investors

- Chinese investors focus on Australia's shale gas

- Pakistani PM woos Chinese investors in energy sector

- Chinese investors look overseas

- Chinese investors should be welcomed in Germany

Putin pays tribute to Siege of Leningrad victims

Putin pays tribute to Siege of Leningrad victims

Chinese ace Li Na before she was famous

Chinese ace Li Na before she was famous

Xi visits soldiers on frozen northern border

Xi visits soldiers on frozen northern border

Premier calls for action to relieve poverty

Premier calls for action to relieve poverty

Tough Guy event in England

Tough Guy event in England

Syria talks bring offer of exit from siege of Homs

Syria talks bring offer of exit from siege of Homs

Anti-World Cup protests wane in Sao Paulo

Anti-World Cup protests wane in Sao Paulo

India celebrates 65th Republic Day

India celebrates 65th Republic Day

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

South China Sea archives open in Hainan

Some good US advice for Japan on comfort women

US, UK in app-tapping scandal

Border control for H7N9 tightens

Int'l hacker got caught in China

Party to reform discipline system

Talent returns to China, but progress slow

300 ill on Royal Caribbean ship

US Weekly

|

|