Used cars get into gear

Updated: 2014-12-19 15:26

By Yang Ziman(Chinadaily USA)

|

||||||||

|

Second-hand car agencies would evolve into service providers, offering services such as evaluation, recommendation and analysis, with the help of the Internet and fierce price wars. Asian News |

Five years on from the mainland auto boom, the time is ripe for an explosion in used car sales, industry experts say. Yang Ziman reports.

Used cars look set to be the new growth engine for the national automobile industry, with total sales volume on the mainland tipped to surpass 9 million by the end of the year.

Shen Rong, vice-chairman of the China Automobile Dealers Association, noted that the era of fast growth in the new-car sector is now at an end. In the next few years, annual sales of second-hand cars will grow by double digits.

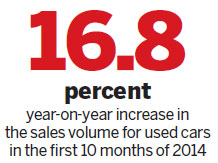

In the first 10 months, the sales volume for used cars hit 4.9 million units - up 16.8 percent over the same period last year. Their total value amounted to 294.5 billion yuan ($47.6 billion) - up 27.1 percent year-on-year. "County and township-level areas hold great potential for sales of used cars," said Shen. "Many people in these less developed regions, because of their limited financial means, tend to purchase a used car as a transitional automobile before they are able to buy a brand new one."

Lin Zhe, CEO of Kaixin Second-Hand Cars - a Shanghai-based company that helps people sell their used cars - said demand in the second-hand car market is outstripping supply, which is the biggest difference between China and a mature second-hand car market like that of the US.

According to the China Automobile Dealers Association, the sales volume of new cars in China was 22 million units last year, while the figure for pre-owned cars stood at only 5.2 million. The ratio for new and used cars sold was 1:0.24.

"In the US, the sales volume of second-hand cars is three times that of new cars," said Lin. "There's great room for growth in the Chinese market."

China's car parc - the number of cars and other vehicles in use in a region or market - was close to 140 million by the end of 2013. In overseas markets, the transaction volume of second-hand cars is 20 percent of the car parc. In China, this proportion is merely 4 percent, Lin noted.

"The O2O (online to offline) market is beginning to take shape," he said. "As new as these online platforms are at present, they are catching up with conventional dealers quickly."

The latest major enterprise to enter the used car market is Ganji.com, a categorized information website that announced the establishment of its O2O second-hand car platform in early December. Second-hand car owners can post details of their vehicles on the platform to attract potential buyers.

"The O2O model is able to reduce intermediary fees, mostly commissions to used car agencies," said Yang Haoyong, chief executive officer of Ganji.com. "The second-hand car market is expected to surge. The year 2010 was a boom year for the Chinese automobile industry. Consequently, 2015 will be an explosion year for used cars, since the average frequency for people to update their cars is every five to six years," Yang forecast.

Li Jianshe, general manager of Lentuo Foundation, a subsidiary of New York-listed car dealer and maintenance firm Lentuo Group, said one problem with the second-hand market is that no market player has distinguished itself as the industry leader.

Consequently, price wars have become the most frequently used competition strategy. As the Internet develops, information symmetry will be more available to consumers. Second-hand car agencies will become service providers rather than intermediary dealers, offering services such as evaluation, recommendation and analysis.

According to a report published by Beijing Yubo Business Intelligence Market Consulting Co Ltd, the room for profit at the moment for large used car companies is very small because the cost of image-building weighs heavily on their profit-generating capacity. Worse still, the price differential - the major profit generator for these companies - is quite limited.

In the highly developed second-hand car markets of Western countries, said the report, dealers not only sell cars but also offer a comprehensive service package similar to new car dealers, which is the main profit contributor. In future, second-hand car companies in China will be like new car outlets that have sales at the center of the portfolio while making money through spin-off services.

A report on the mainland's second-hand car market in 2014, published by Ganji.com in early December, shows that the market in Chengdu, Sichuan province, has been particularly active for the better part of the year. Beijing saw 400,000 posts about selling second-hand cars posted on the website by the end of November, the highest among mainland cities, followed by Shanghai. The report also reveals that online sales volume makes up 40 percent of the total, indicating great potential for the O2O model.

The report also indicates that used car buyers tend to purchase their desired brands at low prices. Cars that sold for below 150,000 yuan per unit accounted for 68.9 percent of the total volume, with those priced between 50,000 yuan and 100,000 yuan being the most popular and making up 20.6 percent of total sales volume.

Contact the writer at yangziman@chinadaily.com.cn

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China OKs modified corn imports

California city fights 'birth tourism'

Build, not break, a bridge for people

Chinese city shops for talent in Houston

Cleaner coal goal in deal by Houston firm

China, US get things done at trade talks

China niche for California design firm

NYC schools can mark Lunar New Year

US Weekly

|

|