Tencent's move gets mixed reviews

Updated: 2015-12-15 11:28

By Jack Freifelder in New York(China Daily USA)

|

||||||||

After making its way to the top of the Chinese videogame market, Tencent Holdings Ltd will bring one of its most successful mobile games to the US and other Western markets in 2016.

To do so, the Chinese conglomerate is using a previous partner, Glu Mobile Inc in San Francisco. In April, Tencent acquired 14.6 percent of the publisher.

Peter Warman, CEO of gaming research company Newzoo, said Tencent's move to partner with Glu Mobile for its WeFire shooting game reflects a need to go beyond China for continued growth.

"They will have to conquer other territories, including the two other biggest markets, the US and Japan," he wrote in an e-mail. "Put both Tencent and Glu Mobile's experience together and I am confident that they will be successful."

"In 2011, Tencent bought US PC game developer Riot Games, giving them a direct presence in Los Angeles and a big franchise developed for a Western audience," Warman told China Daily. "This has turned out to be hugely successful and started a shift in approach by Asian companies toward acquisitions and investments in the West."

Jack Kent, director of IHS Technology's mobile games and apps research department, wrote in an e-mail that it makes sense for Tencent to look overseas for growth, but "we have seen Asian companies struggle to repeat their domestic success when expanding into Western markets".

"Tencent is unlikely to match its domestic market success in Western markets, and it will have to compete with many established players," Kent said. "Japan and the US are much more mature mobile games markets than China. These are markets with very high smartphone penetration, so the overall growth potential is more limited."

Tencent took WeFire to South Korea in September through local partners, according to The Wall Street Journal.

The game, where players shoot down enemy soldiers and move about different battlefields, is free to download, but users can spend money to upgrade their arsenal to get higher scores.

Joost Van Dreunen, CEO and co-founder of SuperData, a New York-based provider of market research and intelligence on free-to-play and digital games, said the partnership between Tencent and Glu Mobile shows Tencent is "continuously keeping an eye out for properties in the Western markets".

"Many of the giant Asian game makers have adopted a strategy centered on acquisition, rather than expanding its empire from the ground up," van Dreunen told China Daily. "Rather than taking one of its own existing titles and optimizing it for a western audience, it makes more sense to just acquire a title or company that is already successful or well on its way.

"This way Tencent sidesteps having to invest in building teams that can help understand all the cultural nuances," he wrote in an email.

The move to bring "WeFire" to international markets was originally announced in November.

Glu Mobile Chief Executive Niccolo de Masi told the Journal in December that working with Tencent lays the potential groundwork for future developments with other videogame titles, he added, despite prior challenges. In 2013, Glu Mobile introduced a Chinese mobile game titled Black Gate Inferno without much success, the newspaper reported.

The global mobile-games market is forecast to reach $30.1 billion in 2015, according to data from Newzoo.

With revenue of $6.5 billion, China is the world's largest market for mobile games. Japan and the US occupy the second- and third-place slots, with $6.2 billion and $6 billion in revenue, respectively.

Tencent generated nearly $2.2 billion from online games in the third quarter of this year, including more than $820 million from smartphone games, according to the company.

Jane Zhang, a principal analyst covering personal technologies for global technology research firm Gartner Inc, said: “Tencent was a pure game operator in the past decade but has gone into mobile game production recently. What I think Glu Mobile can bring in is the product localization.

David Cole, CEO and founder of DFC Intelligence, a gaming and digital entertainment research firm, said the development points to Tencent’s difficulties in addressing Western markets via an internal division.

Tencent has been trying to bring mobile games to the US and other Western markets for years “without a great deal of success,” Cole said.

“Asian companies have really struggled in Western markets and growth has not been nearly what was expected,” Cole added.

jackfreifelder@chinadailyusa.com

- Saudi Arabia announces 34-state anti-terror alliance

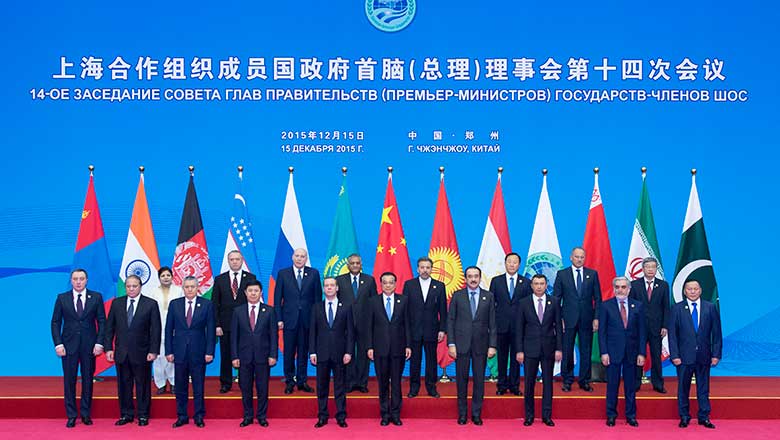

- Premier greets SCO leaders ahead of meeting

- Bus crashes in northern Argentina, killing 43 policemen

- California shooter messaged Facebook friends about support for jihad

- Obama says anti-IS fight continues to be difficult

- Washington's cherry trees bloom in heat wave

Leaders pose for group photo at SCO meeting

Leaders pose for group photo at SCO meeting

Washington's cherry trees bloom in heat wave

Washington's cherry trees bloom in heat wave

Wuzhen ready for Internet conference

Wuzhen ready for Internet conference

Fairy tale tunnel of love in south China

Fairy tale tunnel of love in south China

Beautiful moments of 2015 in China's great outdoors

Beautiful moments of 2015 in China's great outdoors

Student volunteers wear qipao for World Internet Conference

Student volunteers wear qipao for World Internet Conference

China marks Memorial Day for Nanjing Massacre victims

China marks Memorial Day for Nanjing Massacre victims

Six major archaeological discoveries in 2015

Six major archaeological discoveries in 2015

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|